Avoid Turning Your Aftermarket Into An Afterthought

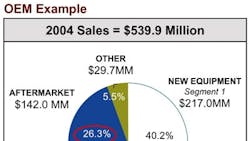

Leading OEMs understand the strategic importance of their aftermarket business to their company's overall financial health. The best of these companies drive 40%-60% of their total revenues and 50%-90% of their gross margin from their aftermarket business. In addition to these returns, their aftermarket business brings other benefits such as stability of earnings and cash flow. They also leverage the company's assets and internal capabilities such as R&D.

How do these leading companies do it? Many of them organize or manage their aftermarkets as focused stand-alone businesses with their own P&L and single-point accountability. They view their aftermarkets as a primary source of growth and invest in them accordingly.

While most OEMs have yet to position their aftermarkets as strategic drivers of growth, there are small steps that companies can take, short of a total business restage, that can quickly produce significant returns. In approaching their aftermarkets, OEM leaders should be asking themselves:

- How is my aftermarket doing in relation to competitors' aftermarket business?

- What can we learn from world-class aftermarket players?

- What quick-hits can we launch in the next four to six months to prove the concept?

- What could our firm's overall growth and profit picture look like if we restaged our aftermarket to aggressively pursue untapped opportunities?

- What organizational changes will be required to ensure that our aftermarket stays focused on growth?

Aftermarket -- Not Afterthought

Leading industrial OEMs, such as Caterpillar, GE Power, Tenneco Automotive and Otis Elevator understand the importance of the aftermarket business to their overall profit picture and make strategic investments in them to aggressively grow the business. Some top executives, having learned the importance of aftermarkets early in their careers, carry this knowledge throughout their careers. Home Depot CEO Bob Nardelli is an example of this. As the head of GE Power, Nardelli faced a flat-growth market but was still able to grow revenues from $6.5 billion in 1995 to $15 billion in 2000. This run up in revenue mainly came from its aftermarket business -- long-term maintenance contracts, inspection and monitoring services and consulting services. It is no surprise to aftermarket observers that Home Depot, under Nardelli's direction, has aggressively entered the "do it for you" home services market -- a classic retail aftermarket.

Companies that understand the power of aftermarkets know that they:

- Provide significant absolute revenue: In some of the world-class companies we studied and worked with, aftermarket business drives 40%-60% of total company revenues.

- Drive disproportionate amount of overall firm margin: Again, in looking at premier companies, aftermarket business accounts for 50%-90% of total gross margin. Even firms that have not aggressively driven their aftermarkets enjoy disproportional contribution. All OEMs with aftermarkets should understand how disproportionate these contributions are.

- Provide a lifetime relationship with customers: Leading OEMs understand that their aftermarket business becomes the front line in client interaction once the warranty period ends. The aftermarket business can drive a higher value over the life of the equipment than the original new equipment sale. Smart OEMs take great care to ensure that these aftermarket interactions are positive and reinforce the OEM value proposition each and every time. These same OEMs also have systems and procedures to collect and track market intelligence on new equipment needs and competitor moves.

- Provide untapped growth opportunities: Apple Computer's breakout launch of iPod and iTunes has taught many firms to look beyond their current core offering for growth. While risk increases as firms move out from core offerings to adjacent/supportive offerings and then ultimately to disruptive or unrelated offerings, the lesson is still valid. In fact, most of Apple's stock growth over the past two years can be directly tied to the growth of its iPod and iTunes business. Somewhat unexpectedly, Apple's long declining Mac personal computer business has received an increase in sales from the so-called "halo" effect of iPod owners becoming first-time Mac buyers. In assessing "outside the core" opportunities, OEMs in less consumer-related businesses should think about how to increase current customer convenience or address their competitors' installed base with slightly modified product offerings or services.

Flawless Execution: Getting The Blocking And Tackling Right

Given its importance to the firm's overall economic picture and the fact that aftermarket is the firm's primary customer-facing entity post warranty, leading OEMs focus on getting aftermarket execution right. The following are some "must haves" with regard to aftermarket execution:

- Bring a market-orientation to the business: Become proactive instead of reactive. Continually bring new products and services to the market. Act as a ruthless competitor.

- Get the organizational design correct: Ensure that the organizational design brings financial focus (standalone P & L) and properly supports a market-orientation posture.

- Put "up and comers" in the business: Do not allow the aftermarket to become an outlet for non-performers. Put some of your best and brightest people in the aftermarket organization.

- Invest in systems and decision support software: Provide the aftermarket with proper tools to manage and grow the business.

- Get the parts business right: Parts pricing policy should be market or portfolio based, not cost-plus. Moving to a portfolio approach avoids cherry-picking and maximizes return on invested capital. Also ensure that discount policy and discipline are meticulously followed.

Getting Going

Top OEM executives who discount the value of their aftermarkets -- either deliberately or through oversight -- do so at their own company's peril. The opportunity to drive revenue and earnings growth is large. Small changes to the structure, focus and management of aftermarkets can have big payoffs.

From a "quick hits" perspective, OEMs should focus on new offerings or enhancements to current offerings that they quickly can bring to market. A few examples include:

- Extended Warranties

- Service Programs

- Wear-part replacement kits

- Revised parts pricing (portfolio pricing instead of cost-plus)

In each of these examples, no engineering or prototypes are required. Launching these offerings only requires analysis and offering design, internal approval and external marketing. Start with these types of offerings and then progress to more technically involved offerings, such as enhancements, rebuilds and retrofits.

Archstone Consulting has significant experience in helping OEMs get the most out of their aftermarkets. In addition to helping reposition businesses for long-term success, our approach can bring near-term growth and sustainable cost improvement opportunities to our clients. These near-term improvements, in many cases, can make these projects self-funding.

Companies cited in this article are used for examples and not client information.

James Ilaria, Principal, Archstone Consulting,has more than 18 years of experience as a management consultant and as an internal strategy executive. He has worked extensively with clients in the areas of strategy, benchmarking and operations improvement and has also authored strategy and supply chain articles for use at the 1999 World Economic Forum in Davos, Switzerland. www.archstoneconsulting.com

© Archstone Consulting, 2006