With the Right Strategy, Companies Can Increase Profit Margins on Sales

To maintain sales during the recession, companies took steps such as slashing prices or doing business with marginal customers they would have thought twice about serving when the economy was booming. As companies’ cost of sales rose, their profits fell and their margins narrowed.

Now the economy is improving, and for many company sales are increasing. But at some companies, profits have not recovered and margins remain suboptimal. These companies are still operating as if it were 2009, at the depths of the recession, and they maintain the mindset that they have to sell regardless of the squeeze on margins. They are mired in a way of doing business that fails to produce the returns they expect.

For these companies, the solution is to meet their profit goals not just within some customer segments but across their customer base. They can accomplish this by ensuring that every customer who buys the company’s products or services does so at a price that permits the company to meet those goals.

Company executives can identify the most profitable customers or products through an analysis of the company’s sales. This analysis usually will find that 80% of a company’s sales are driven by 20% of its customers, or what is known as the 80/20 rule. This is not a new concept. It originated with the Italian economist Vilfredo Pareto, who in the early 1900s observed that 80% of the land in Italy was owned by 20% of the population.

What is new is that because of advances in technology and data analysis, company executives know more about their customers today than ever before and can apply the rule with much greater precision. Not only can they identify their best customers or products, they can identify the best of the best—the 5% or 1% or 0.5% that will account for the most profitable sales. Almost as important, they can readily identify underperforming customers and products – those that are not meeting the company’s profit requirements. Pareto would be dumbfounded.

Sales Strategy to Target Customers

To truly understand customers, build meaningful relationships with them and retain a base of ideal core customers, executivesshould take a comprehensive approach to reaching their optimal customers. This sort of approach begins with segmenting a company’s portfolio of customers based on specific criteria, such as the following:

• Products or services sold to individual customers;

• Volume of customer sales;

• Frequency and stability of orders;

• Cost of sales;

• Margin from sales to the customer;

• Additional company time and resources to serve the customer.

Using such criteria, company executives can begin to make decisions about which customers to target. They can determine, for example, the minimum volume of sales to customers and the minimum hurdle rates (profit goals) or profit margins. They may find that while the volume of sales to a customer is high, the margin does not meet the company’s profit requirements. They may therefore decide to negotiate price increases with the customer or simply raise prices to effectively price out the customer. Even if the margins from sales to a customer are satisfactory, executives may elect to drop the customer because of the high cost of serving the customer, the excess aggravation in addressing the customer’s concerns, or other problems. Conversely, sales to another customer may be low but the margins high, and thus executives may determine that the customer is worth keeping.

In addition to being relevant regarding customers, this analysis can be applied to a company’s products or services. For example, a product’s sales volume may be high but its profit margins low, and unless these margins can be improved, executives may choose to discontinue the product or sell the product line.

The following is an example of how this analysis can be used to evaluate the sales and margins by customer class for a division of a large manufacturer.

|

Customer Class |

Sum |

% of Total |

Count |

% of Count |

|

A |

$49,062,552 |

80.2% |

20 |

4.7% |

|

B |

$9,074,479 |

14.8% |

63 |

14.8% |

|

C |

$3,063,913 |

5.0% |

343 |

80.5% |

|

Total |

$61,200,944 |

100.0% |

426 |

100.0% |

This chart lists the division’s sales by three customer classifications: A, B and C. Class A customers by definition are those customers that account for 80% of the sales dollars, Class B customers are made up of the next 15% of the sales dollars, and Class C customers are defined as those customers that comprise the last 5% of the sales dollars. In the example above, Class A customers account for only 4.7% of the total customer base but represent just over 80% of the total sales, whereas Class C customers represent 80.5% of the total customers but only 5% of the total sales.

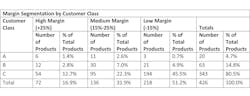

The following margin segmentation chart depicts the number and the percentage of customers within each of the three margin categories as defined by: high, or margins of more than 25%; medium, or margins of 15% to 25%; and low, or margins of less than 15%.

Class C customers account for the largest number of customers within each of the three margin categories. For example, within the high-margin customer base, 54 of the total 72 customers are Class C customers. Class B customers represent about 15% of total customers, and nearly half of these customers are medium margin. Less than 5% of the whole division’s customers are Class A, about half of them medium margin. Furthermore, low-margin customers account for slightly more than half (51.2%) of the division’s total customers.

In the following sales by margin chart, the manufacturer’s sales are categorized by margin. Slightly more than half of its sales (51.4%) are high margin, with Class A customers accounting for most of these sales. Nearly 40% of its sales are medium margin, with Class A customers accounting for nearly 30%.

Increasing Sales Profits

So how might executives increase the division’s profits from the sale of its products? Based on a product-by-product analysis of the division’s products, they could decide to do any or all of the following:

• Grow the company’s base of products with the highest sales volumes and profits.

• Increase sales of high- and medium-margin products by increasing sales volumes, or raising prices of these products, or doing both.

• Convert low-margin to medium-margin or high-margin products by raising prices of these products.

In this example, executives might define the company’s base as high-margin Class A and B customers, which represent only 4% of its customers but account for nearly half of its sales, as well as medium-margin Class A customers, consisting of less than 3% of the company’s customers but accounting for nearly 30% of its sales. With these customers, the goal of executives is to protect the base by maintaining sales volumes and margins. But the status quo is not enough. Executives want to grow the base by converting other of the company’s customers into higher-margin and higher-volume customers.

The key to achieving these goals is to provide superior customer service. For example, a company may guarantee 99% on-time delivery to its high-margin Class A and B customers, offer 97% on-time guaranteed delivery to its medium-margin Class A and B customers, and give a 95% on-time guarantee to its Class C customers.

Another goal is to reduce the division’s exposure to low-margin customers, which represent half of its customers but account for less than 10% of its sales. This might be accomplished by dropping certain high-volume customers or discontinuing certain product lines.

|

High Margin (+25%) |

||||

|

Customer Class |

Number of Products |

% of Total Products |

Total Sales |

% of Total Sales |

|

A |

6 |

1.4% |

$28,703,000 |

46.9% |

|

B |

12 |

2.8% |

$2,341,000 |

3.8% |

|

C |

54 |

12.7% |

$411,000 |

0.7% |

|

Total |

72 |

16.9% |

$31,455,000 |

51.4% |

|

|

Medium Margin (15%-25%) |

|||

|

Customer Class |

Number of Products |

% of Total Products |

Total Sales |

% of Total Sales |

|

A |

11 |

2.6% |

$18,294,000 |

29.9% |

|

B |

30 |

7.0% |

$4,693,000 |

7.7% |

|

C |

95 |

22.3% |

$1,069,000 |

1.7% |

|

Total |

136 |

31.9% |

$24,056,000 |

39.3% |

|

Low Margin (-15%) |

||||

|

Customer Class |

Number of Products |

% of Total Products |

Total Sales |

% of Total Sales |

|

A |

3 |

0.7% |

$2,065,000 |

3.4% |

|

B |

21 |

4.9% |

$2,041,000 |

3.3% |

|

C |

194 |

45.5% |

$1,577,000 |

2.6% |

|

Total |

218 |

51.2% |

$5,683,000 |

9.3% |

Widely Applicable

This approach to a sales strategy can be used across industries, products and service lines—from large manufacturers to appliance parts distributors to billion-dollar supply chain services. It is a holistic approach that encompasses questions such as how to free up working capital, reduce costs, or increase profits. Dropping marginal customers, for example, would allow a company to use working capital money saved by not serving them. Once the strategy is developed, a company can test a working model within a few weeks and startseeing results within a few months.

The recession has taught companies’ executives that selling as much as possible to as many customers as possible is not sustainable. It will result in an erosion of profit margins, a possible loss of shareholder value, and other undesirable consequences. Instead, a company needs to focus on its best customers, products and services, meet its profit targets, and build a strong customer base.

Bart Kelly is a principal with Crowe Horwath LLP in the Atlanta office. Ron Melcher is a principal with Crowe Horwath in the Atlanta office. Stephen Wiley is with Crowe Horwath in the Atlanta office.