Workforce: Final ACA Rules -- Easier to Comply, and Once and For All (Let's Hope)

On Feb. 12, the Obama administration issued the long-awaited final rules for implementing the employer mandate of the Affordable Care Act. The rules are aimed at making it easier for both large and midsize employers to comply with the law:

- Midsize employers (those with 50 to 99 employees) now have an extra year to meet the mandate. They have until Jan. 1, 2016, to comply, as long as they meet several certification requirements.

- Large employers (those with 100+ employees)—while they still have to meet the previously set Jan. 1, 2015 compliance deadline—are now required to provide coverage to only 70% of their full-time employees for 2015, not 95% as stipulated earlier when the administration issued preliminary ACA employer mandate rules in July 2013.

We talked with Stephanie Vasconcellos, an attorney with Neal, Gerber & Eisenberg who advises corporations on employee benefit issues, to get her take on the ACA employer mandate as it pertains to large and midsize manufacturing companies.

IndustryWeek: You have said that from your viewpoint, most employers are still in the process of figuring out how they're going to apply the ACA employer mandate. Why has this been such a drawn-out process?

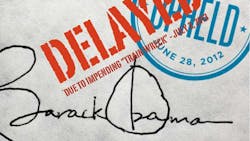

Stephanie Vasconcellos: A lot of the reason it's drawn out is because the government has made it drawn out. It took the federal government an incredibly long time to issue proposed regulations. As you'll recall, originally the act was signed into law in March 2010, and it wasn't until last year that proposed regulations came out. And from everyone's perspective who saw them and read them, the regulations were quite complicated, and it was clear that it was going to cost employers a lot of money and a lot of time to figure out how to apply them.

And for other employees, it's important to communicate how the health plan is changing and what they'll be eligible for.

The other thing [manufacturers should be doing] is working on implementing the systems they need to count hours, so that if the federal government ever comes and says, "You didn't provide coverage consistent with the law," you can say, "Look—here's what we did, here's how it worked." I think there's going to be some understanding that this is still a learning process for everyone, so the more documentation you have showing how and why somebody was or was not offered health insurance, the better off you'll be.

About the Author

Pete Fehrenbach

Pete Fehrenbach, Associate Editor

Focus: Workforce | Chemical & Energy Industries | IW Manufacturing Hall of Fame

Follow Pete on Twitter: @PFehrenbachIW

Associate editor Pete Fehrenbach covers strategies and best practices in manufacturing workforce, delivering information about compensation strategies, education and training, employee engagement and retention, and teamwork. He writes a blog about workforce issue called Team Play.

Pete also provides news and analysis about successful companies in the chemical and energy industries, including oil and gas, renewable and alternative.

In addition, Pete coordinates the IndustryWeek Manufacturing Hall of Fame, IW’s annual tribute to the most influential executives and thought leaders in U.S. manufacturing history.