Finance: Are You Ready to Start Spending Cash Instead of Saving It?

While 2013 hasn't quite shaped up to be the turning point for the economy that most had hoped for, enough positive signs emerged that senior executives at U.S. companies are bullish on 2014. And a lot of that optimism will see a shift from saving cash to investing it in growth opportunities.

In a recent quarterly survey of chief financial officers conducted by consulting firm Deloitte, 60% of respondents (mostly from companies with at least $1 billion in annual sales, in various industries) admit that the state of the North American economies is mediocre right now, but 65% are optimistic about the region's trajectory. Relatively few companies (less than 20%) will use cash as a hedge against business volatility, while nearly 60% plan to invest in organic growth and 50% say they'll be investing in acquisitions.

There is a definite shift in CFOs' sentiment away from defensiveness, notes Sanford Cockrell III, national managing partner with Deloitte's CFO program. However, he says, "CFOs' tempered near-term expectations suggest they are approaching growth in the same measured and incremental way they have cut costs over the last several years."

Measured Optimism on Growth

Looking at CFO optimism on a global scale, the level of positive thinking tends to vary based on geography as well as specific circumstances. For instance, in a recent study of senior finance executives conducted by consulting firm Accenture, 73% of CFOs in Brazil have a favorable outlook on the economy compared to last year, with only 16% being more pessimistic than they were in 2012. On the other hand, the number of pessimistic CFOs in the U.K. (40%) actually outnumber the optimistic (32%), the only country of the nine studied to skew negatively.

See Also: Manufacturing Industry Finance News & Trends

Respondents in the U.S. were somewhat in the middle of the pack, with 43% more optimistic and 31% less optimistic.

"Although CFOs expressed optimism about their prospects for growth, that euphoria is tempered by their inability to forecast their performance, particularly given the economy and other market drivers that remain in flux," says Don Schulman, global managing director of Accenture Finance & Enterprise Performance. "But as architects of growth, CFOs seek to drive their transformation agendas; the entire business can gain as finance leaders deliver timely, actionable data that can improve decision making in an uncertain environment."

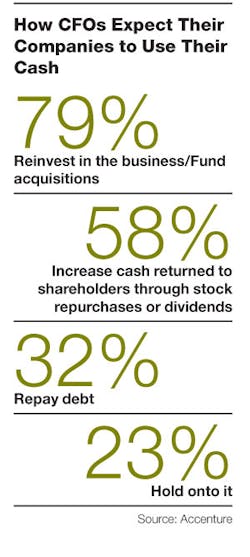

Consistent with the findings of the Deloitte study, 79% of the respondents to the Accenture poll say they plan to reinvest their cash in their business or fund acquisitions. Only 23% say they plan to hold onto cash (respondents could choose more than one answer; see below).

| Stay up-to-date on current cash management best practices at www.businessfinancemag.com. |

"CFOs who have access to reliable information will be best placed to use that cash with greater precision to generate a higher return on investment," Schulman says.

About the Author

Dave Blanchard

Senior Director of Content

Focus: Supply Chain

Call: (941) 208-4370

Follow on Twitter @SupplyChainDave

During his career Dave Blanchard has led the editorial management of many of Endeavor Business Media's best-known brands, including IndustryWeek, EHS Today, Material Handling & Logistics, Logistics Today, Supply Chain Technology News, and Business Finance. He also serves as senior content director of the annual Safety Leadership Conference. With over 30 years of B2B media experience, Dave literally wrote the book on supply chain management, Supply Chain Management Best Practices (John Wiley & Sons, 2010), which has been translated into several languages and is currently in its second edition. He is a frequent speaker and moderator at major trade shows and conferences, and has won numerous awards for writing and editing. He is a voting member of the jury of the Logistics Hall of Fame, and is a graduate of Northern Illinois University.