"A thought for my fellow CEOs: Of course, the immediate future is uncertain; America has faced the unknown since 1776. It's just that sometimes people focus on the myriad of uncertainties that always exist while at other times they ignore them (usually because the recent past has been uneventful)."

Those words from Warren Buffett in his 2012 letter to Berkshire Hathaway stockholders gently chide U.S. business leaders for what a number of observers consider too much timidity in their investments. But for many manufacturers, the fresh memory of a recession that saw production fall 13.6% in 2009 alone -- and employment rolls shed 2 million jobs -- continues to leave them cautious about the future.

See Also: Global Manufacturing Economy Trends & Analysis

At Newtex Industries, CEO Jerry Joliet has grappled with a wrenching series of challenges since taking over the company's top spot in 2006. The company makes a variety of products designed to protect people and equipment from heat and fire. When Newtex introduced its products in 1978 as a replacement for asbestos, the firm quickly grew. But by 2000, Newtex was facing a wave of cheap Chinese competition, while at the same time it opened a factory in China. The combination of Chinese imports and increased operating costs resulted in heavy losses.

But sequestration has already had an impact on Newtex. The company designed a heat shield for Air Force cargo planes, but so far it has only been installed on 17 planes instead of the hundreds originally anticipated. "Now that has been put on hold," he says.

"Executives are feeling a lot of uncertainty," says Bobby Bono, U.S. industrial manufacturing leader for PwC. Where in the past executives had better visibility into future revenue and could make resource allocations based on that, now, Bono says, there is less clarity as to what the future holds, not just with sales but with the impact of regulatory and tax policy.

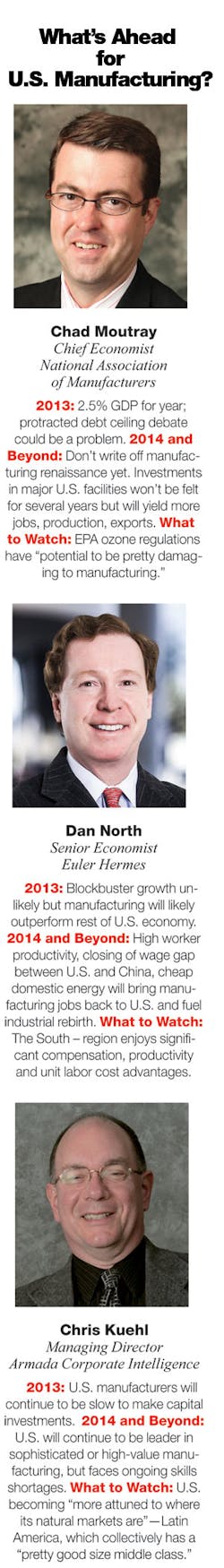

"Most of the companies that survived the recession did so because they were really careful," says economist Chris Kuehl, managing director of Armada Corporate Intelligence. "They would rather risk losing a little bit of market share than get into a debt situation they can't handle."

When the Fabricators & Manufacturers Association (FMA) recently conducted a poll, Kuehl noted, about one-third of the companies were "modernizing as fast as they possibly can." The other two-thirds "were really being cautious." Kuehl said the investment approach seemed to be closely related to the industry sectors they serve, with companies that supply the aerospace and automotive industries typically being more progressive.

Formidable Headwinds Buffeting Manufacturers

Recent economic data have done little to make manufacturers feel sanguine about the future. In April, factory production slid by 0.4%, the third month in the past four that manufacturing output contracted.

"The output backslide in April was broad-based, with widespread weakness in both durable and nondurable manufacturing," observes Cliff Waldman, senior economist for the Manufacturers Alliance for Productivity and Innovation (MAPI). "Suppliers of numerous manufacturing supply chains such as machinery, nonmetallic mineral products and fabricated metal products all suffered contractions in production, indicating fundamental factory sector weakness."

While the Institute for Supply Management's purchasing managers index continued to indicate growth in April, the index fell to 50.7%, the lowest rate of the year, and the employment component fell 4 percentage points to 50.2%.

U.S. manufacturing has shown "very modest growth in production and sales" in 2013, says Chad Moutray, chief economist for the National Association of Manufacturers. He attributes the slowdown to a number of economic headwinds U.S. manufacturers had little control over, including uncertainty over the Affordable Health Care Act, sequestration and weakness in the world economy.

The global economy is wreaking havoc with President Obama's goal to double U.S. exports by 2015. Moutray points out that manufactured goods exports slowed to 5.5% growth in 2012 and expanded at only a 1% rate in the first quarter of 2013. The JPMorgan Global Manufacturing PMI declined in April to 50.5, Moutray notes, signifying "very sluggish growth in production, new orders and hiring worldwide."

Moutray says four of the top 10 markets for U.S.-manufactured goods have declining manufacturing activity levels, with three of those markets being in Europe. "The largest weakness is in the European market, but exports to Canada -- our largest trading partner -- also declined," Moutray says. "Asia and South America saw the largest gains, with manufactured goods exports to China up 9.3% during the first three months of this year relative to the same time period last year."

On May 13, The Wall Street Journal published a poll of 52 economists who predicted that growth in the U.S. economy would be 2.4%, higher than the past two years. The Conference Board predicts a more conservative 1.6% growth figure, saying that growth will pick up in the second half of 2013 but that the "combined fiscal drag from the increased payroll tax rate and sequester spending cuts" would offset the positive effects of the rise in stock prices and in home prices over the past year.

Given that U.S. GDP growth has averaged about 2.5% for the past 20 years, the WSJ prediction normally would be OK, Kuehl tells IndustryWeek. "It would be great if we had not had a recession," he observes, "but we have damage that 2.4% is not going to help us correct."

A major piece of that damage, of course, is the slow recovery in the job market. To date, U.S. manufacturers have added about 530,000 jobs, after losing 2 million in the recession, but manufacturing hiring has slowed to a trickle in recent months. Through April, manufacturing had added only 35,000 jobs in 2013, according to government data.

Kuehl says market conditions have made manufacturers wary and that many are delaying hires for several months. "It is kind of an awful way to run the business because everyone is under stress, but on the other hand, you don't hire them and then six months later have to lay them off," he says.

Home to High-Value Manufacturing

The slow return of jobs has generated considerable debate about what constitutes a U.S. manufacturing "renaissance." Kuehl says industry will never again provide jobs for "the high school graduate who doesn't want to go on to college." But he said manufacturing has reversed 30 years of decline in its contribution to U.S. GDP and remains a world leader in producing sophisticated, high-value goods.

That is evident in the strategy of Legrand, a $5.8 billion manufacturer of electrical and data network products with 30,000 employees. The company invests almost 5% of sales in research & development and has a goal of having 50% of its sales derived from products launched in the last five years, notes Halsey Cook, president of Legrand's Electrical Wiring Division.

The French-headquartered firm expects to reach $1 billion in U.S. sales in 2013. Since acquiring Pass & Seymour in 1983, Legrand has purchased 12 other companies in the U.S. It remains on the lookout for acquisitions, targeting 50% of its growth from acquisitions.

The company is not only developing its technology but making a concerted effort to differentiate its products through more sophisticated designs. In October 2012, Legrand launched its Adorne line of switches and outlets, under-cabinet lighting, and wireless systems for the home. The switches, dimmers and outlets feature a distinctive square design and a flush fit with wall plates that eliminates the need for visible screws.

Legrand is also focused on operational efficiency. For example, the company joined the Department of Energy's Better Buildings, Better Plants challenge and has already improved its energy efficiency by 28% in three years.

Cook says the company is being vigilant about not overextending itself, but he also points out that it has set a goal to double sales by 2017. "You're not going to be able to sit on the sidelines and watch if you want to do that," he says. No doubt, Warren Buffett would approve.

About the Author

Steve Minter

Steve Minter, Executive Editor

Focus: Leadership, Global Economy, Energy

Call: 216-931-9281

Follow on Twitter: @SgMinterIW

An award-winning editor, Executive Editor Steve Minter covers leadership, global economic and trade issues and energy, tackling subject matter ranging from CEO profiles and leadership theories to economic trends and energy policy. As well, he supervises content development for editorial products including the magazine, IndustryWeek.com, research and information products, and conferences.

Before joining the IW staff, Steve was publisher and editorial director of Penton Media’s EHS Today, where he was instrumental in the development of the Champions of Safety and America’s Safest Companies recognition programs.

Steve received his B.A. in English from Oberlin College. He is married and has two adult children.