Overall economic growth in China was slower than expected for much of 2012, but the momentum accelerated noticeably in the fourth quarter, and the outlook is for a period of consistency, according to a new report from the Manufacturers Alliance for Productivity and Innovation.

The group notes that the fourth quarter advance was largely due to the stabilization in exports and the real estate sector, growth-supportive monetary policy, and public support for infrastructure investment.

For all of 2012, however, real (inflation-adjusted) GDP growth decelerated to 7.8%, the first time in more than a decade that growth failed to reach 8%.

“In 2013-2014, the pace of economic expansion is expected to remain at around an 8% annual rate as the global economic environment improves and net exports become less of a drag on growth,” said MAPI economist Yingying Xu, Ph.D “Domestic consumption will benefit from the government’s agenda to boost household income through structural tax reform, a minimum wage increase, a strengthening of the social safety net, and interest rate liberalization.”

Consistent with the overall economic trend, China’s manufacturing production regained some strength in the last quarter of 2012; manufacturing sales revenue increased 7.1% in 2012, slightly lower than MAPI’s previous forecast of 8%.

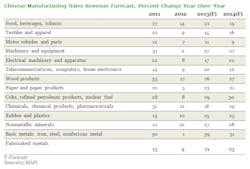

Manufacturing sales revenue growth should see solid improvement in the next two years, with the materials and equipment industries as the lead drivers. MAPI forecasts that final 2013 and 2014 manufacturing sales revenue growth will be a robust 23% in both years.

“Consumer goods will continue to benefit from significant domestic demand, and for equipment industries, the expansion pace for heavy machinery and electrical machinery will be much faster than in 2012,” Xu said. “In addition, for those materials used intensively in infrastructure construction, real estate investment, and automobiles, sales revenue growth will speed up as downstream demand stabilizes and raw materials prices rebound.”

Basic metals—iron, steel, and nonferrous metals—are expected to show the most growth in 2013 and 2014, at 39% and 31%, respectively. Coke, refined petroleum products, and nuclear fuel sales revenue is anticipated to grow by 29% in 2013 and 30% in 2014.

About the Author

IW Staff

Find contact information for the IndustryWeek staff: Contact IndustryWeek