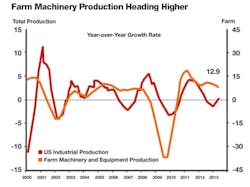

Recent economic news has been positive. A stock market rise, some positive reports on GDP growth, good news from the housing industry and slow but steady retail sales growth all bode well for the near-term health of the U.S. economy. We anticipate that U.S. industrial production, our benchmark for overall economic activity, will continue growth through the remainder of 2013.

IndustryWeek readers involved in the agricultural and farm machinery sectors have no doubt noticed that production is beginning to move higher, giving industry participants more opportunities with each passing month. After reaching its high point in December 2011 (annual basis), production fell into a pattern of slower growth that ended in a recession in August 2012. In January 2013, farm machinery and equipment production was 3.6% below the year-ago level. Annual production as of the May 2013 data has moved to 0.8% above the year-ago level. Quarterly production is 13.7% above the same period last year. We expect growth to continue and the annual production level to end the year 10.6% above the 2012 level.

See Also: Global Manufacturing Economy Trends & Analysis

This spring has been busy for agricultural equipment retailers, despite rainy weather and some planting delays. Higher commodity prices over the past year encouraged farmers to reinvest profits into machinery. Self-propelled combine sales have risen dramatically to 66% above the same quarter last year and 22.1% above the year-ago level. This is the fastest rate of growth since 2009. Two- and four-wheel drive tractor retail sales are currently 24.0% and 22.2% higher than last year, respectively. Internal trends suggest further sales growth ahead in this market.

Agricultural machinery production on a global level is experiencing varied growth rates. Brazilian production saw steady growth in 2012 but fell into a mild recession in early 2013. By April, production had risen 1.5% above the year-ago level, and a rise in quarterly activity makes the annual growth trend look viable. Increasing demand from emerging markets for Brazil's soybean crop is a major factor; China alone consumes around 70% of Brazil's harvest. Doing business in Brazil remains a good long-term objective.

Results are less positive in Europe. Annual European farm machinery production fell 1.9% below the year-ago level of activity. An Eastern European drought combined with excessive heat in Western Europe tempered the need for machinery. More favorable growing conditions this year will help boost demand. Those conditions, in combination with a mild improvement in the general economic environment, should help the European sector recover later this year with the good news lasting into the first half of 2014. However, foreign governments are subsidizing purchases of domestically manufactured agricultural equipment, a move that could significantly impact the fortunes of European manufacturers and exporters.

Such policies could also further influence the fortunes of U.S. manufacturers as these government incentives, combined with moderate global growth, have dampened U.S. exports of agricultural machinery. On an annual basis through April 2013, exports totaled $12.21 billion, a slim 0.5% above the year-ago level. Expect exports to fall below their year-ago level as we move into the summer months. However, foreign demand will rebound, helping bring export levels back up. A slightly weaker dollar would also encourage exports.

| Leverage actionable—and 94.7% accurate—economic forecasts from ITR Economics. Download a free sample report or subscribe now at www.industryweek.com/ITR-advisor. |

Relatively low cost equipment, especially in the light of future inflationary trends, should provide an incentive to move forward with needed expenditures. Low interest rates are also a favorable inducement. A mild rise in interest rates, or the threat of higher interest rates, will help propel side-lined buyers to make the decision now instead of later. We think these trends will be slow to develop over the next year.