Feeling a bit impatient about the weak recovery? You’re not alone.

While 85% of manufacturing and distributor executives are optimistic about their business prospects, a choppy economy and uncertainty about regulations have left them “impatient” with results that are better than before but not good enough to merit increased investment. That’s one of the findings of the Manufacturing & Distribution Monitor report released by tax and consulting firm McGladrey today.

“Most folks had good growth years in 2010 and 2011, but they feel like momentum has stalled a little bit,” observes Karen Kurek, a partner and national industrial products practice leader for McGladrey.

That feeling comes despite the fact that 71% of the companies surveyed had increased U.S. sales in the past year and 57% saw growth in their non-U.S. sales.

The survey of middle-market executives found that they expect average sales increases of 8% in the coming year. “That’s okay but it’s not hitting it out of the ballpark,” says Kurek, with the result that business confidence continues to be undermined.

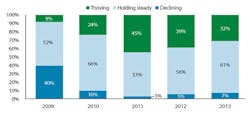

Though manufacturing employment has not grown in recent months, 63% of business executives in the survey said they expected to increase employment in the next 12 months, down slightly from the 67% who said they would do so in 2012. Respondents also said they were more likely to increase employment in the U.S. than in their foreign operations. Executives said they expect to increase their workforces by an average of 4.3%.

The growth in U.S. employment may reflect a growing appreciation for the U.S. market and for the competitive advantages of being close to customers. Some 52% of all respondents said it was important or very important to be in close proximity to their customers. Moreover, 42% of manufacturers said it was important to have their engineers and product developers situated close to their manufacturing facilities.

The survey also found a “significantly lower” interest by middle-market companies in offshoring. Only 5% of executives said they were likely or very likely to relocate operations offshore. Still, executives weren’t predicting a rush to bring operations back to the U.S. Only 14% said they were likely to onshore operations in the coming year.

In focus groups conducted along with the survey, Kurek says, several manufacturers talked about bringing operations back to the U.S. to be closer to not only the U.S. market but Canada and Mexico. They also cited concerns with rising labor costs in China, quality issues, supply chain disruptions and resulting lost sales.

“Customers are demanding to have products much soon than they did even 18 months or 2 years ago,” Kurek reported.

One cautionary note in the survey was concern over rising costs. Some 80% or more of executives expect increase in inventory, materials and components; transportation and fuel; and energy and utilities. However, just 37% expect to see their cost of debt rise in 2013. Kurek noted that for executives who said they would be raising prices, the average was about 4.5%, roughly covering the anticipated cost increases.

Regulations Seen as Drag on Growth

More worrisome to executives, McGladrey found, was the business environment and the impact of regulations. In fact, the top four issues identified by executives as likely to limit growth in the coming year were:

- 74% Government regulations

- 71% Implementation of the Affordable Care Act

- 69% Increase in payroll taxes for Social Security and Medicare

- 67% Federal deficit

Executive will keep a tight rein on spending to maintain margins, but one area where they will open their wallets in 2013 is in information technology.

“Many businesses delayed investing in information technology, thinking that it was a way to control costs and conserve cash. But now executives are admitting that IT spending can no longer wait,” the study concludes. “Spending money on the right IT resources can be an avenue to growth by providing visibility into multiple facets of the business, from cash-flow management, lead time and backlog analysis, productivity by employee data, and much more.”

About the Author

Steve Minter

Steve Minter, Executive Editor

Focus: Leadership, Global Economy, Energy

Call: 216-931-9281

Follow on Twitter: @SgMinterIW

An award-winning editor, Executive Editor Steve Minter covers leadership, global economic and trade issues and energy, tackling subject matter ranging from CEO profiles and leadership theories to economic trends and energy policy. As well, he supervises content development for editorial products including the magazine, IndustryWeek.com, research and information products, and conferences.

Before joining the IW staff, Steve was publisher and editorial director of Penton Media’s EHS Today, where he was instrumental in the development of the Champions of Safety and America’s Safest Companies recognition programs.

Steve received his B.A. in English from Oberlin College. He is married and has two adult children.