NAM/IndustryWeek 4Q Survey: Manufacturers Had a Good Year and Expect 2015 to Be Better

Recent data show relative strength in demand and output in the manufacturing sector, with activity levels reflecting improvements since earlier in the year. In particular, the latest Institute for Supply Management’s purchasing managers’ index has reflected robust growth in new orders and production since the summer, and employment and pricing pressures appear to be moving in the right direction. The forecast for real GDP and industrial production for 2015 also show promise, both of which are anticipated to expand by roughly 3% next year.

That is not to suggest a smooth road ahead, as there are challenges. The slowing global economy, a still-cautious consumer, rising interest rates, a stronger dollar, and tax and regulatory uncertainty could each pose downside risks to U.S. economic growth. Along those lines, manufacturing production and retail sales numbers have been softer than desired in the autumn months, and export sales growth has continued to be sluggish in light of economic challenges abroad.

Manufacturing Leaders Have a Positive Outlook

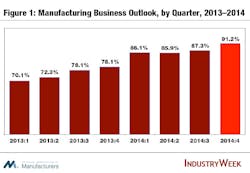

With that said, manufacturers in the most recent National Association of Manufacturers (NAM)/IndustryWeek Survey of Manufacturers remained mostly optimistic, at least for now. Indeed, 91.2% of respondents were either somewhat or very positive in their own company’s outlook (Figure 1). This continues an upward trend that began in the first quarter of 2013, and it was only the fourth time since the survey began in 1997 that the outlook measure has been 91% or better. The last time was in the fourth quarter of 2005. Parsing this data out by firm size, larger manufacturers (i.e., those with 500 or more employees) were the most positive, with slightly more than one-quarter saying they were very positive; in contrast, only 18.8% of the smallest manufacturing firms (i.e., those with fewer than 50 employees) were very positive.

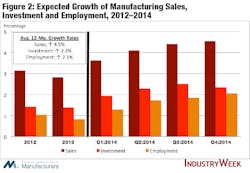

Stronger sales expectations supported the better outlook in the fourth quarter. Manufacturers predict sales to grow 4.5% on average over the next four months, up from 4.1% in June and 4.4% in September (Figure 2). This marks the fastest pace since the first quarter of 2012. In the most recent survey, 77.3% of respondents forecast increased sales over the next year, with nearly 49% predicting sale growth of 5% or more. Medium-sized manufacturers (i.e.., those with 50 to 499 employees) had the greatest sales expectations for the next 12 months, at 4.8% versus 4.0% for smaller entities.

Manufacturers also expect to hire more workers in the next year. Firms plan to increase their employee levels by 2.1% on average over the next 12 months, up from 0.9% one year ago and 1.9% in the last survey. This marks the fastest pace in more than three years (second quarter of 2011). Half of those taking the survey responded that they see positive gains in employment over the next year, up from 46.0% in September. Still, 45.6% do not plan to make any employment changes.

On the other hand, manufacturers expect the pace of growth for capital spending and exports to decelerate over the next year. They plan to increase capital spending by 2.3% over the next 12 months, down from 2.5% in September. To be fair, this still represents an acceleration from the anticipated rate of 1.4% reported in December 2013. Looking specifically at this survey, the lower figure resulted from an increase in those predicting declines in capital investment, up from 7.8% in September to 12.6% in December. Still, 31.7% plan capital spending increases of 5% or greater, suggesting that investment data remain largely a positive story.

Of all of the key indicators, capital spending expectations exhibited the largest differences according to firm size. Large manufacturers plan to increase investments by 3.7% over the next 12 months, but that rate falls to 2.5% and 1.0%, respectively, for medium-sized and smaller firms. More than half of small manufacturing businesses anticipate that capital investments will stay the same, which stands in contrast to the 21.1% of larger manufacturers who said the same thing. In fact, one-quarter of large manufacturers are planning to increase capital investments by more than 10%; whereas, just 9.5% of firms with fewer than 50 employees had that level of optimism.

While domestic demand has been relatively strong, exports continued to be soft, reflecting the global economic environment. Indeed, the pace of expected export growth has decelerated for the second straight quarter, down from 1.6% in June to 1.3% in September to 1.2% in this survey. The percentage of respondents predicting exports to increase over the next 12 months declined from 43.4% in the last report to 39.1% this time. As noted in prior releases, manufacturers who expect increased exports over the next year have a more positive outlook relative to those predicting declines or exports being unchanged. In addition, of those expecting higher exports, 78.6% support enacting Trade Promotion Authority.

Meanwhile, manufacturers expect their inventories to increase 1.1% over the next 12 months. This marks the fourth consecutive quarterly increase in stockpiles. While 53.8% of those taking the survey predict inventory levels to remain unchanged, almost one-third predict increased inventories in the next 12 months.

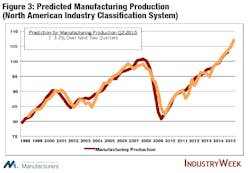

For several quarters now, we have used the NAM/IndustryWeek outlook data in a regression model to predict manufacturing production two quarters ahead (Figure 3). Other variables include current values for housing permits, the interest rate spread, personal consumption and the S&P 500. This model explains 90% of the variation since the data began in the fourth quarter of 1997.

The current model is very encouraging and suggests that manufacturing production should continue to accelerate, growing 3.2% over the next two quarters. In addition to an increased manufacturing outlook, the rising stock market, better housing permits data and decent growth in consumer spending help push this figure higher.

Manufacturers Remain Frustrated with Washington

Despite the stronger economic outlook, manufacturers continue to express frustrations with the political environment. In fact, 72.7% of those taking the survey said that the United States was on the wrong track, with just 9.1% feeling we are headed in the right direction. The remainder were unsure. To put a slightly positive spin on the data, we asked this same question six months ago. In June, 79.3% said that the country was on the wrong track, and 5.0% suggested it was on the right track. As such, while sentiment marginally improved, it remains less than ideal.

This survey took place after the midterm election, allowing us to gauge manufacturers’ reactions to the results. In general, respondents were pleased with the outcome, with 64.8% more optimistic that policymakers would address our long-term challenges. Indeed, 36.8% said they would raise their outlook for 2015 as a result, with 15.2% and 20.0%, respectively, suggesting they would increase employment or business investment. At the same time, 38.4% said the election outcome would have no impact on their activity or outlook.

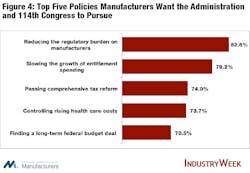

Manufacturers were asked about which policy actions they would like to see pursued by the Obama Administration and the new Congress (Figure 4). Most respondents, 82.8%, cited reducing the regulatory burden. This was followed by a desire to tackle the growth in entitlement spending (79.2%), passing comprehensive tax reform (74.0%), controlling health care costs (73.7%) and finding a long-term federal budget deal (70.5%). Other pressing issues included enacting a true “all-of the above” energy policy, enacting a long-term solution for infrastructure investment, addressing the skills gap and expanding global opportunities through new trade agreements. For some sample comments, see the end of this write-up.

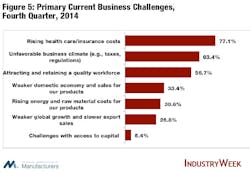

Beyond these policy goals, respondents were also asked about their current primary business challenges (Figure 5). A majority of survey respondents, 77.1%, again cited rising health insurance costs as their top challenge. In the manufacturing sector, businesses see benefit costs rising an average of 6.3% over the next 12 months, with health insurance premiums anticipated to increase 9.5% on average in 2015.

More than 83% of those taking the survey said their health insurance premiums rose by 5% or more, with 50.9% indicating that their costs rose by 10% or more. As one might expect, firm size mattered in these results. The average premium increase for large manufacturers was 7.7%, which was lower than the 9.4% and 10.6% averages seen for medium-sized and small manufacturing businesses.

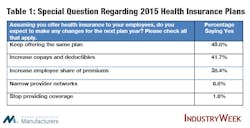

We asked manufacturers about what kinds of changes they might make to their health insurance coverage next year, particularly in light of expected premium increases (Table 1). Roughly half indicated they intend to keep the same plan, nearly 42% said they would have to increase copays and deductibles, and 38.4% said they would need to increase the share of premiums paid by employees.

The second-most pressing issue for manufacturers remains the business climate, noted by 63.4% of those taking the survey this quarter (Figure 5). Businesses would like policymakers to enact comprehensive tax reform and address rising regulatory burdens. In addition, workforce development challenges remain top-of-mind for many manufacturers, with 56.7% listing attracting and retaining workers as a primary challenge. For its part, manufacturers have pushed for solutions to the skills gap issue for a long time, establishing a skills certification system and creating the NAM Task Force on Competitiveness and the Workforce. This fall, it issued a set of action items to proactively address this problem.

Sample Comments

- “Can’t find skilled machinists.” (Primary metals or fabricated metal products)

- “Government regulation and an increasing cost of complying with regulations at all levels: local, state and federal governments.” (Chemicals)

- “Growing strength of [the U.S. dollar] will make our export sales more expensive and therefore more challenging.” (Machinery)

- “Lower taxes and have the government stop interfering with energy policy.” (Miscellaneous manufacturing)

- “Not enough capacity to meet customer demand!” (Computer and electronic products)

- “One of our biggest threats is the lack of a skilled and trained workforce. We can find college grads, but they don't have any skills [that we need] to go with their education.” (Machinery)

- “Passing immigration reform.” (Miscellaneous manufacturing)

- “Pass laws that encourage business and job growth.” (Machinery)

- “Resolving tax issues before taxable year begins.” (Primary metals or fabricated metal products)

- “Rising costs of environmental compliance.” (Primary metals or fabricated metal products)

- “The shortage of railcars in the United States is severely hampering our ability to keep enough inventory on hand.” (Nonmetallic mineral products)

About the Author

Chad Moutray

Chief Economist

Chad Moutray is chief economist for the National Association of Manufacturers (NAM), where he serves as the NAM’s economic forecaster and spokesperson on economic issues. He frequently comments on current economic conditions for manufacturers through professional presentations and media interviews. He has appeared on Bloomberg, CNN, C-SPAN, Fox Business, Fox News, and Reuters television.

Prior to joining the NAM, Dr. Moutray was the chief economist and director of economic research for the Office of Advocacy at the U.S. Small Business Administration (SBA) from 2002 to 2010. In that role, he was responsible for researching the importance of entrepreneurship to the U.S. economy and highlighting various issues of importance to small business owners, policymakers and academics. In addition to discussing economic and policy trends, his personal research focused on the importance of educational attainment to both self-employment and economic growth.

Prior to working at the SBA, Dr. Moutray was the dean of the School of Business Administration at Robert Morris College in Chicago, Ill. (now Robert Morris University of Illinois). Under his leadership, the business school had rapid growth, both adding new programs and new campuses. He began the development of an MBA program that began accepting students after his departure and created a Business Institute for students to work with local businesses on classroom projects and internships.

Dr. Moutray is a former board member of the National Association for Business Economics (NABE). He is also the former president and chairman of the National Economists Club, the local NABE chapter for Washington, D.C. He holds a Ph.D. in economics from Southern Illinois University at Carbondale and bachelor’s and master’s degrees in economics from Eastern Illinois University. In 2007, he was named a distinguished alumnus by Lake Land College in Mattoon, Ill., where he earned his associate’s degree in business administration, and in 2014, he received an Outstanding Graduate Alumni Award from Eastern Illinois University.