How to Expand Your Continuous-Improvement Program to Drive Growth

United States manufactures have incorporated many methods of cost reduction and efficiency for 35 years. Most of these programs are identified by three-letter acronyms like MRP, JIT and ERP. Others include the super manufacturing programs Six Sigma and lean manufacturing.

Most off these programs infer that they can reduce costs, improve profitability and make the manufacturer globally competitive (whatever that means).

Some of the agencies designated to help small- and mid-size manufacturers (SMMs) with continuous improvement imply that using and mastering these programs will lead to growth, including the following:

- The National Institute of Standards and Technology's (NIST) Hollings Manufacturing Extension Partnership (MEP) on its website asserts: “Lean helps companies develop and implement a long-term plan to streamline operations with a focus on growth and innovation."

- Mantec, an MEP Center in South Central Pennsylvania, on it's website says: "To be competitively positioned to capitalize on the opportunities available in the dynamic markets of today and tomorrow –- to not just survive, but to grow and thrive – U.S. manufacturers must address six key critical areas in concert: Continuous Improvement, International Trade, Supplier Development, Sustainability, Technology Acceleration and Workforce.

- In the book Grow to Greatness, author Edward D. Ness, writes: “Good growth companies are characterized by strategic focus, operational excellence, continuous improvement, customer centricity, and high employee engagement.”

There is no suggestion that growth may have something to do with marketing or sales.

- A report “Breakthrough Objectives and Continuous Improvement,” suggests that to increase the company’s ability to grow revenue requires a business plan rooted in continuous improvement.

- A speaker at a convention in Cincinnati offered a seminar on improving sales growth through lean learning.

Continuous improvement is about improving internal processes and has little to do with external factors like customers, markets and sales revenue growth. I think that, in their enthusiasm for many kinds of continuous-improvement programs, some of these authors experience mission creep. With all of the successes in improving internal processes, continuous improvement, they seem to believe, is the remedy for all the manufacturer’s problems. They imply that if you are excellent at all internal operations, then you will somehow grow and increase sales.

I am simply making the case that most continuous-improvement solutions for manufacturers are about internal methods –- methods that can be controlled inside the plant environment; they never address the methods of how you deal with the external environment.

Several years ago I was teaching a seminar in Orlando on growth planning. The audience was comprised mostly of consultants who sold lean manufacturing and Six Sigma services to manufacturing companies. At the end of the seminar, I asked them what measurements they used to determine whether their clients had become lean. They told me that they were lean if the manufacturing company had excess capacity for more sales.

I then asked them: If they had created this excess capacity, how did they ensure there would be more sales? They said they didn’t know and that is why they came to my seminar.

Lackluster Results from Years of Continuous Improvement

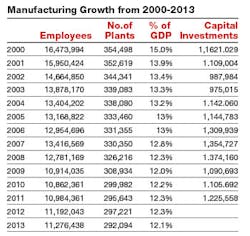

After many years of investing in continuous-improvement programs, it does not appear that American manufacturing is growing. If you examine the chart below in terms of four key factors, there is little evidence of growth.Since the year 2000, U.S. manufacturing has lost 5,197,556 employees and closed 62,404 factories; manufacturing’s percentage of total GDP has slipped 3 percentage points; and investment in capital expenditures has declined.

Something is really wrong here. The cost reduction and continuous-improvement efforts, as important as they are, have not brought real growth to manufacturing.

Growth in terms of sales revenue and employees is obviously needed if we are to reverse these trends. But growth is not going to come from cost reduction or completing the lean journey.

I do not think that it is possible to grow manufacturing in America without focusing on the external environment and developing a plan that describes specific strategies for finding new customers, finding new markets, and developing new products that the customers want and need.

Download

Solving Manufacturing's Biggest Challenge: Driving Revenue Growth

An IndustryWeek Best Practices Collection of Michael Collins' Growth Strategy Articles

How to Develop a Continuous-Improvement Growth Plan

I have always felt that continuous improvement should also address the external environment with a marketing plan. Increasing top-line sales and overall growth are not going to automatically happen because you are Six Sigma certified. Top-line sales growth will require a different kind of plan that should be developed in parallel with any process-improvement projects. If not, the company will get to the end of its lean journey with plenty of new capacity and no new sales.

The following are some of the questions that need to be answered if you are going to develop a plan for growth as part of the continuous improvement process.

- Can you identify the best customers to sell to – now and in the future?

It is important to know how to profile the best customers -- a profitable customer or one with future sales potential -- to grow your business profitability. The simplest way to achieve this is to carefully profile the ideal type of customer; then find more like them. Usually, you can do this by examining the best of your current and past customers.

- Do you know what kinds of products and services the best customers want?

Developing a systematic way of monitoring customers is where you will find many ideas for new products and services. Monitoring customers is almost always the key to success in increasing sales and finding market opportunities, and should be part of your continuous-improvement program, because it provides you with the customer feedback you need. When there is no formal procedure to track customer comments, the chances of not meeting customer needs increases, which leads to customer defections.

- Do you know which market niches (customer groups) to focus on now and in the future?

If you can find out the NAICS code for the customer’s products, you can group these customers into market niches. This code will allow you to find the total number of prospects in the market niche to develop a sales plan.

- Can you compare your products to the competitor’s products in terms of price, delivery, and key features -- model by model?

The first reason competitive intelligence information is important is that it shows you whether you have a competitive advantage. When the objective is to find new customers and new markets. it is important to find out:

* How many competitors there are for each product line or service

* How your products or services compare to their products in terms of

customer buying perceptions

* How your prices compare to their prices from customer buying perceptions.

If you can’t answer these questions you will put your salesman in a bad position at the point of sale. - Do you know the specific reasons you lost orders to competitors?

One of the best indicators of whether a marketing or sales program is working is the ratio of orders to lost orders. Knowing why customers buy or don’t buy is vital to the sales effort.

The reasoning is simple -- it is difficult to know what to do to prevent future lost orders or lost customers if you don’t know why you are losing orders and current customers.

The bottom line is you can’t really develop a plan to increase sales growth or even survive in the new economy without knowing why you lose orders and customers. If you don’t know why you are currently losing orders, then you will find out at the point of sale whether you have competitive advantage or not. A lost-order tracking system should be a part of your continuous improvement program.

I think manufacturing has done an incredibly good job of continuous improvement, but we are never going to reduce our costs enough to compete with the Asian countries or other third world countries who want to be our suppliers.

Cost reduction and efficiency have kept us in the manufacturing game, but manufacturing is not growing. Manufacturers need to move from the internal processes to the external environment and develop methods to find new market opportunities and increase sales. You need to expand your continuous-improvement program to include a sales plan and methods to analyze external factors.

Michael Collins is the author of Saving American Manufacturing. His website is mpcmgt.com.