Automakers Will Burn the EV, ICE Candle at Both Ends for Years

Battery-electric offerings will increase dramatically over the next several years. Fleet and retail customers will benefit from the broader spectrum of choice. Fortunately, there will be enough capacity to satisfy all of their needs, and then some.

Battery-Electric Sales Continue to Climb, Slowly

This year will mark a meaningful change in the mix of battery-electric vehicle sales. Mainstream brands are launching 13 new entries, boosting share already captured by Nissan Leaf, Chevrolet Bolt/EUV, Ford Mach-E, Kia EV6, Hyundai Ioniq5 and VW ID.4. The new offerings will improve the image of the sector that is currently viewed as way too expensive, and for rich innovators.

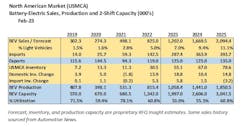

I see North American sales of battery-electric models (BEV) increasing to 1.2 million in 2023, capturing 7% of the light-vehicle market. This represents a substantial improvement from 2022 performance. Yet consumer acceptance will remain relatively low for many reasons, most notably: driving range, high base MSRP and the time it takes to recharge and get back on the road.

Additionally, inventory will be low, restricting the opportunity to roam the dealer’s lot for trim and color alternatives.

Built-in Sales Deterrents for EVs

There are also brand portfolio deterrents, not widely covered in the automotive press, that will keep BEV acceptance low through the 2025 business cycle.

First, legacy brand showrooms will be filled with gasoline inventory that is lower-priced and with reasonable incentives. Shoppers will have the ability to choose a Chevrolet Equinox as a gasoline version immediately, or wait a few months for an Equinox EV and pay more. This showroom dilemma will also exist at Ford, where shoppers can choose between a Lightning pickup and the best-selling F-150 gasoline version.

Sure, there will be BEV test drives. That is critical, but final choice will favor the gasoline version. Shoppers could also be swayed to competitive hybrid versions that offer great mileage and solve the range-anxiety issue.

Nationwide coverage is also an issue. Start-ups, like VinFast, Rivian and Canoo, just don’t have the 50-state distribution system (let alone 10 Canadian provinces) that generates higher volumes. Legacy brands have an advantage here.

Sales Advantages for EVs

The recently approved Inflation Reduction Act will help increase sales of BEV and hybrid models produced in North America, assuming customers know the incentives exist and the sales force can explain how to get them. The sales boost will take time to develop due to the complexity of the incentive requirements. These requirements increase in complexity after 2023 and could result in vehicles dropping off the approved list during 2024 and 2025. This uncertainty is not good for closing deals.

BEV sales will also be helped by any leasing deals offered on imported models. Leasing and subscription services could reach 35% of sales on models like Kia’s EV6, if finance companies pass along the full $7,500 federal incentive to the customer. This “clean commercial vehicle” loophole, where IRA Made-in-America requirements do not apply to leased vehicles, could generate a sales lift for USMCA-produced vehicles as well.

There will be quite a bit of advertising and PR hype during the next few years, but sales of BEV models will remain fragmented. For example, consumers will have 37 new entries to choose from by the end of the year. However, only six models will sell more than 30,000 units during the year, and Tesla will have three of them.

Model-brand identity is difficult for marketing mavens to develop when annual sales are this low. All in, the sales forecast for battery-electric vehicles will reach 2.1 million units by 2025 and be spread over 139 different models, up from 87 in 2023. Not everybody will survive here, folks!

BEV Excess Capacity Is a Good Strategy

Manufacturing executives are hard at work creating a new production landscape. Manufacturing is pushing (versus customer pull) increased capacity for battery-electric production. Everybody is chasing the same vision and loudly explaining it. However, do not get confused with announcements of capacity increases and assume they are reflections of underlying demand.

Production capacity for battery-electric vehicles will increase significantly over the next few years to 3 million units, ensuring enough supply to meet demand. In fact, there will be excess capacity, with utilization around 60%. And that is a good thing! Any sector that is going through a transformation needs enough capacity to get there without bottlenecks, and to allow for marketing and product flexibility. Otherwise, you never get to the vision.

Manufacturers also need a return on their investment. Sure, battery manufacturing incentives will mitigate some of the pain. Just don’t expect any significant reductions in vehicle prices, or additional incentives, through the forecast window. Manufacturers will rely on incentives provided by taxpayers (versus shareholders) to bolster sales. A wider range of inventory at the dealer would really help. Yet, this seems problematic given that many manufacturers are chasing the Tesla distribution model.

Here is what will not happen over the next few years: a reduction in capacity required to meet the demand for gasoline and hybrid vehicles. While they provide competition to battery-electric models, sales of gasoline pickups, utility vehicles and vans are essential for profitability. Getting to the vision and losing money is not an option.

Steve Carlisle, President of GM North America, said it best back in 2020: "We don't know how long the transition will take, so we're in a good spot to continue to grow the business and fund the business with our internal-combustion portfolio while we work on ramping up on the battery-electric side.” That strategy makes sense.

Consumers will decide how long the transition will take, not the government. They will also dictate the shopping process for battery-electric models. If the dealer’s salesforce can’t close the deal due to lack of battery-electric inventory, then legacy OEMs will shun the Tesla distribution model. In fact, having the right levels of battery-electric and hybrid inventory may be a strategic advantage for GM, Ford and Toyota.

The transition will also put additional stress on automotive suppliers. They will be required to have battery-electric parts capacity that will line up with assembly requirements. At the same time, they will have to be ready to meet the requirements of gasoline and hybrid model production. No small task.

Currently, suppliers are gearing up to bid on supplying parts for battery-electric models that will be launched after 2026. When suppliers ask this question during the RFQ negotiation process: “What gasoline light trucks will be dropped when this model is launched?” they shouldnot be surprised when the answer comes back, “None, we need both versions.” The result: engineers and product strategists will be working overtime for the foreseeable future.

Warren Browne is president of RFQ Insights and is adjunct professor of economics and trade at Lawrence Technological University. Browne retired from General Motors in 2009 after 39 years of service. From 1991 to 2009, he held senior executive positions at GM.