IW's C-Suite Survey: An Optimistic Focus on an Uncertain Future

Jeff Drees says the rebound in U.S. manufacturing is real, not just wishful thinking. In 2012, notes the president of Schneider Electric's U.S. operations, the energy management firm had more growth in its industrial buildings business than any other sector as companies built new plants or refurbished existing ones.

See Also: Lean Manufacturing Leadership Best Practices

That growth was driven by the automotive and aerospace industries, Drees explained, but also by the petrochemical industry, whose energy-intensive processes benefit from shale gas prices that are a third the cost of what they had been. Along with cheap energy, the U.S. is benefiting from investments in advanced manufacturing, which reduce the labor content of production and make the U.S. more competitive. Drees also points out that foreign companies are investing in the U.S. because it is a large market with a stable government and physical security, giving as an example the $3.9 billion purchase of Thomas & Betts by ABB.

While Drees expects Schneider Electric to outperform expected U.S. GDP growth of 2% in its hardware offerings, the company is also taking advantage of its energy expertise to move into the software and solutions arena. In October, the company announced several software suites called StruxureWare, initially targeted to data centers, water, healthcare and the grid. The technology is designed to bridge the gap between facilities and the enterprise so that managers have more insight and control of energy usage across their company.

"StruxtureWare enables our customers to automatically pull data from their controls systems, organize it into the relevant information for each function and, more importantly, into actionable insight to make better decisions and improve efficiencies," explains Pascal Brosset, chief technology officer for Schneider Electric.

Schneider Electric reflects broad trends revealed in IndustryWeek's C-Suite Survey, conducted in October with manufacturing CEOs, presidents and other executives. With high levels of quality becoming table stakes for manufacturers, they are increasingly banking on innovation and customer service to differentiate their businesses. As one executive noted about his message to his workforce: "Think differently, do things differently, embrace change."

Surviving Difficult Times

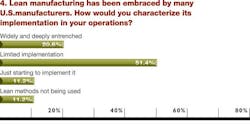

Even in the face of much uncertainty, U.S. manufacturing executives remain an optimistic breed. That may in part be due to surviving the past decade, in which U.S. manufacturing lost millions of jobs and faced increasingly global competition. Survivors no doubt have adapted to an environment which calls for flexibility, investment in new technology and a relentless push for continuous improvement.

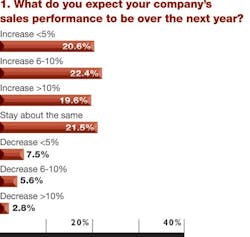

An important reason for the optimism is that they see improving sales in their future. Some 63% of those surveyed said they expect sales to increase in the coming year, with nearly 20% of them predicting sales increases of 10% or more. Approximately 16% of respondents are forecasting a drop in sales.

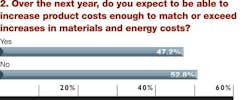

But if sales look bright, that doesn't mean there aren't challenges ahead. Less than half of those surveyed said they expect to be able to increase product costs enough to match or exceed increases in materials and energy costs.

And just over half of IW readers polled said "uncertainty over forthcoming U.S. economic policy" had had a major impact on their business. Mike Stradinger, CEO of Holland 1916, has had a ringside seat to the effects of that uncertainty. Holland 1916 is a manufacturer of identification products, touchscreens, and various fabricated metal products such as operator cabs located in North Kansas City, Mo. With the exception of 2009, the company has been growing rapidly, with sales expanding 60% in 2011 and 30% this year.

Much of that growth has been driven by its operator cabin business, whose primary customers have been oil and gas companies. Stradinger said economic uncertainty and regulatory ambiguity had caused orders to slow down in the third quarter. "A lot of people making large equipment purchases have sort of put their plans on hold," he said. And as a result, Holland 1916, which has outgrown its facilities, is holding off on a decision about moving to a larger facility.

"Uncertainty is the number one issue for us globally," said Veronica Hagen, president and CEO of Polymer Group Inc., a manufacturer of nonwoven materials with plants in nine countries. "Instability and volatility are value-destroying for any business. And the more instability and volatility you have, the less confidence anyone has in investing in the future."

While instability is a global problem, Hagen said, U.S. political leaders could help the manufacturing community by embracing a plan such as Simpson-Bowles. "We should have had leaders that said, ‘Yes, it's tough medicine for everybody but we're going to move ahead, and it will be a solution for us rather than a never-ending argument among us." Once a plan such as that was adopted, she said, it would reduce anxiety and "people would have much more confidence in investing in their business and hiring more people and a virtuous cycle begins."

About 66% of IW readers polled said their firms export products, and 62% expect to see their export sales climb in the next year. About 25% forecast stagnant export sales and just under 13% look for sales to decrease.

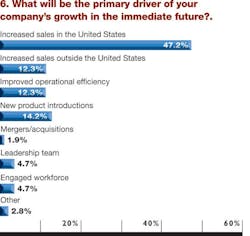

Though two-thirds of manufacturers are exporters, just under half said that the primary driver of their company's growth will be increased sales in the U.S. Some 14% of executives said new product introductions would drive sales, while 12% said their main business driver would be improved operational efficiency. Just over 12% said sales growth outside the U.S. would be their main driver.

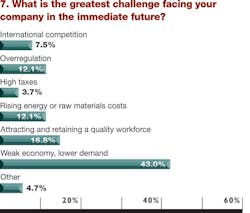

While a plethora of problems have been identified as impacting the U.S. manufacturing community, manufacturers by a wide margin said their biggest challenge was a weak economy and lower demand for their products. But a number of headline-grabbing issues were identified by executives, including attracting and retaining a quality workforce (16.8%), overregulation (12.1%) and rising energy or raw materials costs (12.1%).

Despite the simmering concerns over trade with China, only 7.5% said international competition was their chief challenge. But that didn't stop manufacturers from voicing their displeasure with the U.S.'s main manufacturing rival. Nearly three in four executives said the U.S. should declare China to be a currency manipulator.

Though there is growing concern about U.S. trade practices, manufacturers continue to embrace the value of free trade. Asked what effect NAFTA and other free trade agreements have had on U.S. manufacturing, 43% said these agreements had been either positive or very positive.

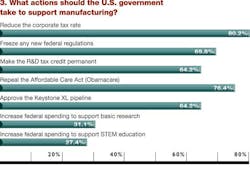

One contentious issue in public policy has been whether the U.S. needs a national manufacturing strategy. Proponents point to the massive loss of manufacturing jobs in the U.S. and the huge trade deficit with China, and argue that the country needs a blueprint to guide and strengthen the sector. By a wide margin, manufacturing executives in our poll voiced support for such a strategy (77% to 23%).

Even so, concerns about the content and results of the strategy remain. Holland 1916's Stradinger, for instance, supports a strategy that brings greater consistency to issues such as tax policy, particularly depreciation. But he worries that such a strategy could result in the government "choosing winners and losers."

Stradinger made the case for an education strategy in which the government plays a role in promoting manufacturing "as a viable career opportunity" and helps change the perception of parents, students, teachers and counselors. He said government can also promote STEM education. Stradinger reported his firm has "several job openings, probably seven or eight, and it is very difficult to find people with the skills we are looking for."

Noting that she is on the board of both a mining company and a large utility as well as running her own manufacturing firm, Hagen said she couldn't imagine a manufacturing strategy that would address all of them. More fundamental, she believes, is the need to address energy, infrastructure and education in the country. She expressed concern that a manufacturing strategy would lead to "another bureaucracy tripping over us."

Attracting the Next Workforce

If one thing brings American manufacturers together, it is agreeing that they've been poor salesmen for their industry. Three out of four executives polled agreed that manufacturing "is an attractive industry for young people to enter," but nearly 87% said manufacturers had not done a "good job of attracting young people to the industry."

"Manufacturers never viewed it as their responsibility to convince people that this is a good opportunity," said Stradinger. "Quite frankly, we always had people because manufacturing was shrinking, but now we wake up and realize we've done a poor job of marketing our companies as workplaces."

Manufacturers were even harsher on American educators. Nearly 93% said the education system did not "adequately support the entry of young people into manufacturing."

As a result, a growing number of manufacturers are taking steps to encourage students to enter manufacturing, either through supporting training programs at vocational schools or community colleges or instituting internship programs.

Schneider Electric is working to rebalance its hiring, from a mix of 80% experienced industry workers and 20% university graduates, to a more balanced profile. Drees said the company has also begun an advanced development program that puts university hires through two years of varied assignments in its plants. The program "grounds them on our products and how we make our money" and is causing more hires to pursue jobs in the manufacturing organization. Says Drees, "It is causing people to think differently about their careers."

See the companion story to this article, "What Keeps You Up at Night."

About the Author

Steve Minter

Steve Minter, Executive Editor

Focus: Leadership, Global Economy, Energy

Call: 216-931-9281

Follow on Twitter: @SgMinterIW

An award-winning editor, Executive Editor Steve Minter covers leadership, global economic and trade issues and energy, tackling subject matter ranging from CEO profiles and leadership theories to economic trends and energy policy. As well, he supervises content development for editorial products including the magazine, IndustryWeek.com, research and information products, and conferences.

Before joining the IW staff, Steve was publisher and editorial director of Penton Media’s EHS Today, where he was instrumental in the development of the Champions of Safety and America’s Safest Companies recognition programs.

Steve received his B.A. in English from Oberlin College. He is married and has two adult children.