In her recent editorial, Pat Panchak cites several ways in which financial performance metrics can undermine any manufacturing operation. Michael Sekora elaborates in Forbes, "The disease killing America's economic health is financial-based planning, and one of the symptoms of this ongoing disease is the loss of the U.S. manufacturing base." Industry is the foundation of military as well as economic power, so the resulting transfer of American manufacturing capability to China is extremely dangerous.

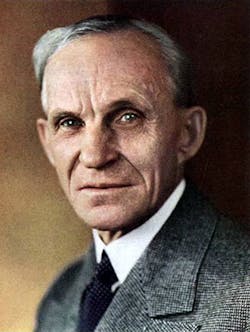

Panchak's article underscores the very ancient principle, "Be careful what you wish, because you are likely to get it," such as purchase price reductions at the expense of quality and lead time. The rest of this article will focus on why financial metrics that are mandatory for financial reports and tax returns have no place in operational decision making. In My Life and Work, Henry Ford and Samuel Crowther warned more than 90 years ago, "That finance is given a place ahead of work and therefore tends to kill the work and destroy the fundamental of service." The reference is probably the best business book ever written, and it is also in the public domain.

Henry Ford's creation of what we now call lean manufacturing is an excellent reason to listen to him today, and so is his company's role in making the United States the wealthiest and most powerful nation on earth. Why, then, do we call his methods the Toyota production system instead of the Ford production system? When the so-called "Whiz Kids" applied financial metrics to the Ford Motor Co. after World War II, it declined to the point where it forgot the methods to which it owed its phenomenal success. In a 2001 Wall Street Journal article, Norihiko Shirouzu reported that a Ford vice president was "trying to entice assembly workers and engineers to abandon nearly all they know about the mass manufacturing system that Henry Ford brought to life about 90 years ago." The rest of the article showed that the vice president was actually trying to teach the workforce exactly how Henry Ford made cars, but he apparently believed the methods to be Japanese.

Finance can be far more dangerous than poor quality because scrap, rework and customer returns all make themselves known very quickly. Financial performance metrics that drive dysfunctional operational behavior are, on the other hand, the elephant on the shop floor that simply does not go away.

When Inventory Is Not an Asset

Everybody knows, at least in the accounting world, that inventory is a current asset: one that can be converted into cash within a year. This means there is nothing wrong with purchasing extra materials to get a good deal or a price discount, as cited by Panchak. Benjamin Franklin, however, warned of the unintended consequences in The Way to Wealth:

"You call them goods; but, if you do not take care, they will prove evils to some of you. You expect they will be sold cheap, and, perhaps, they may for less than they cost; but, if you have no occasion for them, they must be dear to you. Remember what poor Richard says, "Buy what thou hast no need of, and ere long thou shalt sell thy necessaries." And again, "At a great pennyworth pause a while:" he means, that perhaps the cheapness is apparent only, and not real; or the bargain, by straitening thee in thy business, may do thee more harm than good. For, in another place, he says, "Many have been ruined by buying good pennyworths."

Ford cited Franklin as a major influence on his own practices, and his books paraphrase The Way to Wealth extensively. This makes Franklin not only one of the country's Founding Fathers, but also the true originator of what we now call lean manufacturing.

Straiten means to constrain, limit or restrict, and idle cash in the form of inventory does exactly that. Idle cash is furthermore not the least of our problems, as illustrated by Little's Law:

Cycle time (days) = Inventory (units) divided by Throughput (units per day)

High inventories therefore mean longer cycle times, longer lead times and less responsiveness to customer needs. This can require production to meet unreliable market forecasts (which, in turn, require the business to carry more inventory) as opposed to actual customer orders. Ford and Crowther in My Life and Work elaborate with an explicit description of what we now call just in time (JIT) production.

We have found in buying materials that it is not worth while to buy for other than immediate needs. We buy only enough to fit into the plan of production, taking into consideration the state of transportation at the time. If transportation were perfect and an even flow of materials could be assured, it would not be necessary to carry any stock whatsoever. The carloads of raw materials would arrive on schedule and in the planned order and amounts, and go from the railway cars into production. That would save a great deal of money, for it would give a very rapid turnover and thus decrease the amount of money tied up in materials. With bad transportation one has to carry larger stocks.

…We have carefully figured, over the years, that buying ahead of requirements does not pay—that the gains on one purchase will be offset by the losses on another, and in the end we have gone to a great deal of trouble without any corresponding benefit. Therefore in our buying we simply get the best price we can for the quantity that we require. We do not buy less if the price be high and we do not buy more if the price be low. We carefully avoid bargain lots in excess of requirements. … The only way to keep out of trouble is to buy what one needs—no more and no less. That course removes one hazard from business.

Note particularly the sentence, "If transportation were perfect and an even flow of materials could be assured, it would not be necessary to carry any stock whatsoever." Ford recognized explicitly the effect of variation in processing and material transfer times on cycle time, and therefore inventory, more than 60 years before Eliyahu Goldratt illustrated this in the first edition (1984) of The Goal.

If this is not enough to convince the reader that inventory is anything but an asset (except on paper), Ford and Crowther add the following. This underscores again the relationship between cycle time and the amount of money that is tied up in inventory.

"We discovered, after a little experimenting, that freight service could be improved sufficiently to reduce the cycle of manufacture from twenty-two to fourteen days. That is, raw material could be bought, manufactured, and the finished product put into the hands of the distributor in (roughly) 33 per cent. less time than before. We had been carrying an inventory of around $60,000,000 to insure uninterrupted production. Cutting down the time one third released $20,000,000, or $1,200,000 a year in interest. Counting the finished inventory, we saved approximately $8,000,000 more—that is, we were able to release $28,000,000 in capital and save the interest on that sum."

This statement also applies to container ships full of "cheap" offshore goods that can take weeks to reach our West Coast ports. A container ship is nothing more than an inventory-laden floating warehouse that ties up cash, adds to cycle time, and gives defects a place to hide.

When Labor and Overhead Are Not Costs

Everybody again knows, at least in the accounting world, that labor and materials are direct costs, and so is factory overhead. The accounting system assigns the cost of all three to the work to arrive at a final standard cost for the product.

Now suppose the factory has idle capacity and idle workers, and a product that costs $5 in labor, $5 in materials, and $10 in overhead. What does it cost the company to make the product? The obvious answer is $20, which means managers who understand nothing but finance would instantly turn down an offer of $10 per unit. "What does this customer want us to do: sell at a loss, and make it up on the volume?"

Goldratt and Cox in The Goal made it emphatically clear, however, that materials are the only real variable cost because the business pays for the hourly labor and overhead whether or not it uses the workers and equipment. The cost accounting system, therefore, provides the right answer (a standard cost) to the wrong question ("Should we accept this order?").

Managerial or engineering economics, which works with marginal or incremental costs, revenues and profits, would recognize the material as the only marginal cost in the equation. This results in a marginal profit of $5 per unit. Only if the company must pay overtime does labor come into the equation and, by adding $7.50 per unit, should cause the order to be rejected. Ford and Crowther again state the principle in language that is very easy to understand:

"He can take the direct loss on his books and go ahead and do business or he can stop doing business and take the loss of idleness. The loss of not doing business is commonly a loss greater than the actual money involved, for during the period of idleness fear will consume initiative and, if the shutdown is long enough, there will be no energy left over to start up with again."

"The loss of idleness" is what we now call opportunity cost, or unrealized revenues due to failure to exploit opportunities. Opportunity cost is totally invisible to the cost accounting system because one cannot write it off as an expense or, as stated by Franklin, "Lost time is never found again; and what we call time enough, always proves little enough." This sentence later became the foundation of a key performance indicator (KPI) of Henry Ford's production system as well as Eli Goldratt's Theory of Constraints.

Book Value Is Meaningless Except to the IRS and SEC

Depreciation, return on investment (ROI) and return on assets (ROA) are incentives to not replace aging machinery. Suppose, for example, a machine cost $1million, has depreciated for 5 years and now has a book value of zero. It is very tempting from a ROI or ROA standpoint to keep that machine on the job because it adds nothing to the denominator of the financial metric. In Moving Forward, Ford and Crowther told us 84 years ago what is wrong with this kind of decision process.

"As for the buildings and machinery, they must be valued in dollars according to the meaningless methods of accounting that are required by law. Actually they are worth only what we can do with them."

If the machine in the example is obsolete, the business is likely to go happily on its way with a high ROI until a competitor with a lower ROI, but more effective technology, runs it out of business. If, on the other hand, the machine is still serviceable, and none better is available, its real value is still the $1million it would cost to replace it.

When Cheap Offshore Labor is Expensive

Financial metrics, and labor costs in particular, have been the foremost argument for discharging $15- or $20-an-hour American workers in exchange for what is essentially offshore slave labor. Industrialization and higher productivity abolished slavery peacefully in every advanced nation except the United States, and could have probably done so here through the equivalent of a Marshall Plan to industrialize the South. Industrialized nations in which slavery is economically unfeasible do not need cheap labor either, and Frederick Winslow Taylor in The Principles of Scientific Management made this emphatically clear more than a hundred years ago.

"…the one element more than any other which differentiates civilized from uncivilized countries— prosperous from poverty-stricken peoples— is that the average man in the one is five or six times as productive as the other."

This means, of course, that an employer who makes his $20-an-hour workers sufficiently productive over here will not have to depend on inventory-laden, and therefore potentially defect-laden, supply chains that stretch halfway around the world. Manufacturers have received, after a month or more lead time, nonconforming offshore material or parts, and many readers have doubtlessly had similar experiences. Ford and Crowther in My Life and Work are somewhat more blunt in their description of executives who cut wages, or by implication go offshore for cheap labor, instead of looking for ways to make the jobs more efficient.

"Cutting wages is the easiest and most slovenly way to handle the situation, not to speak of its being an inhuman way. It is, in effect, throwing upon labour the incompetency of the managers of the business. If we only knew it, every depression is a challenge to every manufacturer to put more brains into his business—to overcome by management what other people try to overcome by wage reduction."

If financial metrics are grossly unsuitable for operational decisions, what should we use? Henry Ford got world-class results from exactly three: Time, Material, and Energy.

Three KPIs: Time, Material, and Energy

Henry Ford (Ford Ideals: from "Mr. Ford's Page") defined these key performance indicators explicitly.

"You can waste time, you can waste labor, you can waste material—and that is about all. …Time, energy, and material are worth more than money, because they cannot be purchased by money. Not one hour of yesterday, nor one hour of today can be bought back. Not one ounce of energy can be bought back. Material wasted, is wasted beyond recovery."

It is useful for mnemonic purposes, however, to consider the time of people and the time of things (cycle time) separately. This provides four easily memorable shop floor KPIs to guide decisions and improvements:

-

Waste of the time of people: waste motion, waiting for parts or equipment.

- Ford pointed out that job designs often required people to spend more time walking (e.g. to get or move materials) than working. Visual observation of most fast food restaurants shows that there are probably $15 an hour jobs in there somewhere, but they are buried under exactly this kind of waste motion. Nurses in hospitals often spend much of their time walking, although the Henry and Clara Ford Hospital was laid out to minimize this. When workers have to wait for parts or tools at a stockroom, their wasted time can easily cost more than the item in question.

-

Waste of the time of things, especially cycle time.

- The workforce should recognize as waste of time any part that is not actually being acted upon by a tool. This includes, of course, all forms of inventory, whether in container ships, warehouses or storage racks on the shop floor.

- Masaaki Imai in Gemba Kaizen elaborates, "There is far too much muda between the value-adding moments. We should seek to realize a series of processes in which we can concentrate on each value-adding process—Bang! Bang! Bang!—and eliminate intervening downtime." The value-adding "Bang!" can be literal in the case of a stamping machine, but the basic idea is that the process adds value only when the tool is in contact with the part.

- Charles Standard and Dale Davis in Running Today's Factory: A Proven Strategy for Lean Manufacturing add the analogy of golf, in which the club (tool) is in contact with the ball for roughly 1.8 seconds out of a four-hour game. The takeaway is that the ratio of value adding to non-value adding time is similar in many factories.

-

Waste of materials

- This includes not only scrap and rework, but also unnecessary machining. Anything that is thrown away, or even sent back for recycling, should therefore attract attention. Avoidance of this kind of waste supports ISO 14001.

- Henry Ford could have probably qualified for ISO 14001 certification even though he could have legally thrown into the river whatever waste wouldn't go up his smokestack. He either avoided making the waste, or else found a use for it. Kingsford Charcoal was, for example, a byproduct of Ford's waste wood distillation operation. Ford also recovered saleable coal chemicals, including sulfur that would have otherwise become acid rain, before using the resulting coke as fuel or for steel manufacture.

-

Waste of energy

- Elimination of unnecessary process steps, especially energy-intensive ones, reduces this waste, and is consistent with ISO 50001. The same goes for LEED (Leadership in Energy and Environmental Design) buildings.

Other shop floor metrics have been proven to work, but almost all can be expressed in terms of these four. This includes the Toyota production system's Seven Wastes.

Conclusion

The job of cost accounting is to provide income statements, balance sheets, and other reports that are required by the Securities and Exchange Commission and the Internal Revenue Service. Managerial or engineering economics, consideration of opportunity costs, and assessment of waste (muda) must, on the other hand, drive operational and shop floor decision processes.

William A. Levinson, P.E., is the principal of Levinson Productivity Systems, P.C. He is the author of The Expanded and Annotated My Life and Work: Henry Ford's Universal Code for World-Class Success, and numerous other books on quality, management, and productivity.