Few companies plan for anything other than strong growth—usually several points stronger than the rate of GDP growth. Just like the residents of the fictional Lake Woebegone, all our children are above average and all our new product efforts are going to be successful.

But back in the real world that’s not how it works. That’s because few growth plans actually anticipate the obstacles that new product efforts can be expected to encounter.

As an example, I was recently talking with a frustrated new product executive from a large supplier of gasoline driven products sold through Big Box DIY retailers. Her team had just spent 3 years and many millions of dollars designing and building a very innovative new product line moving the company into battery driven products. She was shocked when, at the last moment, her sales colleagues sank the deal with concerns about the technology partner’s supply reliability and the brand reputation effects they might suffer if the new technology was not as robust or serviceable as expected.

The sales team’s concerns may have been valid. After all, there is a tremendous amount of buying power consolidated in a handful of DIY retailers. But the question I had for her was why that concern had not been uncovered and dealt with before so much of their constrained engineering resources had been wasted.

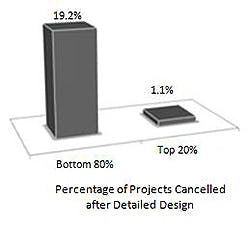

By weeding out losing projects early, companies in the top 20% were able to focus on better execution, get products to market in half the time and generate twice the volume of new product profits.

So what could our frustrated new products executive have done differently? We recommended the use of a firewall that blocks projects that score low on what we call the Big 5 Feasibilities—commercial, technical, manufacturability, regulatory and intellectual property/freedom to operate. Additionally, during the project charter stage, it is useful to identify all of the stakeholders across the organization and solicit their input on all of the potential ways the project could fail and what the impact would be. If you don’t have clear routes around the obstacles, step one in the project plan is to assess whether the obstacles are fatal.

While innovation requires risk, the goal of the firewall is to identify the risks that aren’t worth taking and then to either find ways around them or shelve the project. In the previous example, if the technology partner reliability issue had been uncovered and addressed up front, the company might have decided that it was too risky to proceed. That would have freed up years of resources to work on better opportunities. Alternatively, they could have done some work to find a different technology partner or have designed the reliability required to protect their brand into the line up front.

About the Author

Mike Dalton

Managing Director

Mike Dalton is the founder of Guided Innovation Group, where for nearly 20 years he has helped leaders in highly engineered product companies make new products a reliable competitive advantage. He has contributed numerous Industry Week articles and is the author of Unlocking Innovation Productivity and Simplifying Innovation.