Supply Chain & Logistics: Globalization Blues: Too Many Companies are Victimized by Their Own Supply Chains

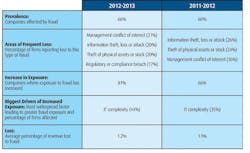

While manufacturers increasingly expand their supply chains overseas to tap into high-growth emerging markets, they are often unknowingly inviting unwelcome participants along for the ride: criminals. The incidence of companies falling victim to fraud, for instance, is up 9% over the past year, with seven out of 10 companies having been victimized, according to a global fraud study conducted by Kroll, a provider of risk management services. And it could be the supply chain itself that's partly responsible for the increase in fraud.

"The move to a more global business model that relies on a network of suppliers and partners is leading to a higher risk of fraud," explains Tom Hartley, Kroll's CEO. As manufacturers expand into riskier overseas markets and tap into the resources of third-party logistics providers and other outsourcers, they also increase their exposure to fraud. Nearly one in five companies surveyed (19%) say they were a victim of vendor, supplier or procurement fraud last year (see chart, "A Profile of Fraud in the U.S.").

See Also: Lean Supply Chain Logistics Best Practices

Corruption and bribery, too, pose significant threats to U.S. companies doing business overseas, particularly in certain markets in Africa, Latin America and India. Nearly half of the companies surveyed (46%) say they chose not to expand into a foreign market due to concerns about corruption.

Even more alarming, Hartley adds, is how often fraud is perpetrated by an insider, oftentimes a senior or middle manager. Thirty-two percent of respondents say their companies were the victim of a fraud committed by a manager, 42% of companies were victimized by a junior employee and 23% were due to an agent or third-party.

"The measure of a good company is not whether or not you've suffered a fraud," Hartley says, "it's how you prepare for it, how you deal with it and how you move on afterwards." Some common risk management best practices he's seen include focusing more on vendor screening, whistleblower programs and employee training.

Maxim Integrated (IW 500/331), a manufacturer of analog and mixed-signal semiconductor products, has a detailed risk assessment compliance strategy, notes Greg Chalkley, director of global trade services. That includes written policies and procedures, internal controls, training, internal audits and, significantly, management commitment. (According to the Kroll study, the manufacturing sector had the highest overall incidence of fraud, but manufacturers as a whole are not actively investing in anti-fraud strategies.)

A Profile of Fraud in the U.S.

Companies should determine their risk profile, Chalkley points out, identifying all the types of possible risks and their sources, their likelihood of occurrence, controls that are in place to prevent incidents, a realistic appraisal of what could go wrong, and the potential impact of risk. Such a risk assessment, he says, needs to be continuous and ongoing, and should include appropriate follow-through and corrective actions.

A major stumbling block, though, is that many companies don't have timely access to information on their global supply chain partners. "Companies require both visibility and control so that they can understand their customer base, make the best pricing decisions and make the right choices regarding a wide array of opportunities and risks," says Sean Kracklauer, president of advisory and research services with consulting firm The Hackett Group.

One of the culprits for this lack of visibility, Kracklauer believes, is a continued reliance on stand-alone spreadsheets and manual data sourcing. As a result, companies are unable to access more forward-looking analyses based on a wider variety of non-financial data sources. Globalization leaders, however, have mostly or fully automated key areas thanks to their access to near real-time information on their supplier base.

About the Author

Dave Blanchard

Senior Director of Content

Focus: Supply Chain

Call: (941) 208-4370

Follow on Twitter @SupplyChainDave

During his career Dave Blanchard has led the editorial management of many of Endeavor Business Media's best-known brands, including IndustryWeek, EHS Today, Material Handling & Logistics, Logistics Today, Supply Chain Technology News, and Business Finance. He also serves as senior content director of the annual Safety Leadership Conference. With over 30 years of B2B media experience, Dave literally wrote the book on supply chain management, Supply Chain Management Best Practices (John Wiley & Sons, 2010), which has been translated into several languages and is currently in its second edition. He is a frequent speaker and moderator at major trade shows and conferences, and has won numerous awards for writing and editing. He is a voting member of the jury of the Logistics Hall of Fame, and is a graduate of Northern Illinois University.