Updated 11:31 a.m.

The 3D printing industry has let mass-production manufacturers down for decades, failing to reach the technology’s potential to revolutionize production, said Stratasys CEO Yoav Zeif in explaining why his company is buying rival Desktop Metal for $1.8 billion.

“I’m here for three-and-a-half years, and I’m struggling with the positioning of additive globally,” Zeif told investors in a conference call following the deal’s announcement. He noted that additive should be able to tackle some of the biggest challenges facing manufacturing from labor shortages to sustainability concerns to operating efficiencies, but it hasn’t. “We are the only profitable company in this industry, so something doesn’t work... Additive doesn’t provide the quality per part, cost per part or process that manufacturing need.”

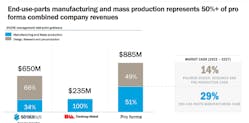

His solution: scale. Get bigger and expand offerings by buying a company that can immediately expand its product suite. Stratasys’ portfolio is almost entirely polymer-based 3D printing. Desktop Metal specializes in metals. Combining the two will expand material offerings, but more importantly, Zeif said, it will give the companies the credibility they need to convince large manufacturers to replace existing assembly lines with additive equipment.

“We want an inflection point. We want manufacturing,” Zeif said. “That is what we are doing here. We are shortening the time frame to be heavily into manufacturing.”

Desktop Metal Co-Founder, Chairman and CEO Ric Fulop echoed those statements, adding, “We expect to transform the additive industry and bring it into the world of mass production.”

Stratasys, founded in 1989, will buy Desktop Metal, founded in 2015, in an all-stock deal. Though the companies are calling the deal a combination, not a buyout, Desktop Metal shareholders are getting Stratasys stock in the deal, and Stratasys CEO Yoav Zeif will be the CEO of the combined company. Fulop will stay on as chairman of the board of directors.

Fulop called the deal “a turning point in driving the next phase of additive manufacturing for mass production.”

“The combined company is expected to offer customers end to end solutions from designing, prototyping and tooling to mass production and aftermarket operations across the entire manufacturing lifecycle," the companies said in their merger announcement.

During the call with analysts and investors, Fulop and Zeif focused on the huge potential the deal brings to manufacturers. Zeif said many major producers have expressed interest in adopting additive for large-scale manufacturing, but they didn’t trust that young, often startup technology providers would still be around a decade later to service machines or offer upgrades.

“Many companies are having concerns about taking these steps and transforming production lines because the other side isn’t strong enough,” Zeif said, adding that the Stratasys' purchase of Desktop Metal may allay those fears.

When it came to discussing the likelihood of the deal going through, however, both executives got cagey and elusive. One analyst asked specifically about the chances of winning regulatory and anti-trust approvals.

When asked if Desktop Metal would get a breakup fee if it isn’t able to complete the merger (a typical provision for the company being purchased), Fulop said only that the deal includes standard merger provisions.

Nano in the Wings

Something to watch as the teams at Stratasys and Desktop Metal push forward their deal is the ongoing attempt by rival Nano Dimension Ltd. to take control of Stratasys.

The leaders of Massachusetts-based Nano Dimension have amassed a 14.2% stake in Stratasys and pushed their peers at Stratasys to engage in talks about joining forces before launching an unsolicited takeover bid. (After word of the Desktop Metal plan, Stratasys was changing hands around $15.30.) On May 25, Nano said it is moving forward with a special tender offer paying $18 per Stratasys share that, if successful, would grow its stake in Stratasys to between 53% and 55%.

“We believe our offer delivers certain all-cash value to Stratasys’ shareholders at a premium in excess of what Stratasys can deliver to its shareholders,” Yoav Stern, Nano Dimension’s chairman and CEO, said. “We look forward to successfully completing the special tender offer as we continue to execute on our strategic plan to drive value creation for customers and shareholders and to create a pre-eminent leader in the rapidly growing AM market.”

In a note separate from its Desktop Metal news, Stratasys’ board of directors said it “will carefully review and evaluate” Nano’s offer and plans to provide a recommendation to its shareholders within 10 business days. Stratasys’ directors last month turned away Nano’s offer (then for $20.05 per share after a first step up to $19.55) and have in recent months said Nano’s offer undervalues Stratasys while also noting they did not want to expose the company to risks related to a governance battle Nano is fighting with its largest shareholder.

IndustryWeek Editor-at-Large Geert De Lombaerde contributed to this report.

This is a developing story. Expect updates throughout the day.