How San Diego Reflects National Manufacturing Trends

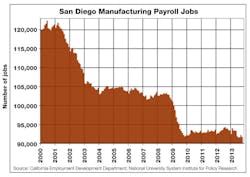

From 2000 to 2011, the U.S. lost 5.8 million manufacturing jobs and 57,000 manufacturing firms closed.

The U.S. Department of Commerce shows that “U.S. multinational corporations… cut their work forces in the U.S. by 2.9 million during the 2000s while increasing employment overseas by 2.4 million.”

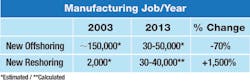

Over the last three years, we have finally seen a growth of about 526,000 manufacturing jobs nationwide for a 4.59% growth rate, but California has lagged behind the nation at only a 0.63% growth rate for 7,900 jobs gained. Mainly due to the effects of sequestration on our military/defense industry, San Diego continued to lose manufacturing jobs in 2013, shedding more than 2,000 jobs from February – November.

Reshoring/Resurgence of “Made in USA”

A September 2003 report prepared for the U. S. Congress, U. S.-China Committee on Economic and Security Review Commission, by Peter Nolan of the University of Cambridge stated, “A ‘herd’ mentality to participate in the ‘Chinese miracle’ developed among global giant corporations… Global corporations now view China as central to their long-term strategy.”

A Stone Associates interview with Technology Forecasters (10/21/03) corroborated the fact that some companies were following this “herd mentality” in migrating to China even when it didn’t make economic sense: “There is a herd mentality with OEMs in China—sometimes it makes sense, sometimes it doesn’t—not always rational decision… People tell their bosses what they want to hear—(going to China) gives a boost to the stock valuation, but you really have to do the analysis on a case by case basis.”

Now, the offshore supply chain dynamics are changing:

- Oil prices tripled in the last 5 years raising shipping costs

- Labor rates rose about 15-20% year-over-year for the last 5 years in China

- Component/material prices increasing

- Automation/robotics in U.S. has increased productivity

- Political instability in China - Labor riots/strikes

- Risk of disruption from natural disasters

- U.S. dollar declining

Most companies don’t look beyond quoted unit price to make a decision of which vendor to select. They don’t do a Total Cost of Ownership (TCO) analysis, which simply stated, is an estimate of direct and indirect costs. The 13th edition of the APICS (supply chain organization) dictionary says: "In supply chain management, the total cost of ownership of the supply delivery system is the sum of all the costs associated with every activity of the supply stream.”

The Reshoring Initiative was founded by Harry Moser, former CEO of GF AgieCharmilles (now GF Machining Solutions), in 2010. The goal is to change the sourcing mindset from “offshored is cheaper” to “local reduces the Total Cost of Ownership” and train OEMs and suppliers on why to source local and how to use the TCO Calculator. Free Total Cost of Ownership (TCO) software is provided for OEMs and suppliers/unions.

Sourcing is slowly moving back to the United States. The 2012 MIT Forum for Supply Chain Innovation Reshoring Study revealed: 61% of larger companies surveyed “are considering bringing manufacturing back to the U.S” and 15.3% of U.S. companies stated that they are "definitively" planning to re-shore activities to the U.S. In April 2012 www.mfg.com stated that 40% of contract manufacturers had done reshoring work this year.

Job growth: ≈500,000

Reshored jobs: ≈80,000

Reshoring % of total: ≈15%

Now in 2013, more companies are moving their services and manufacturing operations back to the United States. Nationally, General Electric and Whirlpool have moved some appliance manufacturing back to the U. S. Caterpillar moved operations from China to Mexico and the U.S. Locally, EcoATM, 451 Degrees and Solatube have reshored by moving manufacturing back to San Diego County. Some of the parts, assemblies and products that are not cost effective to manufacture in the U. S. are going across the border to Baja California, Mexico, and major contract manufacturers in Tijuana, Mexico, such as Sumitronics, are experiencing significant reshoring.

The demand for “Made in USA” goods seems to be increasing and is helping the resurgence of American manufacturing in certain areas, especially true in the apparel industry. Indeed, many consumers like the quality perception boost associated with “Made in USA” labels certifying that these goods were in fact made in America. American made items are also growing in popularity because our production costs are declining while Chinese labor is actually increasing.

Offshore outsourcing will continue indefinitely. The desirable locations for outsourcing will change over time, and the purely financial benefits of lower cost will erode over time. The challenge is to keep as much as possible within the United States, and if more companies would utilize the TCO estimator worksheet, it would help maintain and return manufacturing to America.

Additive Manufacturing Takes Growing Role in San Diego

Additive Manufacturing has been hailed by The Economist as the catalyst of “the third industrial revolution” and is projected to have a significant impact on manufacturing in the near future. It has the potential to revolutionize the way we make almost everything. Currently about 28% of the money spent on 3-D printing of parts is for final products, but it is predicted to rise to 50% by 2016 and to 80% by 2020.

The major additive manufacturing methods are:

- Stereo lithography

- 3-D printing

-

Laser sintering

- high powered laser fuses powered metals into fully dense 3-D objects, layer by layer

-

Fused-deposition modeling

- A plastic or metal wire is unwound from a coil, supplying material to an extrusion nozzle to form success layers

San Diego is blessed with hundreds of design engineering and product development companies, many of which have one or more types of additive manufacturing equipment. There is also a service bureau for additive manufacturing in Poway, Solid Concepts, which has all of the types of equipment. A few of the engineering design/product development companies with which we are familiar are:

- A Squared Technologies

- Clarity Design

- DD Studio

- D&K Engineering

- Dynapac Design Group

- Expertise Engineering

- Fallbrook Engineering

- Flex Partners

- Leardon Solutions

- Koncept Design

- Redpoint Engineering

- Triaxial Design

In addition, there is the MakerPlace in San Diego, which inventors and entrepreneurs can think of as their “dream” garage shop for developing and producing their own products. It is a place where they can use a variety of fabrication equipment and tools to work on projects: Woodworking, metalworking, electronics, embroidery, sewing and specialty tools such as 3-D printers, laser cutters and engravers. There are even “incubator” offices upstairs for businesses to operate out of the same building as the fab shop.

Training to Meet Manufacturing Skills Gap

In 2011, the U.S. Bureau of Labor Statistics estimated that 2.8 million manufacturing workers, nearly a quarter of all U.S. manufacturing employees, were 55 or older. The improvement of the manufacturing industry has been a mixed blessing because while more skilled workers are needed, the supply is limited because baby boomers are retiring or getting close to retirement. “The oldest baby boomers turned 65 on Jan. 1, 2011, and every day thereafter for about the next 19 years, some 10,000 more will reach the traditional retirement age, according to the Pew Research Center.” What makes the situation worse is that there are not enough new ones to replace them because the subsequent generations were smaller and fewer chose manufacturing as a career.

This has resulted in an insufficient number of workers trained for advanced manufacturing jobs. Modern manufacturing is highly technical and requires an understanding of and proficiency in a wide variety of competencies. In the past 15 years, the manufacturing industry has evolved from low-skilled production-type assembly work to being highly technology-infused. Thus, it is more of a skills gap in the specific skills needed by today’s manufacturers than a shortage of skilled workers.

A key component in attempting to address this skills gap has been the development of the National Association of Manufacturers-Endorsed Manufacturing Skills Certification System—a system of stackable credentials applicable to all sectors in the manufacturing industry. In June 2011, President Obama announced that the Skills Certification System was the national talent solution for closing the skills gap and addressing this key issue for American manufacturers. The Society of Manufacturing Engineers (SME) Education Foundation leads in encouraging youth to get involved in manufacturing technologies through STEM-related activities in the K–12 levels, as well as supporting and advancing the Certification System for manufacturing skills.

San Diego is fortunate to have more opportunities for training in manufacturing skills than many other regions as shown below:

- San Diego City College – AA degree in Manufacturing Technology, Machining Certificate

- SDCCD Continuing Education Center – metal fab, welding, plasma cutting

- Miramar College – biotech/biomedical lab technicians

- Mira Costa College – Machining Certificate

- San Pasqual High School – two year machining program

- Chaparell High School (Charter) – two year machining program

- Quality Controlled Manufacturing Inc. – machining training and apprenticeship

- Workshops for Warriors (non-profit) – machining, sheet metal fab, welding, programming

Licensing vs. Starting a Company

As a member of the steering committee for the San Diego Inventors Forum (SDIF), I have noticed that in the last two years, more inventors are planning to license their technology versus starting a company (probably about 70%) compared to about 50% previously. However, this trend doesn’t hold true for CONNECT’s Springboard program for entrepreneurs according to Ruprecht von Butlar. In an interview, he said, “The demand for the Springboard program has stayed consistent over the past few years, but the composition has changed ─ more technology, biotech/biomedical, and life science. All of the entrepreneurs in the program have either already formed companies or plan to form companies rather than licensing their technology.”

I also interviewed Dr. Rosibel Ochoa, executive director of the UCSD Jacobs School of Engineering von Liebig Entrepreneurism Center. She said they have 30 teams in their program, and all of them plan to start companies rather than licensing their technology. The Center serves UCSD professors, graduate students, undergraduate students, and alumni. The professors are the only persons more interested in licensing their technology rather than leaving UCSD to be part of a team to start a company.

The difference between the Inventors Forum and the other two programs may be the fact that most of the inventors coming to our meeting in the past two years have been in the “baby boom” generation, now between the ages of 48 – 68, and they may realize by now that they don’t have the entrepreneurial skills to found and develop a company. Also, many of them are serial inventors, who enjoy the technical part of inventing a new product, and then want to go on to working on their next invention. Many of the under-40 inventors seem to be more interested in starting a company.

Outlook for 2014

Positives:

- Reshoring is creating more manufacturing jobs and generating more regional GDP.

- Additive manufacturing is accelerating development of new products.

- Broad access to skills training is available in San Diego.

Negatives:

- Unknown economic impact of Obamacare for manufacturers because of employer mandate

- Possibility of full sequestration being restored to pay for extending unemployment benefits

If the current military/defense budget remains in effect without the restoration of full sequestration that affected San Diego adversely last year, this year still should be better than 2013 for local manufacturers. All of us in San Diego’s manufacturing industry certainly hope so.

Michele Nash-Hoff is president ofElectroFab Sales. She is the author of "Can American Manufacturing Be Saved?"