Whether it’s the movement of parts, industrial machinery or consumer products, the growth of global trade has brought new opportunities for both domestic and foreign manufacturers. The expansion of trade has led to another major growth industry – services.

As manufacturers boost their import and export activity, their need for insurance, logistics, financing, engineering support and maintenance services increases, as well. The impact of services on global trade is gaining more attention as the Trump administration considers a new trade strategy. Bloomberg News noted that Microsoft Corp., Goldman Sachs Group and FedEx Corp. are all exporters of services when they do business overseas. The U.S. currently has a $248 billion surplus in exports of services, according to Bloomberg. That could be at risk if policies negatively impact demand from countries like China, Japan and Mexico, which have a large services deficit with the U.S., the news service reported.

Manufacturers use a wide range of services at different stages throughout the manufacturing and supply chain processes. They may include services needed early in the value chain, such as research and development or engineering, or services at the end of the chain, such as maintenance or retailing. Other services, such as financial or telecommunications are needed at every stage, according to a report by the U.S. International Trade Commission (ITC).

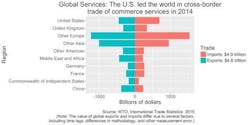

The world’s largest global cross-border exporter and importer of services is the U.S., according to the ITC’s 2016 annual report. Exports of services decreased $1.3 billion to $749.6 billion in 2016, the U.S. Census Bureau reported. Financial services exports decreased $7.3 billion. But other business services, which includes research and development services; professional and management services; and technical services, increased by $5.2 billion.

Meanwhile, imports of services increased $13.1 billion to $501.8 billion in 2016. Key services imports include travel (for all purposes including education) – up $8.8 billion; charges for the use of intellectual property – up $2.9 billion and other business services – up $2.1 billion.

So what’s driving the global need for services in the manufacturing industry?

“The issue becomes as we get more and more influx and trade continues to rise you see the ports get abused in a way,” said Alison Ponder, senior director for the private equity practice at management consulting firm SSA & Co. “They can’t handle the growing volumes. We see congestion at the ports. We see the amount of wait time increasing, and that requires folks to get more advanced in how they manage their inventory.”

With this increase, manufacturers need help with critical processes, such as inventory management, logistics, tax services and market research, Ponder said.

Spotlight on Logistics Services

To handle the increasing complexity and demand, some manufacturers may seek the assistance of a third-party logistics provider to manage various aspects of their shipping, warehousing and even final assembly, says Regenia Sanders, who leads the supply chain practice at SSA.

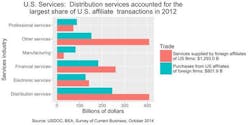

Other factors increasing the need for distribution services include the trend toward nearshoring, the growth of e-commerce and the development of advanced manufacturing practices, such as 3-D printing, according to the ITC’s “Recent Trends in U.S. Services Trade: 2015 Annual Report.” Manufacturers are demanding that logistics firms reconfigure their routes to better serve regional production centers and meet shorter lead times. E-commerce sales models also require coordination among retail, logistics and transportation services firms to meet shorter delivery times, according to the ITC report.

In some cases, logistics providers will provide e-commerce support, such as sales, marketing and payment services. 3-D printing technology is another area where manufacturers can take advantage of logistics services. UPS, for example, announced in May 2016 that it would offer 3-D printing services. The service, called Fast Radius, may help manufacturers reduce inventory for slow-moving parts, assist manufacturers with short production runs and allow for cost-effective customization of goods, according to UPS.

Many logistics providers are also providing maintenance and other care services for manufacturers, according to ITC.

Spotlight on Technology and Engineering Services

Many manufacturers are outsourcing electronic services, including audiovisual, computer and telecommunication services, to lower costs and increase productivity, according to ITC’s 2014 services report.

“For example, engineering firms can cycle work plans around the globe 24 hours per day using less expensive engineers in such locations as China, lowering costs and substantially increasing productivity,” the report states. “Similarly, electronic services have enabled many computer services, including data processing, to be shifted from the United States to countries with lower labor and computer services costs, such as India.”

NEED TO LEARN MORE ABOUT EXPORTING? GET EXPORT ADVISOR IN YOUR INBOX EVERY MONTH.

Manufacturers also are taking advantage of technology services that help them leverage the power of big data. Many of these services are cloud enabled, which allows manufacturers to gain the analytical insights they need without making large IT infrastructure investments.

“Companies are trying to figure out how to differentiate themselves in the market, and the way to do that is to take a look at your product,” Sanders says. “And a key input into R&D is to take a look at some of that market research to understand what the customers are asking for and that starts a whole trickle-down effect throughout the entire supply chain.”

Manufacturers as Service Providers

In some cases, manufacturers are selling their own services to diversify their offerings. This may include leasing for large machinery or equipment or maintenance services. For example, ITC notes that some semiconductor equipment manufacturers now offer services to help fabs operate their equipment and tools more efficiently. They may offer models and simulations for fabs before starting a new process to ensure the equipment is working when it should.

As more companies move toward the Internet of Things, equipment manufacturers may offer to collect preventive maintenance data from their machines or send field technicians or engineers to solve problems on site, according to ITC.

“The biggest add-on in the longevity for these manufacturers is servicing these products,” Ponder said. “So that’s definitely something their trying to capture as well so they don’t get just the initial cash outlay.”

About the Author

Jonathan Katz

Former Managing Editor

Former Managing Editor Jon Katz covered leadership and strategy, tackling subjects such as lean manufacturing leadership, strategy development and deployment, corporate culture, corporate social responsibility, and growth strategies. As well, he provided news and analysis of successful companies in the chemical and energy industries, including oil and gas, renewable and alternative.

Jon worked as an intern for IndustryWeek before serving as a reporter for The Morning Journal and then as an associate editor for Penton Media’s Supply Chain Technology News.

Jon received his bachelor’s degree in Journalism from Kent State University and is a die-hard Cleveland sports fan.