Globally, production of electronic goods has been the fastest growing manufacturing sector over the last 15 years. Production in the US has benefited from this global boom; the U.S. share of global high-tech production has increased slightly since 2000.

However, under several conventional measures of global competitiveness, U..S high-tech production seems to have lost ground.

A closer examination of the composition of sector production suggests that there is room for optimism for trade and production of US electronics. Broadly speaking, high-tech goods can be split into five main sub sectors: computers and office equipment, communications equipment, consumer electronics, electronic components and boards and precision instruments.

The first three of them are relatively labor intensive and commoditized (and production has hence moved to lower-cost locations), and the latter two generally involve the design of highly engineered components, where the US holds a strong competitive advantage.

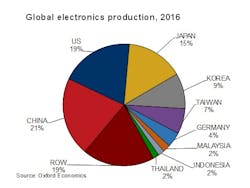

In terms of national production, electronics is a highly concentrated sector. More than 70% of high-tech production occurs in just five countries: China, the US, Japan, South Korea and Taiwan. Production in China has risen rapidly since the turn of the century, from just under 6% of world production in 2000 to 21% in 2016, and in 2015, it overtook the US as the world’s largest producer.

But it is also important to emphasize that the US’s share of global output has also increased slightly over the same period (from about 15% in 2000 to 19% today). China’s rise has come at the expense of production in Europe (which is not a major global player in the sector), and especially in Japan, whose share of global high-tech output fell from 28% to 15% from 2000 to 2016.

Electronic goods are heavily dependent on globally integrated supply chains. Thus, high-tech goods are one of the most heavily traded sectors in many major producers. An iPhone, for example, is manufactured in about 20 countries across Asia, North America and Europe (with the US itself being a major supplier). Much of the design occurs in the US, high-value components are produced in Asian centres such as Japan, South Korea and Taiwan, and about 85% of final assembly occurs in China.

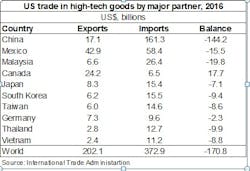

Electronics production in the US has grown at an average of 7% from 2000 to 2016 (faster than the world average) but paradoxically the US runs a large trade deficit in electronic goods of $171 billion in 2015, or 44% of sector gross output. This is a much larger deficit than for total manufacturing, which was 11% of gross output. China accounts for almost 85% of the US trade deficit in electronic goods, but the US also runs smaller deficits with nine of its ten largest trade partners in electronic goods (accounting for 80% of total sector trade).

On the face of it, such a large trade deficit suggests a significant competitive disadvantage for US high-tech production, which seems inconsistent with the strong growth of US production in recent years. The apparent paradox is partly explained by simple trade accounting convention that the full value of an imported product is allocated to the country, even if most components of the product were manufactured in the US or elsewhere. As a result, import numbers can overstate competitiveness problems. Research by the Dallas Federal Reserve and others indicate that the US trade deficit with China may be overstated on the order of 50%.

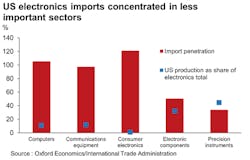

Even beyond this accounting problem, a deeper dive into the subsectors in the nearby chart shows that the trade deficit is concentrated in the subsectors for which US production is minuscule. The extreme example is consumer electronics. Import penetration is more than 100%, but the sector only accounts for less than 1% of US high-tech production. Similar patterns can be seen in computers and communications equipment. These three sub sectors account for over 80% of the high-tech trade deficit. To some extent, it makes sense that the products of these three sectors would be largely imported – all three require relatively labor intensive assembly and rely on established production processes that benefit from scalability. Indeed, global production in all three sectors is dominated by China; it produces 29% of the world’s computers, 21% of consumer electronics products and a whopping 65% of communications equipment. The US, by contrast, produces less than 15% of world output in all three sectors.

The electronic components and precision instruments sub sectors show starkly different trends. Import penetration is far lower—34% in the case of precision instruments—and the level of production is far larger, accounting for three-quarters of US high-tech production. More significantly, this relatively low level of import penetration has been stable for the past decade.

This illustrates the fact that these sectors, rely on more specialized production techniques, so their production is concentrated in developed countries such as the US. US trade in the precision instrument sector, which includes high-value medical equipment, measuring, testing & navigation equipment, watches & clocks, optical instruments and photographic equipment, only slipped into deficit in 2014, and as of 2016 it accounted for just 5% of the total high-tech trade deficit.

At 14.8% of gross output in 2015, the US trade deficit in electronic components is similar to that of manufacturing as a whole. The trade balance in electronic was in surplus as recently as 2008, but the deficit has been widening every year since then. Production trends in this sector are global, with high-value components produced in the developed world (particularly in Japan, Korea and Taiwan, but also in the US) and assembly occurring primarily in China. Final sector output is used primarily as inputs into other electronics and high-value manufactured goods and processes.

A similar trend can be seen in the relative productivity across the major electronics subsectors. Relative to the electronics sector as a whole, both the precision instruments and electronic components subsectors are more competitive, while computers and office equipment, communications equipment and consumer electronics are all less competitive than the overall high-tech sector.

Looking ahead, China’s shift up the value-chain should see movement towards higher-value electronics, for example to producing parts for high-value components. This is likely to see increased competition with the likes of Korea, Taiwan and Japan. The sheer size and scale of the Chinese market means it is likely to continue to be the major market player. Other Asian producers, such as Malaysia, Indonesia and Thailand each account for about 2% of global production, and production has been growing rapidly in Vietnam and the Philippines. These low-labor cost producers should benefit from rising production costs in China. However, the adverse impact of this offshoring from China on the US is likely to be minimal, because it is happening in sub sectors for which the US is not a major manufacturer.

We expect global high-tech production growth to slow to 4% per annum from 2017-25. Demand for traditional electronic products, such as computers, consumer electronics, and increasingly, smartphones, is slowing as these markets reach saturation. With growth of traditional electronic products slowing, longer-term sector growth will be driven by the production of components used to power connected devices, self-driving cars and high-value industrial processes. Total electronics production in the US is expected to be slightly lower, at 3.1% per annum, and exports of electronic goods are expected to rise by 5.8% per year from 2017-25 in US dollar terms. But production growth in the precision instruments sector is expected to be stronger than the world total given the US’s relative strength in that sector, with exports set to rise by 7.4% per year from 2017-25.