If you have taken a marketing class, you will for sure know about the 4 Ps of marketing: product, price, place and promotion. The 4 Ps have been around for over 50 years and have been widely adopted in most organizations. The key word here is “most.” In the industrial and manufacturing world, one of the P’s is highly neglected. Many firms manage their marketing strategy without having a declared pricing strategy, a formal price management process or a focus on pricing discipline. This is why I often say that pricing is the orphan of the industrial marketing mix.

In 2011, Kevin Mitchell, president of the Professional Pricing Society, was quoted saying that only 5% of Fortune 500 US firms had a dedicated pricing team. This number was a guess-timation based on attendance to pricing events and participation in social media groups related to pricing. Since then, this number has been widely used to depict the level of adoption of pricing in large organizations across the board.

To set the record straight, I wanted to investigate the penetration of the pricing function in large U.S. industrial firms and answer the following research questions:

1. How many U.S. industrial firms have a dedicated pricing team?

2. How many U.S. industrial firms have dedicated pricing roles or titles?

4. When firms have dedicated pricing titles, what are the types of titles?

5. What is the size distribution of these pricing teams?

Why are these questions so important? They are critical for multiple reasons that I list below:

1. When pricing is not formally managed by professional pricing teams, “price-setting” decisions are typically managed by marketing or finance teams and “price-getting” actions are managed by sales organizations. The level of fragmentation does not lead to optimal pricing decisions. In fact, it is well known that when pricing is not formally managed, cost-plus (applying a markup percentage to all costs to estimate the asking price) and freemium (free product or service; fees for extra features) become the de facto pricing strategies.

2. When pricing is part of a basket of tasks conducted by marketing managers, product managers or sales managers, it often falls at the bottom of the list. Pricing is only discussed during the budgeting process and at times of business reviews. It is reviewed reactively when business conditions worsen or large deals are negotiated. I do not believe in multitasking when it comes to pricing.

3. When pricing is not based on customer value, it is typically based on a cost-plus mechanism or relative to competition. Past research shows that only 15 to 20% of firms adopt value-based pricing as a primary pricing orientation. To make matters worse, most industrial firms with engrained cost mindset use cost-plus pricing to set pricing for their innovations, potentially leaving a lot of money on the table.

About the Research

I downloaded the 2018 IndustryWeek 500 list for fiscal year 2017. For the purpose of data collection, investigation and validation, I also secured access to the following professional databases:

1. Zoominfo, a professional B2B database provided by Zoominfo, a company founded in 2000 that specializes in the management and marketing of B2B professional databases, with over 19 million company profiles.

2. The Professional Pricing Society, a global professional organization dedicated to the management and development of the pricing profession, with a proprietary database of 33,000 contacts from around the world.

3. LinkedIn, a division of Microsoft, with a public database of 450 million members.

Before conducting secondary research, I held a series of conversations with experts from PPS in order to agree on the most critical definitions. These definitions guided the research in the databases and informed the process of validation of all positive cases.

Pricing Organization: I define a pricing organization as a team of 20 pricing professionals located at the corporate level or within business units or regional divisions, and led by a vice president of pricing, a director/head of pricing, or a pricing manager.

Dedicated Pricing Titles or Role: The pricing title or role includes the traditional pricing titles of pricing analyst, pricing specialist, pricing administrator, pricing actuary, pricing coordinator, pricing supervisor, pricing manager, pricing director, and vice president of pricing. I also included other nontraditional titles if pricing was mentioned in the title and it was a full-time role. I excluded from our data collection the following dedicated titles: margin, value, revenue management, and transfer pricing.

Summary of Research Findings

In 2018, the top 500 industrial firms listed in the IndustryWeek 500 ranking represented $5.4 trillion in sales revenues, $440 billion in net income or 6.7% average return on sales, and an average revenue growth of 13% versus 2017. My research shows that these top 500 industrial firms employed 2,631 pricing professionals in total. Sixty-one percent (61%) of firms have dedicated pricing tiles or roles.

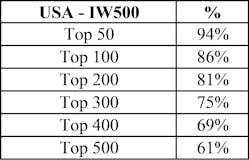

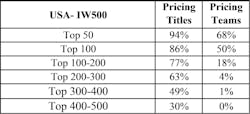

This proportion of pricing titles decreases from 94% in the top 50 industrial firms to 61% in the top 500 firms, indicating an even lower penetration of pricing role in the Top 1000 firms should I extend the research.

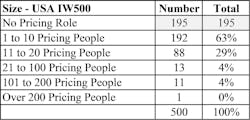

Of the 500 industrial US companies on the IW US 500 list, 305 had dedicated pricing titles for a total of 2,631 pricing professionals employed. The average number of pricing professional per firm stands at close to nine. A distribution of the number of pricing professionals shows that 92% of pricing teams have less than 20 professionals. Only 12 industrial firms have more than 101 pricing professionals in their teams. The largest pricing team stands at 225 professionals.

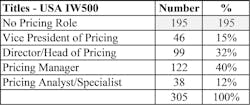

The database search allowed for identification of pricing titles as shown below. Forty-seven percent (47%) of teams are led by a vice president, director or manager of pricing. For 12% of the industrial firms, we could only find the title of pricing analyst or specialist. (Note that 100% total is due to rounding.)

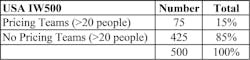

With the validation from PPS, I define a pricing organization or team as a team with a minimum of 20 professionals that is led by a vice president, director or manager-level position. The research shows that only 15% of top 500 US industrial firms fall into that definition.

The table below shows that the proportion of these top industrial firms that have pricing teams under my definition falls sharply below the Top 100 mark. In fact, only 5% of the bottom 300 industrial firms out of the top 500 have a dedicated pricing team.

Implications for Industrial Firms

The research reveals how far behind the manufacturing and industrial world is with the adoption of pricing as part of the 4 Ps of the marketing construct. We can see that after the top 50 or 100, the penetration of the pricing function is quasi non-existent. That also potentially means that the next 500 industrial US firms do not have dedicated pricing teams. These companies might have pricing roles under marketing but no sizeable pricing teams. One can only assume that the responsibility of pricing falls under marketing managers, product managers, and sales leadership.

Large industrial firms belonging in the top 100 list have very large annual sales revenues and potentially very complex organizational and divisional structures. Having dedicated pricing roles and a pricing team with 20 to 30 professionals is a good first step. But how do you manage pricing for a $100 billion business with this low number of pricing professionals? How do you manage pricing discipline for thousands of SKUs and millions of customer transactions?

Leaders of industrial firms continue to underestimate the potential impact of pricing teams and pricing in investments. There are plenty of anecdotes, books and consulting reports that show the tremendous impact of pricing to the bottom line. It is well known that every $1 invested in pricing leads to $7 to $10 in EBITDA impact. Yet, these leaders continue to focus on cost-cutting, market share growth, and cost-plus pricing. Some industrial sectors have realized the potential impact and have made considerable investments: chemicals, medical equipment, spare parts, and industrial services. We still have a long way to go to convince these leaders to pay attention. It is hard work but the payback is real. Be bold. Join the pricing revolution!

Stephan M. Liozu, Ph.D. is chief value officer at Thales Group and founder of Value Innoruption Advisors, a consulting boutique specializing in value-based pricing, digital pricing, and industrial pricing. Stephan wrote nine pricing books and is a frequent keynote speaker at industrial and digital conferences.