The acceleration of all things digital was critical for business continuity at the front end of the COVID-19 pandemic. Today, as labor shortages affect different industries nationwide, employers are clamoring for more workers to drive business forward. But the mismatch between rising job openings and lagging hiring levels is one of the dilemmas of the current labor market. The recovery in jobs has been uneven with some sectors springing back faster than others. Worker shortages in manufacturing add to challenges in meeting customer and market needs, stalled innovation and rising workloads for existing employees. Here we explore four probable reasons for the slower pace and suggest steps that leaders should consider.

Entry-Level Workers Go to Other Sectors

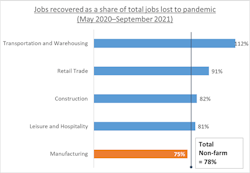

In early 2020, the U.S. rapidly lost 23 million nonfarm jobs but then made a swift comeback. According to the Bureau of Labor Statistics, one-third of jobs lost were added during the two months following the initial COVID-driven downturn, and 78% have been added as of September 2021—a remarkable rebound in a short period.

The manufacturing sector—which was slower than many sectors to add jobs following the Great Recession—has regained 75% of its 1.4 million jobs lost in the pandemic. While three quarters is encouraging, the sector lags behind other industries in filling positions. We analyzed four sectors that typically compete with manufacturing for entry-level talent (see figure 1). Among these, transportation and warehousing had recovered and surpassed net payrolls from the pre-pandemic level (February 2020). Moreover, manufacturing posted a historic high number of job openings at 892,000 in August 2021 but only added 31,000 net payrolls. At this rate, it could take the sector at least another year just to meet its deficit of 350,000 jobs.

Figure 1: Manufacturing lagging other industries in jobs recovery

Source: Deloitte analysis based on Employment, Unemployment, and Openings, Hires, and Separations data from Bureau of Labor Statistics.

Exploring Possible Reasons Behind the Lag

The uneven recovery in manufacturing reflects a convergence of factors. Consider these four:

1. An empowered workforce is reassessing job prospects

There is an ongoing reassessment today—with the workforce reconsidering not only ‘what’ work to do, but also the ‘where’ and ‘why,’ including location and industry preferences. For example, according to the Federal Reserve, California and Texas—two states with the largest manufacturing payrolls—recovered only 43% and 46% of pre-pandemic manufacturing job levels, respectively. (In comparison, nonfarm job recovery was 62% and 86%, respectively.) The high variance may suggest the workforce in those states is reassessing career options and industries other than manufacturing. Other factors could include hesitance to return to work as variants spread, childcare demands and availability elsewhere of flexible work arrangements.

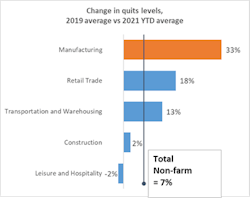

A rise in the quit rate is also reducing the impact of manufacturers’ hiring efforts. The 2021 January-August average monthly hiring levels in manufacturing are 27% higher than the average 2019 levels and higher than for each of the competing industries. However, the average monthly quit levels are higher than both 2021 and 2019 levels, as well as those of other industries such as transportation and warehousing. One result is that manufacturing has only added about 230,000 net payrolls through September 2021. So, is the labor force leaving manufacturing for opportunities in other industries?

Figure 2: Manufacturing hiring is up, but so is the quit rate

Source: Deloitte analysis based on Employment, Unemployment, and Openings, Hires, and Separations data from Bureau of Labor Statistics, accessed on October 18, 2021

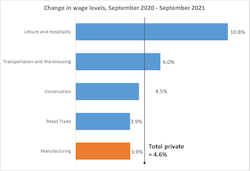

2. Wages and benefits could be a deciding factor

Although manufacturing wages for entry-level jobs are generally higher compared to competing industries such as transportation and warehousing, recent data suggests that manufacturing may not be offering the wage raises of competitors. The advantage may be waning. Average hourly wages in manufacturing rose by 3.9% between September 2020 and 2021 versus 6% for the transportation and warehousing sector and 10.8% in the leisure and hospitality sector.

Figure 3: Wages are increasing at a higher pace across other industries

Source: Deloitte analysis based on Occupational Employment and Wage Statistics data from Bureau of Labor Statistics, accessed on October 18, 2021.

Benefits could be another influential factor. In a comparison of benefits by industries, manufacturing emerges favorably by offering category-leading benefits in healthcare, vacation days, sick leave and retirement . The industry also does well in workplace safety, recording lower workplace fatalities compared to transportation and warehousing. However, other benefits could also be important for manufacturers to reevaluate in light of changing workforce experiences and expectations. Production workers who are on site may not have the flexibility other employers can offer with childcare, flexible hours, or remote work when needed.. Manufacturers need to consider ways to make it easier for the workforce to rejoin.

3. Retail and tech giants may have stronger employment offerings and branding

Manufacturing could be playing catch up with retail and technology companies in brand, perceptions and employee offerings. According to our research, less than 5 in 10 Americans surveyed believed manufacturing jobs to be as stable and secure as jobs in other industries. Less than 3 in 10 Americans surveyed would encourage their children to pursue a manufacturing career. It is likely that the perceptions of manufacturing have not kept pace with industry advances, leaving a gap with realities for job stability, career growth, pay and benefits. Americans surveyed also selected manufacturing sixth among industries to start a career, five places behind technology. Manufacturing likely needs a rebrand to get out the good news on its advanced technologies and career advancement opportunities.

4. Manufacturing hiring criteria may be too restrictive

The manufacturing industry has recently been reducing or eliminating some hiring requirements to expand the candidate pool. However, the industry’s hiring practices could be out of sync. For example, typical knowledge, ability and expectation requirements for entry-level jobs in manufacturing are similar to entry-level warehousing jobs. Why, then, is there a hiring gap for manufacturers when manufacturing offers a higher wage?

As suggested in the 2018 Deloitte and the Manufacturing Institute skills gap study, manufacturing should pivot to hire for attitude and ability to learn, not only current skills. In fact, critical thinking emerged among the top five in-demand skills—revealing that manufacturers do not need to exhaustively check all the boxes for skills when hiring.

Capitalize on the Reassessment

For all the business and societal change the pandemic has wrought already, one area that has remained a stubborn constant for manufacturers is the need for a more competitive talent strategy to hire and retain critical workers. The current period of U.S. labor market reassessment offers a new window of opportunity as firms look to fill their openings today. Manufacturers can help fill in what, where and why workers should join them now by considering their employment branding, rewards, and hiring requirements. Those with a stake in manufacturing share aspirations for improving industry perception and value propositions to attract a skilled workforce. In what areas will you compete?

Paul Wellener is a vice chairman and U.S. industrial products & construction leader at Deloitte LLP.