The Great Regulation Rollback Is Finally Here. But Is it Working?

During a recent National Association of Manufacturers roundtable at the White House, Ed Paradowski sat one seat away from President Donald Trump. Paradowski made up for the distance during introductions by reaching past the person next to him and handing Trump his business card.

“Ed Paradowski, President of Apache Stainless Equipment,” he announced in a firm, friendly way. “We have 175 employees, all skilled tradespeople, some of the best skilled tradespeople in the state of Wisconsin … We would love to have you out in Beaver Dam, Wisconsin.”

Paradowski was invited to the roundtable because he wanted change; he had seen business become much more regulated since he began his career in 1995, building a diesel fuel tank company from scratch into a $12.2 million business that Kohler acquired in 2001.

“There are so many barriers to entry that have nothing to do with commerce, with solving problems for clients, which is what entrepreneurs typically want to do,” Paradowski says. “And that list over time is growing.”

Recently, a refrigeration-panel regulation got some of his colleagues into hot water. Even though they followed the rules, he says, the foam in the panels, received from a supplier, did not perform to its stated specifications, and they were slapped with a hefty fine for noncompliance.

“The performance miss was not intentional or deceitful,” Paradowski said in an email. The company “was under the assumption that the cooler panels performed as required.”

Manufacturers have been complaining about overregulation since back when three spinning wheels in a hayloft was considered mass production. The Code of Federal Regulations was 15,000 pages in 1950; by 2016, it was 180,000 pages, according to the Regulatory Studies Center at George Washington University. (Despite Paradowski’s frustrations, the number of regulations actually grew more per year, on average, between 1950 and 1995 than between 1995 and 2016.)

In 2016, during his presidential campaign, Trump issued a Contract with the American Voter in which he promised that for every new federal regulation, his administration would roll back two.

Paradowski found that rhetoric refreshing. “We’ve made it so difficult in the workplace,” he says. “The only companies that can afford all the infrastructure and compliance are the big companies, and I’ve always been a small company guy.”

In his first weeks as president, Trump followed through on his campaign promise with an executive order stating that for every new rule, two existing rules must be eliminated and net cost must not exceed zero. In its Trump-O-Meter, PolitiFact rated that as “Promise Kept.”

But the real picture is more complicated. Despite Trump’s promises, the checks and balances of the founding fathers mean that government’s default pace is Paleolithic. The pace of change in the manufacturing sector is also traditionally slow and measured, balanced against carefully crafted 10-year plans.

This means that while progress is being made, and enthusiasm among certain manufacturers is growing, the short- and long-term impacts of the efforts remain unclear. So we have analyzed the numbers and talked to the manufacturers at the center of the movement to see if this regulatory rollback lives up to the hype.

A Numbers Game

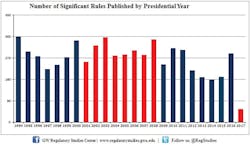

It’s true that the Trump administration has pared the number of new regulations. Keith Belton, director of the Manufacturing Policy Initiative at Indiana University, notes that Trump issued fewer than half as many significant regulations during his first year in office (375) as presidents Barack Obama (879) or George W. Bush (860). Significant regulations are federally defined as either having a significant economic impact or interfering with other agencies or rules, or with the president’s priorities.

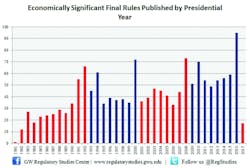

Major regulations are a much smaller category of significant regulations that have an economic impact of $100 million or more in benefits or costs annually. Trump introduced 34 major regulations in his first year, compared to 79 for Obama and 54 for Bush. Of those major new regulations, those affecting manufacturing include three for Trump, 11 for Obama and two for Bush.

Even with the cuts in new regulations, however, Belton is skeptical that the Trump administration can fulfill the 2-for-1 promise—or that the rollback will have a big effect on manufacturers.

“Even if you try to undo a regulation, it takes a minimum of a year,” Belton says. “And often if it’s a major regulation, it could take three to four years to make the change. So if you’re a manufacturer and you’ve already started complying with something, and three years from now it’s going to go away, it isn’t going to make a difference to you if there’s already a lot of costs that you’ve incurred.”

Belton says the kinds of regulations that would substantially affect manufacturers have a recurring significant cost year after year. But, he adds, “usually, the cost of those regulations is incurred on day one. Once you’ve paid for it and it’s in place, it’s in place 20 years.”

Tidying-Up Time

More impactful to manufacturers, says Belton, is the pruning of the federal regulatory agenda that’s happening deep in the halls of bureaucracy. Traditionally, that list of all the proposed regulations currently in the pipeline has been a thicket of rules under serious consideration bound up with others that someone thought were good ideas at some point, and then nothing happened.

“They might have an idea for a regulation and it might stay in there for like 10 years, even though nobody might be working on it in the agency,” Belton says.

Neomi Rao, the conservative academic who serves as Trump’s administrator of the Office of Information and Regulatory Affairs, made it her mandate to get rid of the dead wood, says Belton, and the agenda has become a tool that manufacturers actually can use to know what’s coming so they can get ready to comply.

“This administration is saying, ‘We’re actually going to take the time to make sure the regulatory agenda is accurate, and actually reflects everything that we’re working on,’” he says. “It’s more up to date and accurate. And that’s good—manufacturers want to know if a regulation that looks troublesome or costly to them, when it’s going to be issued—if it’s going to be issued.”

What’s the Big Deal?

Michael Lotito is an attorney who represents corporate employers for the firm Littler Mendelson, and has testified on workplace policy issues from the employer’s perspective. During Trump’s tenure thus far, Lotito says, his manufacturing clients have benefited most from the nullification of the Fair Pay and Safe Workplaces rule (informally known as the “blacklisting rule”). That rule, an executive order signed by Obama in 2014, required federal contractors to disclose labor law violations and stipulated that those violations be considered when awarding federal contracts.

Of the $8.1 billion in compliance cost savings Trump claimed for his rollbacks in 2017, an estimated $6 billion came from the rollback of the blacklisting rule alone, according to a federal cost report.

Another major rolled-back regulation affecting manufacturers is the Obama-era Persuader Rule, which expanded the requirement for employers to report their anti-union efforts. That was rescinded in 2017. And a 2016 injury recording rule, which required employers to electronically submit to the government records of work-related injuries and illnesses for public posting, was also rescinded.

In addition, the administration tabled the Overtime Rule, which would have doubled the salary cap for overtime compensation, and put on hold a new Equal Employment Opportunity pay-reporting rule intended to identify gender and racial disparities in pay. And it is pushing for legislation that would limit employers’ responsibility for labor law violations against their contract laborers, shifting the responsibility to the third-party agency that hires the contract workers.

Having more narrow impact are the Trump administration’s reversal of safety requirements like the Obama-era silica-dust and beryllium exposure rules—which effect only certain segments of manufacturing.

In Littler’s Annual Employer Survey for 2018 of 1,100 U.S. executives, 64% said the reversal of workplaces policies between administrations is putting a strain on their business.

Lotito says that new state and local labor laws always have the potential to dilute the impact of rolled-back federal regulations. Last year, Littler tracked 2,700 state and local government labor regulations that were introduced, and 390 enacted.

Marc Braun, president of Cambridge Engineering—a Missouri manufacturer of industrial heating and ventilation equipment—says that Trump’s rollback in regulations has not affected his business, which is not in a heavily regulated field and strives to run a workplace that compensates people well and exceeds OSHA requirements.

“We want to call our business to a much higher standard than regulations will ever allow for,” said Braun, a lecturer on lean and continuous improvement. “We want to create an environment where workers are thriving, rather than simply meeting minimum standards.”

Any benefits of a looser regulatory attitude are indirect, he says. “I think the general feeling of more freedom to experiment and grow has certainly had a positive impact. Confidence is significantly higher with the business leaders we talk to about purchasing capital equipment, and that has been making significant growth in our business.”

The reduction in the corporate tax rate, from 35% to 21%—thanks to the successful Trump tax reform push—has also freed up businesses to invest in the capital equipment that Cambridge manufactures.

Battle of the Sad CAFERolling back regulations is a precarious venture: what’s good for one segment of the industry might be another’s job-killer. The Trump administration has the backing of the Alliance of Automobile Manufacturers—a trade association that represents Ford, GM, FCA, Toyota, BMW and seven other major automakers—in its quest to redraw the automotive fuel economy (CAFE) standards for 2022 to 2025, established under the Obama administration. The plan, in place since 2009, incrementally increases requirements for vehicle fuel economy to 54 mpg by 2025.But the largest automotive supplier organization in the United States, the Motor & Equipment Manufacturers Association (MEMA), opposes the rollback. Laurie Holmes, MEMA’s senior director of environmental policy, says that minor changes could be acceptable but a wholesale rewriting would jeopardize suppliers’ substantial investments in fuel efficiency technologies*, made over time. MEMA is throwing its weight behind its opposition, prominently noting in its literature that automotive suppliers employ 871,000 workers in the U.S., making them the largest source of manufacturing jobs in the country.

While many in the industry cheer less regulation, Kathie Leonard, CEO of Auburn Manufacturing in Mechanic Falls, Maine, worries about the hit her 50-person company could take if the Department of Energy rolls back energy efficiency standards. About a fourth of their business comes from energy efficient insulation products for HVAC systems in schools, hospitals and other institutions.

“It’s not just my product—there’s a lot of products out there that wouldn’t be used if there weren’t incentives for saving energy,” says Leonard.

Though Leonard is seeing more business optimism, it’s not materializing into more business for her. She has customers in Mexico who are hedging their bets until they know what’s happening with NAFTA.

“Change tends to slow things down because everybody goes on hold, thinking, ‘OK, this is going to change—maybe I shouldn’t make a move until that happens and I know I’m going to benefit from it,’” she says. Her advice to Trump: “Don’t go back and forth. Every time you whipsaw or change your mind about something, it throws everybody off their game. And then the more we feel uncertain, the better chance there is that we’re not going to invest. We’re going to take a wait-and-see attitude, and that hurts everybody.”

Trump comes as a package. His gut-level pronouncements can be a refreshing change from the Paleolithic pace of government, but they also bring an uncertainty that manufacturers—accustomed to planning years in advance for every strategic move, tend to dread.

Still, just by attempting an ambitious deregulation agenda, Trump is creating a kind of business gemutlichkeit. Whether that will translate into higher profits and more prosperity, or just burn off in a vibrant flare, remains to be seen.

Paradowski is in the prosperity camp. During the 2016 presidential campaign, he didn’t tell people he was voting for Trump. But he’s feeling more emboldened now—he thinks Trump has been effective with his regulatory approach, bundled with the steel tariffs, trade talks and tax reform.

“Maybe this is the only way real change can happen at the pace of the private sector,” he says. “Kind of drop the pipe bomb in the room to get everybody shaken up.”

*Correction: "Renewable energy technologies" was changed to "fuel efficiency technologies" to accurately reflect MEMA's priorities.

About the Author

Laura Putre

Senior Editor, IndustryWeek

As senior editor, Laura Putre works with IndustryWeek's editorial contributors and reports on leadership and the automotive industry as they relate to manufacturing. She joined IndustryWeek in 2015 as a staff writer covering workforce issues.

Prior to IndustryWeek, Laura reported on the healthcare industry and covered local news. She was the editor of the Chicago Journal and a staff writer for Cleveland Scene. Her national bylines include The Guardian, Slate, Pacific-Standard and The Root.

Laura was a National Press Foundation fellow in 2022.

Got a story idea? Reach out to Laura at [email protected]