96% of Manufacturers Need or Want More Specialized ERP

Manufacturing in North America has become more complex as long-run, repetitive manufacturing becomes less common. More and more manufacturing in the Western Hemisphere centers around demanding processes like engineer-to-order (ETO), product lifecycles are becoming shorter and manufacturers are focusing more on the specific needs of the vertical industries they serve. In many cases, more of their revenue is coming from aftermarket service contracts, where manufacturers are contracting for maintenance and sustainment work for capital equipment they sell or delivering vendor managed inventory (VMI).

Has enterprise resource planning (ERP) software these manufacturers use to run their business kept pace with this growing need for specialized functionality? According to a study we conducted at IFS North America, it has not. We conducted a survey among a random sample of 200 executives with middle market to large manufacturers. And we found that these manufacturers, using a variety of well-known ERP products, face substantial ERP functional gaps created by the changing and more demanding nature of manufacturing.

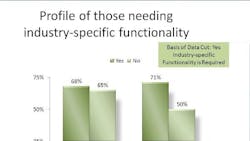

In our study, 67% of respondents said they required more industry-specific functionality than their current ERP software provided. And even among those who said they did not have a need, 29% still expressed a desire for greater vertical industry functionality.

Some Needs Greater than Others

Not surprisingly, some types of manufacturers expressed a greater need than others. The single greatest need for more industry specific functionality was among manufacturers who say managing return on assets (ROA) is a core part of their business (See Figure one below, Return on Assets). Indeed, few ERP products offer embedded enterprise asset management (EAM) functionality, forcing process manufacturers and others operating expensive and mission critical assets to essentially run two separate enterprise systems or perform extensive work in spreadsheets or manual systems.

Imagine the dilemma faced by the executive team of a chemical processing company as they plan to replace aging plant equipment. What is the cost to maintain the existing systems versus the cost of replacement? What will the impact be on production, and how can the production schedule be altered to allow for the project? Are there maintenance inventory parts associated with the existing equipment that will no longer be necessary? Are there maintenance parts associated with the new equipment that need to be ordered proactively? None of these questions can easily be answered unless EAM functionality is tightly integrated with ERP.

On the whole, process manufacturers reported a greater need for more industry specialization, as did companies involved with engineer, procure, construct (EPC) contracting and aftermarket service management.

One thing that surprised me about this data is that companies involved in large, high value and complex projects reported an only slightly greater need for vertical industry functionality than those that did not. At IFS, we are starting to see embedded project management functionality as a "sleeper" that is catching up with these project-intensive businesses one at a time. A project-based manufacturer may run a separate project portfolio management solution or run complex engineering, fabrication or installation projects in spreadsheets. But as they experience greater pressure to bid competitively, control delivery schedules and manage project risk, ERP with powerful embedded project management tools is becoming a necessity.

The survey data paints a picture of a manufacturing industry where a significant sector of the manufacturing industry is poorly served by ERP vendors. Those who report requiring greater vertical industry functionality:

- Are 12% less likely to have implemented ERP, but more likely to have implemented other, less comprehensive applications.

- Rate the fit of their current applications lower than those who have no industry-specific needs.

- Fill functional gaps by running various other applications and spreadsheets -- which may or may not be integrated with ERP.

Creating Enterprise Risk

Perhaps the real takeaway from the study data is that these functional gaps are putting manufacturers lacking the right vertical industry ERP functionality at a severe disadvantage. Respondents say these gaps make them less able to serve their customers and more likely to experience productivity drains as they perform extensive rework and double entry in the various systems necessary to meet all of their needs (See Figure 2 below, Gaps Hurt Business).

A majority of manufacturers that require more industry-specific functionality report decreased real time visibility and an increased degree of business risk. Upon review, it becomes apparent that lack of visibility and resulting risk is a direct result of the fact that so many different systems are used to manage these more complex and demanding businesses. One of the primary functions of ERP is to enhance visibility by unifying business functions on a single application. By definition, as more business-critical work like asset management or project management is performed outside of a centralized instance of ERP, visibility decreases and the likelihood that serious business issues will develop unchecked increases.

Conclusion

More than ever, ERP is not a one-size-fits-all proposition. Not every ERP product is right for manufacturers with more complex needs. And today, more and more manufacturers are facing a degree of business complexity that places new demands on the ERP product they rely on to run their mission-critical processes. This need for vertical industry functionality has implications not only for the ERP product a manufacturer chooses, but for the vendor organization behind that product. In considering various product offerings, the ability of a vendor's project team to understand the complex processes your business is running and configure software accordingly is also critical.

Cindy Jaudon is President and CEO of IFS North America. http://www.ifsworld.com/en-na/