Reshoring Gaining Strength Among Large Manufacturers, BCG Survey Finds

Manufacturers producing goods for the domestic market increasingly are likely to add capacity in the U.S. rather than any other country, new data from the Boston Consulting Group shows.

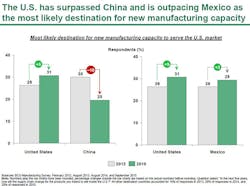

Among companies expecting to increase production capacity in the next five years for goods consumed in the U.S., 31% reported they plan to do so in the United States, while 20% said they plan to add capacity in China. Just two years ago, 30% said they would add capacity in China to serve the U.S. market and 26% said they would increase production in the U.S. BCG researchers called the reversal “striking.”

Manufacturing executives reported that the increase in reshoring is already underway. Some 17% of respondents reported actively reshoring production today, an increase of 250% since 2012.

“These findings underscore how significantly U.S. attitudes toward manufacturing in America seem to have swung in just a few years,” said Harold L. Sirkin, a BCG senior partner and a coauthor of the research. “The results offer the latest evidence that a revival of American manufacturing is underway.”

“The fundamental economic forces that are prompting many companies to reassess their global manufacturing footprint have not changed,” explained Michael Zinser, a BCG senior partner and coleader of the firm’s global manufacturing practice. “Given the big differences in wage growth and productivity—and the greater attention companies are paying to total cost—there is good reason to believe that the cost-competitiveness of the U.S. compared with China and many other major export economies will continue to improve in the near term.”

Advanced manufacturing technologies such as robotics, whose costs are shrinking as their capabilities increase, are helping to make the U.S. more attractive for investment. Fifty-six percent of respondents said that lower automation costs have improved the competitiveness of U.S.-made products compared with similar goods sourced from low-cost countries. Moreover, 71% said advanced manufacturing technologies will improve the economics of local production, and 75% said they will invest in additional automation or advanced manufacturing technologies in the next five years.

Despite plans to invest in more automation, manufacturing executives said they also expect to add to their payrolls. Half of respondents said they expect their companies will increase U.S. employment by at least 5% over the next five years as a result of reshoring; 27% predicted a job increase of at least 10%.

While the survey showed encouraging trends about U.S. manufacturing, it did pick up concerns about recent turbulence in the global economy, caused by falling energy prices and swings in exchange rates, BCG pointed out. The 2015 survey shows that manufacturers believe that the U.S. will account for a slightly lower portion of their companies’ global production capacity than they indicated in 2014, the firm reported. The ratio of those projecting net job increases versus net job losses, while still 2-to-1 in favor of increases, also declined since the 2014 survey, which found a 3-to-1 ratio in favor of job creation.

Other factors impacting manufacturers’ production plans include such rising U.S. health-care costs, federal and local regulatory uncertainty, increases in the U.S. minimum wage, and unclear progress on tax reform.

“Although interest in reshoring remains strong, this year’s findings indicate that a number of companies are still holding back,” noted Justin Rose, a BCG partner and leader of the firm’s North American Industrial Goods Operations team. “This reinforces the fact that the U.S. can’t simply rest on positive global macroeconomic trends if it is to fully capture the opportunities created by the shifting economics of global manufacturing.”

About the Author

Steve Minter

Steve Minter, Executive Editor

Focus: Leadership, Global Economy, Energy

Call: 216-931-9281

Follow on Twitter: @SgMinterIW

An award-winning editor, Executive Editor Steve Minter covers leadership, global economic and trade issues and energy, tackling subject matter ranging from CEO profiles and leadership theories to economic trends and energy policy. As well, he supervises content development for editorial products including the magazine, IndustryWeek.com, research and information products, and conferences.

Before joining the IW staff, Steve was publisher and editorial director of Penton Media’s EHS Today, where he was instrumental in the development of the Champions of Safety and America’s Safest Companies recognition programs.

Steve received his B.A. in English from Oberlin College. He is married and has two adult children.