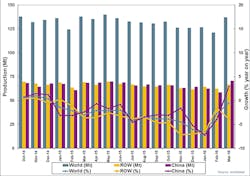

Global raw steel production during March reached its highest total in nine months, since June 2015, according to the latest report by the World Steel Association. Across the 66 member nations, March raw steel tonnage rose 13.3% from February to 137.3 million metric tons. However, that result is 0.5% less than the March 2015 total, and it brings the year-to-date raw-steel total to 385.7 million metric tons, down 3.33% versus the January-March 2015 total.

The Brussels-based World Steel Assn. tracks raw (or ‘crude’) steel production and capacity utilization on a monthly basis for its 66 member nations. Raw steel is the output of basic oxygen furnaces and electric arc furnaces that is cast into semi-finished products, such as slabs, blooms, or billets. The Association reports tonnage and capacity utilization data for carbon and carbon alloy steel; data for production of stainless and specialty alloy steels are not included.

During March, global raw-steel capacity utilization rose 3.9% from February, to 70.5%. This is figure is 1.3% lower than the March 2015 capacity utilization rate.

The increasing output and capacity utilization rate from February to March is perhaps illustrative of the recovery in the primary steel market’s fundamentals in the E.U. and North American Markets, as indicated in World Steel’s recently issued report on short-term demand worldwide, and in regional markets.

Importantly, the forecast revealed a long list of continuing problems afflicting the Chinese steel industry – the largest by far among the 66 nations. For the month of March, China’s raw steel production increased 20.74% from February to 70.7 million metric tons, an increase of 2.9% over the March 2015 total. For the year-to-date, Chinese steelmakers have produced 192 million metric tons, 2.55% less than the comparable figure for 2015.

In Japan, the domestic steel industry produced 8.6 million metric tons of raw steel during March, 3.63% more than during February but 7.54% less than during March 2015. The January-March total for Japan is 25.8 million metric tons, or 3.64% less than 2015’s three-month total.

India’s steelmakers produced 8.06 million metric tons of raw steel during March, 8.0% more than during February and 3.5% more than during March 2015. The year-to-date total for India is 22.9 million metric tons, up 1.8% from last year’s first three months’ total.

The South Korean industry produced 5.4 million metric tons of raw steel during March, an increase of 6.8% from February and a decrease of 8.7% from March 2015. The year-to-date production total is 16.2 million metric tons, a 4.3% decline from the same three-month period of 2015.

Across the European Union (28 nations), March steel production rose 5.8% from February to 14.1 million metric tons. This also represents a 9.5% decrease from the March 2015 tonnage total, and brings the year-to-date total to 40.9 million metric tons, 7.0% less than last year’s comparable figure.

German steelmakers produced 3.8 million metric tons of raw steel during March 2016, 13.2% more than during February and 1.7% less than during March 2015. Germany’s January-March production total is 10.8 million metric tons, 2.54% less than last year’s comparable result.

In Italy, March raw steel production was 2.0 million metric tons, 4.44% more than the previous month and 4.0% less than the year-ago total. The year-to-date result is 3.4% behind Italy’s tonnage for the first three months of 2015.

Steelmakers in France produced 1.1 million metric tons during March, 14.2% less than during February, and 23.3% less than during March 2015. The year-to-date raw-steel production total is 3.8 million metric tons, which is 6.1% less than the 2015 total.

Spanish steelmakers produced 1.2 million metric tons, 1.9% more than during February and 18.0% less than during March 2015. The year-to-date steel production total is 3.4 million metric tons, down 10.75% compared to 2015.

Turkish steelmakers produced 2.7 million metric tons of raw steel during March, 15.6% more than during February and 1.3% more than during March 2015. The year-to-date steel production total is 7.7 million metric tons, up 1.9% compared to 2015.

The Russian steel industry produced 6.0 million metric tons of raw steel during March, 6.2% more than during February and 2.1% less than during March 2015. The January-March 2016 total raw-steel tonnage is 17.2 million metric tons, 5.2% less than the three-month result for last year.

In the Ukraine, March steel production rose 10.25% from February to 2.2 million metric tons, and that figure is 28.1% higher than the year-ago total. The current year-to-date production total is 6.1 million metric tons, 18.0% higher than the January-March 2015 result.

Brazilian raw-steel production during March was 2.5 million metric tons, 2.97% higher than during February but 9.5% lower than during March 2015. The year-to-date production total is down 9.05% versus the comparable period of 2015.

Finally, U.S. steelmakers’ March output rose 5.0% from February to 6.7 million metric tons (7.4 million short tons), improving by 4.9% on the March 2015 result. The year-to-date production total is 19.6 million metric tons (21.6 million short tons), down 1.2% versus 2016.

About the Author

Robert Brooks

Content Director

Robert Brooks has been a business-to-business reporter, writer, editor, and columnist for more than 20 years, specializing in the primary metal and basic manufacturing industries. His work has covered a wide range of topics, including process technology, resource development, material selection, product design, workforce development, and industrial market strategies, among others. Currently, he specializes in subjects related to metal component and product design, development, and manufacturing — including castings, forgings, machined parts, and fabrications.

Brooks is a graduate of Kenyon College (B.A. English, Political Science) and Emory University (M.A. English.)