U.S. industrial production fell 0.5% in April, the Federal Reserve reported today, further evidence of a sluggish economy slowed by increased taxes, weakness in some global markets and continuing uncertainty in the business community.

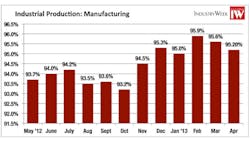

Manufacturing output declined by 0.4% in April, after a revised 0.3% decrease in March. Capacity utilization again moved down in April, declining 0.4% to 75.9%. That is 1.6% higher than in April 2012, but still 2.8% short of the long-term average.

Calling the manufacturing picture "bleaker," Cliff Waldman, senior economist for the Manufacturers Alliance for Productivity and Innovation (MAPI), said: “Suppliers of numerous manufacturing supply chains such as machinery, nonmetallic mineral products, and fabricated metal products all suffered contractions in production, indicating fundamental factory sector weakness. Even wood products output, which had been enjoying substantial growth as a result of the modest U.S. housing rebound, has now seen significant contractions for two consecutive months."

The output of durable goods dropped 0.6% in April. Output decreased for all major categories of these big-ticket items except computer and electronic products.

The largest drop was in the output of nonmetallic mineral products, which fell 1.7%, according to the Fed report. The production of motor vehicles and parts decreased 1.3%, while the indexes for the other major categories recorded smaller losses. Capacity utilization for durable manufacturing fell 0.7% to 75.7%, a rate 1.3 percentage points below its long-run average.

The production of nondurable goods edged down 0.1% in April after having fallen 0.3% in March. Among the major components of nondurables, the indexes for apparel and leather and for petroleum and coal products each dropped about 1.5% in April. The Fed reported losses of between 0.5% and 1% in textile and product mills, paper, and printing and support. The indexes for food, beverage, and tobacco products; chemicals; and plastics and rubber products each rose, but by less than 0.5%. Capacity utilization for nondurable manufacturing was little changed at 77.5%, a rate 3.2 percentage points below its long-run average.

Outside of manufacturing, mining output increased 0.9% while utilities fell 3.7% as heating demand fell to more typical levels.

About the Author

Steve Minter

Steve Minter, Executive Editor

Focus: Leadership, Global Economy, Energy

Call: 216-931-9281

Follow on Twitter: @SgMinterIW

An award-winning editor, Executive Editor Steve Minter covers leadership, global economic and trade issues and energy, tackling subject matter ranging from CEO profiles and leadership theories to economic trends and energy policy. As well, he supervises content development for editorial products including the magazine, IndustryWeek.com, research and information products, and conferences.

Before joining the IW staff, Steve was publisher and editorial director of Penton Media’s EHS Today, where he was instrumental in the development of the Champions of Safety and America’s Safest Companies recognition programs.

Steve received his B.A. in English from Oberlin College. He is married and has two adult children.