Make Your Move: Consumer Product Goods Benefit from Rising Employment

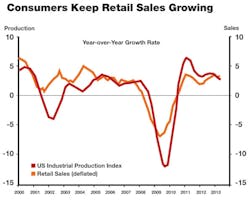

Recent numbers show that U.S. consumers are alive and well, increasing their purchases and helping drive the economy forward. Retail sales excluding automobiles are at record highs, a positive sign for near-term economic health. With disposable personal income rising at a 1.8% annual rate, consumers' incomes are at least keeping up with inflation. We expect activity to maintain a healthy pace, causing annual retail sales to improve through 2013.

This good news is partly due to the employment trend moving upward. We've seen 2.1 million jobs created in the last year (annual average basis), gains that have brought employment to the highest level in four years. Public-sector workers have fared badly. Total government employment is 0.3% below last year due to continued budget constraints. Job losses at the state level number around 15,000 positions, and the federal government has cut 5,000 jobs. Sequestration furloughs have left some federal workers employed but now with fewer hours each month.

See Also: Global Manufacturing Economy Trends & Analysis

Within the private sector, employment gains are widespread, helping to improve the general consumer situation. Growth over last year's levels can be seen in the manufacturing (1.1%), health care (2.0%), construction (2.1%), and retail trade (1.5%) sectors. While the job situation will improve through 2014, employment will still not regain its pre-recession peak heights during that period.

Many people wonder how the seasonally adjusted unemployment rate held steady at 7.6% in June even though employment improved. This was a result of the labor force participation rate increasing slightly as more individuals are now re-entering the workforce. The Federal Reserve is watching this number carefully, as it has stated that its efforts to spur the economy will continue until the unemployment level falls below 7.0%.

Newly employed consumers are going out to eat on the good news. Annual full-service restaurant sales stand at a record $234.7 billion, a gain of 5.9% from the past year. Since food and beverage inflation comes in at only 1.4%, this indicates that the growth is real and not inflation-driven. However, the pace of rise is diminishing in this market; quarterly sales grew 4.5% from the same period last year. This change implies that although consumers are spending money on simple luxuries, they are not doing so at the same pace as last year.

Purchases of lower-cost items are also moving upward. Annual retail sales of clothing are currently 3.7% ahead of the same 12-month period last year. Activity within the market is mixed; annual sales at men's clothing stores have fallen 1.4% below last year; sales at women's clothing stores are up 3.0%; and family clothing stores have seen a 4.4% gain over last year. Although inclement weather decreased wholesale purchases of clothing in March and April, annual wholesale trade of apparel, piece goods and notions is up 4.2% from last year. We expect that warmer temperatures ahead may increase consumer activity and thus purchases from retailers, providing a boost for nondurable goods wholesalers through the summer of 2013.

Activity in the vehicle sales sector shows that the consumer is confident enough to purchase big-ticket items. A positive economic environment has pushed annual light-vehicle retail sales past 15 million units in June for the first time since July 2008. For those in the vehicle retail sales sector, we expect sales will rise for another quarter before faltering in late 2013 and then declining during 2014.

| Stay on top of economic news and trends affecting manufacturing with Alan Beaulieu's Make Your Move blog at www.iw.com/blog/make-your-move. |

Even with all this good news, we still expect that the consumer -- and thus retailers, distributors and manufacturers -- will be facing headwinds as we enter 2014. Key leading indicators such as housing starts and corporate bond prices are signaling downward pressure on the economy once the new year rolls around. If you haven't already, begin to adjust your sails accordingly to take advantage of current growth and prepare for the challenges that lie ahead.