NAM/IndustryWeek 2013 Q2 Survey: Outlook Positive in the Face of Mediocre Growth

The U.S. economy has been a mixed bag during the first half of 2013. We have made some progress, particularly when looking at the all-time highs in the stock market or the consumer confidence measures that are now at levels not seen since before the financial crisis. Real GDP is growing modestly, up 2.4% in the first quarter, and it is expected to rise 1.8% in the current quarter. Much of that increase can be attributed to decent gains in consumer spending and steady increases in housing construction, both of which have helped boost output and lift sentiment.

Despite these positive signs, there continue to be weaknesses in the economy and in the manufacturing sector that are holding back growth. In addition, concerns remain high over the implementation of the Affordable Care Act (ACA) and the unfavorable business climate due to taxes and regulation.

NAM's Chad Moutray discusses the NAM/IndustryWeek 2Q 2013 Survey

Most of the domestic and global measures of output, sales and employment for manufacturers indicate that the sector is expanding very slowly, if at all. The Institute for Supply Management’s Purchasing Managers’ Index illustrates this point with its May reading of 49.0, its first contraction since November. Sluggish new orders at home and abroad have reduced activity, with slowing export sales, higher taxes and reductions in government spending providing a drag on growth.

To illustrate this point, we only need to look at the mediocre growth rates over the past 12 months for industrial production, up just 1.3%. Ideally, we would like to see manufacturing output rise 4% or greater annually to sustain growth and create jobs. This phenomenon is not unique to the United States, with manufacturing activity increasing very slowly globally. This slow growth has hindered manufacturers’ ability to grow exports, which were up just 1% in the first three months of this year relative to the same time period last year.

While the long-term health of manufacturing in the United States should be robust, the short-term prognosis has been disappointing. There has been some progress since the end of 2012 when businesses were pulling back prior to the fiscal cliff deal. However, these gains have been modest and appear to have stalled during the spring. In the last NAM/IndustryWeek Survey of Manufacturers report, I described this as “a complicated mix of both progress and enduring headwinds.” That depiction still seems fitting, particularly as the latest survey’s findings were not much different than they were three months ago. Manufacturers need momentum, not stagnation.

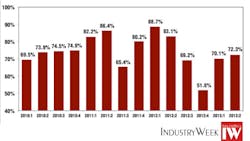

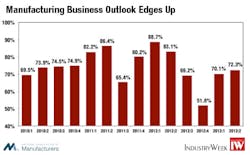

The percentage of respondents who characterized their current business outlook as positive rose slightly from 70.1% in March to 72.3% in June. The proportion identifying themselves as “somewhat positive” (60.6%) was essentially the same in this survey as the last, with fewer people saying they were “somewhat negative” (down from 28.2% to 24.4%). This was the largest difference between the two surveys. As noted in the previous survey, these results show some improvement from December’s low of 51.8%, but they are still well below the high of 88.7% in March 2012. There are still far too many manufacturers that view their business outlook as negative.

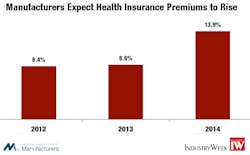

Manufacturers were asked about average health insurance premium increases. As evidence of the increased worry about what lies ahead after implementation of the ACA, respondents had an average premium increase of 8.4% in 2012, 8.6% in 2013, and 13.9% in 2014.

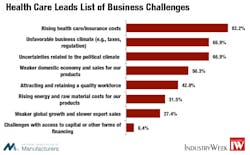

The top concern among manufacturers continues to be the rising cost of health insurance, cited by 82.2% of respondents in this survey. That is up from 74.0% in the previous survey, and it is a sign of increased anxieties related to the ACA. In a series of special questions on health care, virtually all respondents said that they offered insurance coverage to their employees, with 38% saying that they self-insured. At the same time, more than 56% were either not prepared or uncertain about how their firm planned to implement the ACA at the beginning of 2014. Along those lines, a surprisingly large percentage (41.2%) said that they were uncertain if their business would join a health insurance exchange later this year. Manufacturers still have questions, and as a result, many have not fully internalized the changes that they need to undergo to comply with the new law.

Survey Q&A: Health Insurance and the Affordable Care Act

Many of the responses for next year noted the uncertainties about what their premium increase might be. There is definitely a perception that premiums will go up significantly in 2014. Along those lines, the ACA also introduces a 40% tax on high-cost health insurance plans beginning in 2018. Respondents were asked if they planned to reduce their coverage to avoid the so-called “Cadillac” tax—23.3% said they would, with 39.3% uncertain.

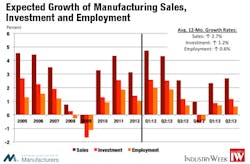

The slight increase in manufacturers’ outlook in this survey carried through to marginally higher expectations for sales and capital spending over the next 12 months, but hiring plans remain somewhat skittish. Sales are expected to grow 2.7% on average across the next year, up from 2.3% in the last survey. At the same time, capital investment spending should increase an average of 1.2%, which represents a modest uptick from the 0.9% average expected increase in March. Neither of these figures signifies rapid growth in activity, but like the optimism number, the pace is faster than six months ago but slower than a year ago.

The good news is that 62.1% of manufacturers surveyed said they expect higher sales in the next 12 months, up from 45.3% in December and 55.3% in March. Moreover, almost one-third predict increased new orders of 5% or more. Still, a sizable percentage (22.7%) is expecting sales to remain the same, with 15.2% forecasting declines in sales over the next year. Regarding capital spending, 35.1% indicate plans to increase their investment spending over the next year, with roughly half expecting levels to stay the same.

Hiring plans continue to remain subpar, with respondents planning to grow their employment by 0.6% on average in the next 12 months. That was down from 0.7% growth in the previous survey. Behind this low number, 51.6% expect their employment numbers to remain the same in the next year, with 24.2% intending to grow their employment up to 5%. Reflecting recent weaknesses in the marketplace, however, nearly 16% intend to reduce their employment. Meanwhile, roughly two-thirds of manufacturers in the survey anticipate wage and salary growth of up to 3% in the next year—a figure that does not include the cost of benefits. The average increase for all respondents was 1.6%, just slightly higher than the 1.5% gain stated in the March survey.

Manufacturers said they expect inventories to shrink by 0.3% on average over the next year, down from a decline of 0.1% last time. This was the fourth consecutive decrease in inventory stockpiles since June 2012, with the shrinkages in 2013 being much more modest than forecasted last year. Reduced inventories provide a silver lining. With reduced stockpiles, production will need to pick up significantly if and when new orders start to take off, which should be a positive for future activity once we get past the current weaknesses. Nonetheless, manufacturers have had to reduce their prices to sell their goods, with the average increase being 1.1% in this survey, down from 1.5% three months ago.

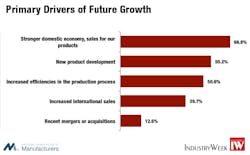

On the international front, manufacturers have struggled lately to boost their exports, particularly with slowing economies worldwide. This goes beyond the European recession, which has deepened in recent reports. In the March 2012 survey, respondents predicted growth of 1.4% in terms of their international sales on average. That number has consistently declined in the next three surveys. In this survey, manufacturers expect exports to increase 1.2% over the next 12 months, with 41.7% predicting higher levels. Most of those firms expect growth of 3% or more, but a large percentage of respondents (53.2%) say their export levels should not change.

International sales are still seen as a primary driver of future growth for almost 40% of manufacturers. As with past reports, those firms that expect increased exports over the next 12 months tend to be more positive than those that anticipate either no growth or declining export levels. In fact, 84.2% of those manufacturers that are more optimistic about international orders are positive about their company’s outlook, whereas that figure is 63.3% for those that are less positive about export growth.

The survey findings tend to vary by firm size. Larger manufacturers (e.g., those with 500 or more employees) were more positive than their small and medium-sized counterparts, but the difference was not as large as in past surveys. Of the large businesses, 74.2% were positive versus 72.4% for medium-sized (50–499 employees) and 70.9% for smaller firms (fewer than 50 employees). The gap between small and large manufacturers had been 9.4 percentage points in March, suggesting some degree of coalescing this time around.

However, the differences between manufacturers by firm size were larger for sales. Larger manufacturers have sales expectations of 3.2% over the course of the next 12 months, with 2.5% for small and 2.6% for medium-sized firms. Almost 33% of smaller manufacturers predict no sales growth over the coming year, a figure that is just 20.9% for larger businesses. Indeed, 70.1% of larger manufacturers have positive sales expectations for the next year, compared to 51.9% for small and 63.7% for medium-sized enterprises.

NAM/IndustryWeek 2013 Q2 Survey Responses

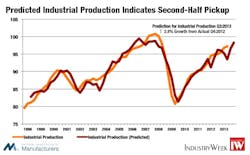

Finally, one of the benefits of having a long time series of data is the ability to use that information to forecast the future direction of the sector. We use the NAM/IndustryWeek output data in a regression model to help predict manufacturing production two quarters ahead. Other variables include housing permits, the interest rate spread, real personal consumption and the S&P 500. This model explains roughly 90% of the variation since the data began in the fourth quarter of 1997.

The current survey findings suggest that the index for manufacturing production should grow 1.8% between its April value (the most recent release) and the fourth quarter of 2013. Moreover, it would suggest a 2.8% increase year-over-year from the fourth quarter of 2012. As such, the data indicate that manufacturing activity might pick up in the second half of the year. Behind the more optimistic production numbers expressed in this particular model were larger effects from the improvements in the housing sector and the stock market. In fact, if those two variables had been at the levels they were a year ago, the model would have predicted flat growth year-over-year in production.

The NAM/IndustryWeek Survey of Manufacturers has been conducted quarterly since 1997. This survey was conducted among NAM membership between May 16 and 31, 2013, with 317 manufacturers responding. Responses came from all parts of the country, in a wide variety of manufacturing sectors and in varying size classifications. Aggregated survey responses appear below. The next survey is expected to be released on Monday, September 9.

About the Author

Chad Moutray

Chief Economist

Chad Moutray is chief economist for the National Association of Manufacturers (NAM), where he serves as the NAM’s economic forecaster and spokesperson on economic issues. He frequently comments on current economic conditions for manufacturers through professional presentations and media interviews. He has appeared on Bloomberg, CNN, C-SPAN, Fox Business, Fox News, and Reuters television.

Prior to joining the NAM, Dr. Moutray was the chief economist and director of economic research for the Office of Advocacy at the U.S. Small Business Administration (SBA) from 2002 to 2010. In that role, he was responsible for researching the importance of entrepreneurship to the U.S. economy and highlighting various issues of importance to small business owners, policymakers and academics. In addition to discussing economic and policy trends, his personal research focused on the importance of educational attainment to both self-employment and economic growth.

Prior to working at the SBA, Dr. Moutray was the dean of the School of Business Administration at Robert Morris College in Chicago, Ill. (now Robert Morris University of Illinois). Under his leadership, the business school had rapid growth, both adding new programs and new campuses. He began the development of an MBA program that began accepting students after his departure and created a Business Institute for students to work with local businesses on classroom projects and internships.

Dr. Moutray is a former board member of the National Association for Business Economics (NABE). He is also the former president and chairman of the National Economists Club, the local NABE chapter for Washington, D.C. He holds a Ph.D. in economics from Southern Illinois University at Carbondale and bachelor’s and master’s degrees in economics from Eastern Illinois University. In 2007, he was named a distinguished alumnus by Lake Land College in Mattoon, Ill., where he earned his associate’s degree in business administration, and in 2014, he received an Outstanding Graduate Alumni Award from Eastern Illinois University.