Reliance Industries Net Profit Up 1.5%, Meets Estimates

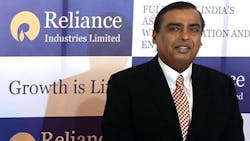

MUMBAI, India -- Reliance Industries (IW 1000/64), India's largest private firm, said today its quarterly net profit edged up 1.5%, matching estimates, as higher sales offset the impact of weak margins from refining operations.

The energy giant, controlled by India's wealthiest man, Mukesh Ambani, said net profit for its fiscal second quarter ended Sept. 30 rose to 54.90 billion rupees ($900 million), from 54.09 billion rupees from a year earlier.

"Reliance's first half [April-September] performance reflects the resilience of our business model in a period of volatility and uncertainty," Ambani said in a statement.

Turnover rose 14% to 1.65 trillion rupees.

The earnings met analysts' expectations of a 54.8 billion rupee profit.

Analysts have been concerned in recent months about Reliance's ability to boost gas production from its oil blocks off India's east coast.

Crude oil production from Reliance's main oil field KG-D6 fell 41% year-on-year to 1.0 million barrels of crude oil, a company statement said.

Natural gas production slid 52% from the previous year's level to 94.6 billion cubic feet.

Reliance has attributed the fall in production to "geological complexity and natural decline in the fields."

Government Stepping In

Last month, the Indian government said it is considering the appointment of global experts to investigate the decline in Reliance's gas output, which has been falling for three years.

Reliance's gross refining margins for the first quarter fell 19% to $7.7 a barrel from $9.5 a year earlier.

In 2011, British energy giant BP (IW 1000/4) paid $7.2 billion to acquire a 30% stake in 21 of Reliance's oil and gas fields.

Reliance hopes that BP's deepwater drilling expertise will give the Indian giant the skills to develop hard-to-exploit reserves and find more oil.

Reliance operates the world's largest oil-processing complex in Jamnagar, where two adjacent refineries have a combined capacity to process 1.24 million barrels of oil a day.

Reliance has built up a war chest for acquisitions, with cash reserves of 905.4 billion rupees ($14.5 billion) as of the quarter ended Sept. 30.

The energy behemoth has been scouting for acquisitions and looking to diversify its revenue sources by expanding into financial services, retailing, hotels and communications.

The company said revenues for its retail business rose 31% to 34.56 billion rupees. It now operates more than 1,550 stores in 136 cities across the country.

Ambani has also announced a foray into the Indian media sector as well as telecom.

In June, Mukesh and younger brother Anil, who fought a public feud for spoils of their father's business empire, announced a $2.1 billion deal to share telecom tower infrastructure, cementing a reconciliation between the once-warring siblings.

Reliance Jio Infocomm, the telecom unit of Mukesh Ambani-led Reliance Industries, signed the agreement with Reliance Communications, the flagship firm of the Anil Ambani group, to share the latter's telecom tower equipment.

Copyright Agence France-Presse, 2013

About the Author

Agence France-Presse

Copyright Agence France-Presse, 2002-2025. AFP text, photos, graphics and logos shall not be reproduced, published, broadcast, rewritten for broadcast or publication or redistributed directly or indirectly in any medium. AFP shall not be held liable for any delays, inaccuracies, errors or omissions in any AFP content, or for any actions taken in consequence.