Linking Cost Reduction and Growth Strategies Drives Financial Success

The past six years have been tough for both companies and their employees. As events that led to a painful recession unfolded in 2008, companies across the country struggled to stay afloat. Budget cuts, mass layoffs, unprecedented furloughs, and “doing more with less” became business-as-usual in almost every workplace. And manufacturers were right in the thick of it.

In response to these pressures, industrial companies were forced to significantly reduce structural and operational costs, by cutting indiscriminately and often into the muscle. Yet they remained vigilant about cost optimization, proactively managing growth through productivity-focused actions, adding shifts when needed, and paying overtime to workers.

But by adapting to the new economic realities of today, the manufacturing sector may have unwittingly put itself in a precarious position for tomorrow.

While industrials’ profit growth has outpaced the S&P 500 during the past four years, revenue growth has lagged. The profit growth will likely abate, particularly as emerging markets slow down, owing to their unsustainable growth pattern. That slowdown has already started happening in China, India, and Brazil, as these low-cost locations become less competitive.

Labor is also becoming a concern as selling, general, and administrative cost growth has been outpacing the growth of cost of goods sold. Labor costs have remained relatively stable thanks to companies working harder with what they have, but not because they are taking more effective approaches, such as investing in automation, that would ultimately lower labor costs.

Because nationwide unemployment has remained higher than what is typical at this point in an economic recovery cycle, wage pressures have been muted, allowing variable compensation structures to endure, but likely not for long.

As a result, industrials are confronting a rocky road ahead. Although it will vary by subsector and even by company, over the next few years, manufacturers face slower growth and potential wage inflation. The companies that survive—or actually thrive—will be those that have clear capabilities systems tied directly to cost structures that differentiate them from their competitors.

Readiness for Growth

When industrial companies address cost reductions without considering their strategic agendas, and vice versa, they do not achieve enduring performance improvements. Cost cutting alone is often a one-time or short-term exercise that is performed only for the sake of reducing costs immediately.

Instead, a company needs to look at its strategy, how it wants to play in the market, and how it wants to respond to its competitors. A company becomes ready for growth through strategic clarity, resource alignment, and supporting organizations. Armed with that information, it can make more informed decisions about cutting costs in places that are not driving its competitive advantage, directly enabling the growth agenda in a much more effective way.

In fact, when companies address the revenue and cost agenda holistically and simultaneously, they typically realize multiyear profit improvements. In Strategy&’s experience, companies that systematically realign industrial cost structures with their strategy typically see 20 to 25 percent cost reductions in addressed areas, freeing up investments to grow the top line.

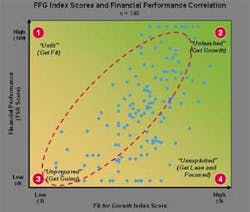

Strategy&’s Fit for Growth* Index, a quantitative measure of how prepared companies are for growth, discovered a consistent correlation between companies that tie cost structures to capabilities systems with total shareholder returns generated over an extended period, further confirming the importance of connecting a company’s cost and growth agendas (see graph ). In short, the market demonstrates that companies that systematically cut costs in order to free up funds for growth investment have long-term sustainable financial performance.

Steps Toward

Industrials can take several steps toward performance improvement by addressing growth agendas and cost reduction initiatives simultaneously. The first step is to reassess or reconfirm their strategy and how they compete in a way differentiated from that of competitors to win in the market. Companies should then identify and clearly articulate the specific capabilities that enable the differentiated “way to play” (i.e., how they deploy resources differently from competitors).

Once these are established, the company needs to design its operating model to optimize costs and enable growth. The company operating model defines how the business will run through four formal and four informal elements. The formal elements address decision rights, motivators, information, and structure, and the informal elements address norms, commitments, mind-sets, and networks. To design an operating model, companies must first reshape the cost structure by supporting the differentiating capabilities and trimming costs in other areas that do not drive the “way to play.” Next, they need to apply the same capability filter to their growth investments together with the traditional growth strategy elements of understanding the intrinsic elements of the market segment, such as size, trends, growth rates, and value creation potential.

If done correctly, funds from low-productivity investments and operating costs are freed up for investment in higher-value priorities. This also helps top management energize the organization by connecting the often dreaded cost measures with a positive outlook on growth.

Achieving Success

Undertaking a program that produces sustainable results should be at the top of the agenda for manufacturers. But executing appropriately on that program is key. Several factors can help ensure success.

A company’s goal should be to achieve sustainable competitive advantage by building enduring and differentiated capabilities that give it a unique and defensible right to win in the markets it serves. It must understand that this type of change could require rethinking the fundamentals of the current business system and explicitly invite different perspectives on how to transform the operating model. It should establish a program that is holistic and integrated, one that focuses on enterprise profit drivers by emphasizing revenue growth and cost efficiency.

Additionally, senior management must be driving the program while actively engaging functional and business unit leaders to design and implement its future direction, holding them responsible for communicating the program’s purpose and delivering results. They must establish clear milestones and targets, track progress, report results, and assign accountability.

As manufacturers face slower growth and potential wage inflation over the next few years, they must position themselves for profitable growth by tying cost structures to defined capabilities systems. The priorities most worthy of high levels of investment are those that align with the growth of the business, helping it build the capabilities that distinguish it from competitors. As companies move resources from nonessential to critical capabilities, they build competitive advantage that wins in the marketplace.

*Fit for Growth is a registered service mark of PwC Strategy& (US) Inc. in the United States.