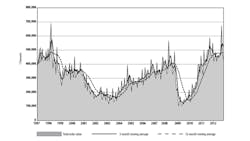

New orders for machine tools and related technology in the U.S. fell 26.6% from March to April, from a revised figure of $507.2 million to $372.50 million. The new figure also indicates a decline of 12.6% from the April 2012 result, $426.44 million.

The totals are reported by AMT - The Association For Manufacturing Technology, based on actual data for domestic and imported equipment and other products ordered by U.S. machine shops and other manufacturers participating in the U.S Manufacturing Technology Orders program.

The latest month’s result shows a 28.7% month-to-month drop for metal cutting equipment and components, but only a 1.2% month-to-month decline for metal forming and fabricating equipment and components.

Also, the April results bring the year-to-date total for machine tool orders to $1.65 billion, a 7% decline against the four-month total for 2012.

“Order totals leveled off to the averages we’ve seen so far this year, but they aren’t out of line with analyst predictions,” AMT president Douglas K. Woods observed.

“Likewise, the Purchasing Manager’s Index recently dropped below 50,” Woods continued, “indicating contraction within manufacturing – but hiring continued to expand throughout the industry. With auto sales strong, the housing industry showing signs of a true rebound, and consumer confidence on the rise, we expect to continue seeing steady but slower activity.”

Regional Results

In addition to the nationwide analysis, the USMTO report presents data for six geographic regions. In the Northeast new orders for manufacturing technology were essentially unchanging, totaling $72.29 million after the March result of $72.27 million. However, the new figure indicates a regional increase of 4.4% versus the April 2012 total.

For the first four months of 2013, the Northeast region has logged $251.08 million worth of new orders, a 4.0% decline versus the January-April 2012 period.

In the Southeast manufacturing technology orders dropped 3.3% from April to May, falling to $35.16 million in April from $36.37 million recorded for March. The region has year-to-date new orders totaling $139.10 million, 16.3% below the comparable figure for 2012.

The Southeast region’s year-to-date total of $139.10 million, 16.3% lower than the comparable figure for start of 2012.

The North Central-East region posted new orders totaling $71.3 million during April, a 50.9% fall-off from the figure recorded for March, $145.12 million; and a 34.6% decline from the year-ago result. For the first four months of 2013, the North Central-East region has had new orders totaling $434.94 million, down 2.8% compared with the same region for

The North Central-West region posted April new orders for manufacturing technology totaling $69.88 million. It’s a result that is 34.5% less than the comparable total for March, and 10.3% less than the total posted for April 2012.

The region’s 2013 year-to-date total is $330.6 million, or 2.6% above the total for January-April 2012.

The South Central region’s April total for new orders was $59.60 million, down by 10.8% from the March result, $66.85 million; and down 30.7% against the result for April 2012. From January through April, the region has accounted for $257.42 million in new orders, which is off by 28.3% compared with the four-month figure for 2012

Last, for the West region the April new orders totaled $64.27 million, off 19.6% from March’s result of $79.95 million. The January-April total for new orders in the West region is $238.30 million, a 9.1% increase versus the total for the first four months of 2012.