In my experience purchasing organizations don’t reflect enough on how their suppliers regard their strategies, at least on an individual basis. Over the years I have given a lot of thought to this issue and how it affected my ability to successfully manage suppliers in support of company goals. As part of this I made it a point to talk with executive-level people at several dozen key suppliers. The following charts and discussion summarize much of what they told me.

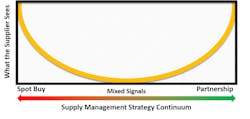

The charts try to categorize how an OEM customer is seen by an individual supplier, not by a supply chain in general. This seems a more appropriate way to look at things since individual supplier management is usually where the-rubber-meets-the-road. The format of the charts lays out the percentage of time suppliers see their OEM customer looking to work with them (along the y-axis) against a strategy spectrum (along the x-axis) from Spot Buy (leverage) to Partnership (collaboration).

-

Typical OEM Purchasing

This chart shows how the vast majority of OEMs are seen by their suppliers. While most of the time they feel they are treated somewhere on the middle of the strategy spectrum, there are instances when customer behaviors vary from the norm, sometimes applying more leverage (win-lose) as the primary modus operandi and other times looking to work more collaboratively with them (win-win) such that the size-of-the-pie can increase. The majority of the time, however, suppliers told me their customers applied a mixture of those two approaches depending—at least from the supplier’s perspective—on what side of the bed the individual buyer they were working with got up from that morning.

Is this all bad? Well, we all know that there are times when leverage needs to be applied. And there are times when collaboration is called for; however, the approach being used is usually not apparent in the Request for Quote. What is discouraging to suppliers whose customers operate this way is they can’t anticipate a consistent working relationship from their customer on any particular job.

-

Better OEM Purchasing

As hinted at in discussing the previous chart the suppliers I’ve talked to appreciate OEM customer consistency above almost everything else. Correspondingly, from their point-of-view, the strategy shown by this chart shows a better version than the Typical OEM Purchasing strategy. You’ll note that it looks a lot like the previous chart except that the strategy generally applied by the OEM is more tightly grouped somewhere—could be anywhere—along the supply management strategy continuum. Suppliers tell me that they can learn to work within the constructs of any customer management style as long as it is predictable. Why? Because predictability allows them to best align their proposals with their customers’ needs. And through this better alignment, they can provide their customers with a lower overall cost.

-

Worst OEM Purchasing

In direct contrast to the previous chart this one shows how an OEM customer without a consistent procurement strategy looks to a supplier. Suppliers working with customers that operate like this understand that for an individual job their proposals have an equal chance of being evaluated anywhere along the strategy spectrum.

Why do suppliers consider this a worst-case OEM purchasing strategy? To increase their chances of obtaining a job their bids have to plan for a Spot Buy scenario which means that suppliers can’t provide their customer with an optimal solution to actual needs. So things like supplier design support and/or targeted investment go out-the-window. You’d be surprised at how often suppliers have told me about customers that operate in this manner. A corresponding observation was made by the owner of a company we had done business with for years. He said that as long as OEMs continued to rotate people into and out of buyer positions as quickly as they seem to, this issue probably cannot be solved.

-

Schizophrenic OEM Purchasing

A number of suppliers told me that their customers treated them in a schizophrenic manner, either leveraging them to the max or trying to collaborate closely with them. Trying to bridge this gap accentuates the negative aspect of the previous Worst strategy since it puts suppliers in either a spot buy or collaboration position without knowing up-front which the customer wants. This means that the basis of how they put together a particular quote proposal will either be completely aligned or completely out-of-whack with what their customer is looking for. This is bad from the supplier perspective since it means that if they guess wrong they won’t be competitive and will have wasted their time in preparing it.

No one likes having to deal with a customer who operates in a bipolar manner. Because of this OEMs who act schizophrenic end up with fewer suppliers—at least the top-notch ones—who will work with them.

-

Leveraged OEM Purchasing

Many OEMs use leverage as their primary negotiating strategy. Believe it or not, this is ok with suppliers since they can choose first—whether or not to do business with this customer—and second, if they do decide to bid on a job they understand that their offer needs to be bare bones. Of course, there is always the situation where supplier firms resent being treated as commodity suppliers even when they are, in effect, supplying a commodity. All I can say about this is that the onus is always on the supplier to show their customers that what they offer has more value than just the parts provided. If they can’t do this and don’t like being leveraged, they should get out of the commodity business.

-

Collaborative OEM Purchasing

Collaborative strategies take more time and effort to manage and they may not make sense when the part being purchased is a commodity. However, as cited above, sometimes suppliers can make the case to customers that they provide higher value when they are treated as a partner. A good case in point here is the fastener product category. A generation ago, hardware was seen strictly as a commodity and consequently purchased solely on piece-price. And you could always get a better price on a fastener by re-sourcing to suppliers seeking to get-their foot in the door. Today, not so much. Most big companies sign up for a point-of-use fastener service, which minimizes overall supply chain waste and in doing so saves them money. This is definitely not a commodity buy although the actual parts in question are standard and available from a variety of sources.

Fasteners are a good example where an industry that once sold what was considered a strict commodity has raised its status to one where collaboration is the preferred OEM purchasing strategy. For a change like the above to occur, though, OEMs have to be open to trying it. So, OEMs whose preferred procurement strategy tends toward collaboration are usually the ones to whom suppliers present such business cases. Saying this in another way, these OEMs are the one who generally get a competitive jump on their more leverage-based competitors.

Overall Conclusions

So what would the best face be for an OEM to present to a supplier? Above all, suppliers want consistency. This is so they can better align their proposals with customer needs and select customers to work with who will best benefit from their strengths. Of course, OEMs tend to want collaborative-type levels of support while paying a commodity (bare bones) price. So how do you span this gap?

I am a long-time fan of smaller, privately held suppliers. Why? For many reasons, including that they:

- Tend to have more enthusiasm for satisfying the needs of their customers, i.e., trying new things out. This is what it takes to add to value over just the part delivered.

- Tend to also be more open-minded to collaborative relationships, i.e., it’s not always a one-way street. Smaller firms understand that for them to be financially healthy, their customers must be, too.

- Tend to have the kind of drive and product expertise that lead to breakthroughs in either design or processing that corporate suppliers don’t always exhibit. If you can’t trust that you won’t be taken advantage of by those you are working with, you likely won’t share improvement ideas.

On the other hand, there is a danger in having a supply-customer relationship where the customer is significantly bigger than their suppliers. Namely, this can put OEMs in a position to apply leverage which over time suppliers will learn to live with by cutting support.

OEMs need to determine which approach to supply management will best support their business. Those that focus solely on piece-price tend to focus on a leverage strategy as shown in Chart 5. Those that focus on total cost tend to focus on the collaborative strategy shown in Chart 6. In my experience the vast minority have taken the total cost approach which, by the way, is a basis for developing a lean-performing supply chain.

My next column will discuss how big corporations with company-sponsored health insurance have outsourced support for this benefit to the insurance companies themselves, and the effort this can have on employees. I’ll use a personal case in doing so.

About the Author

Paul Ericksen

Executive Level Consultant; IndustryWeek Supply Chain Advisor

Paul D. Ericksen has 40 years of experience in industry, primarily in supply management at two large original equipment manufacturers. At the second he was chief procurement officer. He then went on to head up a large multi-year supply chain flexibility initiative funded by the U.S. Department of Defense. He presently is an executive level consultant in both manufacturing and supply chain, counting Fortune 100 companies among his clientele. His articles on supply management issues have been published in Industrial Engineering, APICS, Purchasing Today, Target and other periodicals.