Effectively Managing Pricing Variability in B2B Companies

Senior executives across organizations have the strategic objective of reducing or eliminating unintended variation in their business, yet they often ignore variation in pricing. In the words of a Chief Operating Officer for a global manufacturing company, "today we accept a degree of variation in pricing that would get a plant manager fired...." When managed effectively, pricing variation has the potential to deliver significant profits to the bottom line and give companies the competitive advantage they need to succeed in today's markets.

To manage pricing variation, business-to-business (B2B) companies must understand its causes. Take an example of a typical B2B company with the following attributes:

- Has 20,000 SKUs (stock-keeping units)

- Products sold through four distinct channels

- Products sold to 30,000 customers across 30 industries

- Products sold in 30 countries across four regions

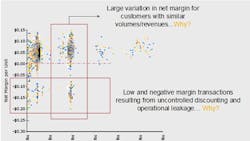

In combination with hundreds of pricing decision makers such as business unit leads, sales executives, and pricing managers, these attributes cause significant pricing variation. As illustrated in Figure 1, the outcome is large variation in margins for customers with similar characteristics, ultimately resulting in significantly lower margins.

Figure 1. Pricing variability at a typical B2B company.

Drivers of Variability

In a typical B2B company, many different factors drive pricing variability, including:

- Sales performance

- Analytic insight

- Process execution

1. Sales Performance

Consider a simple example: a manufacturer makes a sophisticated product that represents a critical component of an end customer's final products. Due to its value to the end customer and its importance, the product should command premium pricing. However, the manufacturer sales rep is not adequately trained to understand product value or articulate it to the end customer. In their negotiations with the end customer, rather than focusing on value-added differentiators, the sales rep focuses on competing in price with an inferior product that is priced significantly lower. A more informed sales rep would have approached the same situation differently by articulating the value and negotiating a higher price, ultimately delivering higher margins.

Another issue is lack of necessary price negotiation guidance at the point of sale. In the absence of well-conceived guidance, sales reps rely on their relationships with customers (regardless of the customer's value to the company) or instincts to negotiate a price that will help them win the deal at any cost. This can lead to substantial pricing variation with a strong negative impact on profits.

A well-communicated training plan that incorporates guidance at the point of negotiation can help create a more informed sales force that can articulate product or service value propositions more effectively, negotiate successfully, and deliver higher profits. It ultimately leads to more consistency in pricing and dramatically less variation.

2. Price and Margin Analytics Insight

To tackle pricing, companies must become more aware of pricing variation and where it exists. Typically, companies look at aggregate margin performance -- whether it is at the business unit level or regional level. Such analyses overlook critical areas of inconsistency in pricing. In a typical B2B negotiation, a company negotiates a broad range of terms including volume discounts, regional discounts, rebates, freight costs, and payment terms, among other items. A granular review of each of these items at a transaction level is the only way to uncover areas of variability and their underlying root causes. By identifying root causes, companies can undertake appropriate remedies to implement corrective actions.

Deep technology investments in CRM, ERP and Supply Chain systems allow companies to collect a rich and broad repository of data. When relevant pricing insights from such data is delivered effectively to the sales team, it can serve as a powerful capability to improve negotiation consistency. For example, if a sales rep is negotiating a deal with a customer, they should know the margins associated with the last 10 similar transactions. They should also know the customer purchase history -- in other words, is this a long-term customer with a deep relationship with the company or a non-strategic customer that is always shopping for the lowest price? Such insight can dramatically shape the negotiation dynamic and improve consistency of the outcome.

3. Pricing Process Execution

Without a comprehensive process to enforce compliance among sales teams and within organizations, pricing variability will continue. Sales teams can still have the power to make discretionary pricing decisions based on their instincts, but companies need to enforce parameters and best practices Pricing processes should not completely take away the freedom to negotiate, but rather define acceptable boundaries of variation that provide sales reps the necessary negotiation room while reducing pricing variability.

Take the example of a large manufacturing customer: in response to increasing raw material costs, the company implemented price increases across its product portfolio. Despite the list price increases, there was almost no change in the realized prices (final negotiated prices). Without effective enforcement mechanisms, the sales teams were discounting away price increases. Not only was the company facing higher raw material prices, but its inability to increase realized prices also resulted in a profit margin squeeze. Once the company implemented a solution with the right policies to improve compliance and communicated them to the sales team, it saw increases in realized prices and ultimately drove higher margins.

Low Hanging Fruit

Addressing pricing variability is a simple concept, yet powerful in its potential to deliver higher profits. Yet, few companies take advantage of this opportunity. In this article, we have just scratched the surface of different drivers of variability. Regardless of what these drivers are in your specific business, it is critical for you to identify them, develop a well-conceived plan to address them and execute effectively.

Tapan Bhatt is Senior Director of Marketing for Vendavo (www.vendavo.com), a global provider of price management and price optimization software for business-to-business companies.

Interested in information related to this topic? Subscribe to our weekly Value-chain eNewsletter.