Manufacturers Expect a Payback from Sustainable Supply Chains

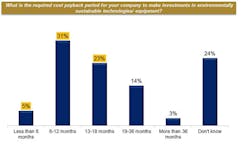

Sustainable supply chains are coming of age, based on survey responses from business leaders around the globe. What may be more interesting is why sustainability appears to have risen in corporate priority: Nearly 60% of respondents, according to a recent AlixPartners survey, expect a cost payback on sustainability-related investments within 18 months. In other words, many sustainability programs have grown from simply being “nice for the environment” to include “good for the bottom line.” This melding of “green” with accretive suggests that sustainable supply chains are winning the war for scarce capital and managerial attention.

Understanding the nature of some of these green and money-producing initiatives shed light on what underlies this movement. Top programs cited from respondents include, but are by no means limited to, such things as:

Mode conversion:truckload to intermodal; less-than-truckload (LTL) to truckload; airfreight to surface transport;

Energy reduction:reducing idling time; timer controlled lights; preventing speeding; improved insulation;

Alternative energy use:co-generation plants; diesel/compressed natural gas (CNG) convertible engines;

Materials recycling:corrugate compacting; reusable packaging;

Employing renewable energy sources:solar power; wind turbines;

Network optimization:reconfiguration to reduce distance traveled.

While few of the items on the preceding list are “new,” the relative role, level of maturity and prominence within the supply chain may be more current. By way of example, a class 8 truck at idle consuming $3.90/gallon diesel fuel may easily burn through one gallon per hour with needless emissions to the atmosphere. Even as diesel prices in the U.S. have moderated from a 2008 peak of $4.76 per gallon, fuel prices in general have outpaced most other controllable supply chain costs, creating a mutually beneficial movement to curb avoidable use. It is therefore no surprise that 72% of global respondents in our survey (and 88% of European respondents) affirmed the existence of a corporate policy or set of objectives regarding environmental sustainability.

The Nature of Green Initiatives

The record low cost of natural gas in the U.S. has created some unique opportunities as well. Site-specific co-generation power sources operating on natural gas can substantially reduce greenhouse gas emissions and provide an economically advantageous alternative to power from the traditional electrical grid—as well as provide redundancy in case of power interruption. The economic cases can include the option to lease the power conversion equipment, thus avoiding a capital investment. Some government agencies have added financial inducements to encourage the use of these environmentally-friendly technologies.

The “cold chain” (chilled and frozen food distribution) provides another excellent example of high-impact sustainability application. Energy is one of the major expenses to maintain adequately cold environments during inhospitable hot months in many regions of the world. Improved insulation is a common and in most cases necessary step to moderate energy consumption. However, the operating circumstances of many cold warehouses have to accommodate constant traffic of fork trucks, pallet jacks and foot traffic into and out of climatized areas.

The standard for passageway insulation in many sites has been a curtain of vertically slit plastic running to the floor. The obvious benefits of this approach are that it: is inexpensive to install; requires little or no automation; provides visibility to oncoming traffic; allows foot and fork truck traffic; and is relatively easy to repair. The major disadvantage is that it provides a relatively poor thermal barrier between the climatized zone and the surrounding ambient environment, resulting in avoidable energy consumption.

The market has responded with high-speed insulated doors – many of which are triggered by proximity sensors. These doors provide far better insulation without degrading the ease and speed of entry.

In the not-too-distant past, such innovations would be considered a novelty and might be installed by the lucky site manager with funds left over in his or her capital budget for the fiscal year. Increasingly, these and many other sustainability-related investments are taking shape as capital authorization requests that justify the investments based on a defensible financial business case. Environmental improvements and proof to customers of undertaking sustainability programs are collateral benefits.

Sustainable Sourcing Strategies

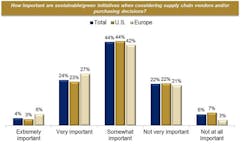

Supply chains are, by definition, an interlinked network of trading partners. Therefore, it comes as no surprise that sustainability is impacting sourcing choices. Nearly three-quarters of overall respondents consider sustainability as at least “somewhat important” in purchasing decisions. We view this as a critical catalyst in the propagation and advancement of sustainable initiatives.

If launching green programs for the sake of the environment coupled with financial returns prove inadequate, customer mandates become a very compelling factor. One-third of respondents acknowledged a willingness to pay a modest premium (single-digit percentages) to their sustainable suppliers, suggesting that suppliers’ money-saving and environmentally-friendly programs may help their top lines, too.

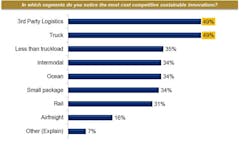

Third-party logistics providers (3PLs) and common truckload carriers are leading the pack for sustainability innovations, according to respondents. Given the competitive market in which 3PLs and truckload carriers compete, it follows that sustainability serves as both a means to contain operating costs as well as to positively differentiate in the marketplace. Providers are not disillusioned: 84% in our survey believe lower costs trump being environmentally-friendly in the final equation.

What do we make of this seeming contradiction where one-third of respondents are prepared to pay a premium to green suppliers and four-fifths of respondents think that cost competitiveness is what matters most to customers? This is perfectly logical given the overlap of sustainable business practices with simultaneous cost-savings. Perhaps the only real question is how much and how long a provider can retain sustainability-related savings before passing it along in the channel.

Between these survey results, one-on-one briefings with respondents, and sustainability-related supply chain engagements, we expect rapid and continued growth of initiatives that are jointly environmentally-friendly and financially compelling. The extent to which customers evaluate a prospective supplier’s “green-ness” in the purchasing process could dramatically accelerate the pace of this movement.

We are particularly encouraged by the one-third of respondents prepared to financially reward green suppliers. We also expect growth of supporting providers as well. Co-generation operators, dual-fuel equipment makers/installers, and other businesses whose products or services support sustainability will directly benefit from green expansion. We all stand to benefit from sustainability programs. The fact that the same programs improve bottom-line results make them all the more likely to be undertaken in the first place.

Foster Finley is managing director & co-leader of Supply Chain Practice, AlixPartners. He has over 27 years of industry and consulting experience. Prior to joining AlixPartners, he spent 13 years leading and executing operational consulting assignments at A.T. Kearney and Deloitte Consulting. He also spent seven years running manufacturing operations for Rockwell Automation (formerly Allen-Bradley Co.) in Milwaukee, Wis.