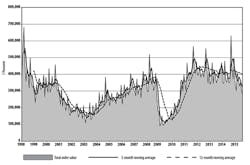

U.S. manufacturers’ new orders of machine tools fell 10.2% from July to August, settling at $285.92 million for the month. The discouraging result — which is drawn from the U.S. Manufacturing Technology Orders Report, issued each month by AMT – the Association for Manufacturing Technology — represents a 21.2% drop from the new-orders total for August 2014, and brings the year-to-date total for manufacturing technology orders to $2.77 billion, a decline of 10.0% compared to the eight-month order total for 2014.

It also is the second consecutive monthly decline in new orders, and the sixth monthly decline for 2015. August’s total represents the lowest monthly value for new orders of the current year, and the lowest since the recent peak in new orders, set during September 2014. More particularly, the August total represents the lowest monthly figure for machine units 2015 – at 1,747 it is just one less than the total for January 2015.

The USMTO is based on actual data provided by companies participating in the USMTO program, who produce and distribute metal cutting and metal-forming and –fabricating equipment, including domestically manufactured and imported equipment.

The report is based on actual values for new orders, and the results are presented as nationwide totals and as totals for six regions of the U.S.

“While there is a sense of unease in manufacturing now, as indicated by this reduction in orders combined with drops in the PMI and industrial production, some leveling after a period of strong growth is expected and helps build stable, longer-term growth,” observed AMT president Douglas K. Woods.

“We are a diversified industry, and pockets of manufacturing continue to show resilience, such as automotive stamping and medical devices,” Woods assured. “While there is some cause for caution, we do not anticipate more than ‘market flatness’ into the early part of 2016.”

A full report on nationwide and regional machine tool orders is available at IW's affiliate site, AmericanMachinist.com

About the Author

Robert Brooks

Content Director

Robert Brooks has been a business-to-business reporter, writer, editor, and columnist for more than 20 years, specializing in the primary metal and basic manufacturing industries. His work has covered a wide range of topics, including process technology, resource development, material selection, product design, workforce development, and industrial market strategies, among others. Currently, he specializes in subjects related to metal component and product design, development, and manufacturing — including castings, forgings, machined parts, and fabrications.

Brooks is a graduate of Kenyon College (B.A. English, Political Science) and Emory University (M.A. English.)