The Competitive Edge: The Big, Smelly Elephant in the Room

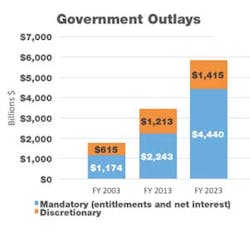

Don’t look now, but government is shrinking, at least the discretionary income part. You’d never know it from the growth in federal outlays in recent years -- from $3.45 trillion in 2013 to a new nominal record of $3.65 trillion in 2014 and a projected $3.9 trillion in 2015. And yet while the pie is growing, over the coming decade most federal agencies will be forced to compete for bites of a diminishing slice of it.

It’s Getting Crowded in Here

Why? According to the Congressional Budget Office, while mandatory outlays in this year’s federal budget -- primarily Social Security, Medicare and Medicaid -- account for about two-thirds of all federal spending, by 2023 they will account for 76%. Simple arithmetic tells us, conversely, that the portion of discretionary programs -- including the National Institutes of Health, National Weather Service, FBI and even Defense Department -- will decline from 35% to 24% of the total budget. In other words, like kudzu in a garden, the mandatory portion of federal outlays is crowding out other national priorities and challenges.

As economic writer Robert Samuelson observed, “Government is being slowly transformed into a vast old-age home, with everything else devalued and degraded.” And no wonder: according to the Pew Research Center, about 10,000 baby boomers will reach age 65 every day through 2030. Social Security touches 57 million people today -- more than any other federal program (Medicare covers a mere 50 million) -- and is expected to grow by 1.5 million per year for the next decade.

Running on Empty

But even as Social Security obligations grow as a proportion of total federal outlays, the system is running out of money. So is Medicare. The most recent annual report of the Social Security and Medicare Boards of Trustees stated bluntly, “Neither Medicare nor Social Security can sustain projected long-run programs in full under currently scheduled financing, and legislative changes are necessary to avoid disruptive consequences for beneficiaries and taxpayers.” By 2033, Social Security reserves will be depleted and, while the trustees will be able to tap into tax revenue, they’ll legally be able to pay only 75 cents for every dollar of scheduled benefits. Medicare’s trust fund is expected to be exhausted almost a decade earlier.

This is surely a crisis, or at least one in the making. And yet another congressional term has come and (for all intents and purposes) gone with no attempt to face this challenge. With national elections looming this fall, legislators are dancing away from the most pressing issues to avoid providing political adversaries any ammunition. And no issue provides more fodder for both political parties than entitlement reform. No wonder it’s been called the “third rail of American politics.”

Serious Long-Term Risks

Despite the dearth of action by our national leaders, the growth of mandatory spending and the dire condition of the trust funds pose serious long-term risks to this country’s economy, particularly the financial security of younger generations. That’s why U.S. Chamber of Commerce boss Tom Donohue has taken to calling it “the big, smelly elephant in the room.” Lawmakers know that future needs are being sacrificed to shield entitlement programs that are on an unsustainable growth path. They also know that the only ways to stop the inevitable -- mandatory program expenses eventually crowding out other types of federal spending -- are to find a way to reduce expenses, raise revenues, or both.

As the Chamber’s Donohue, NAM’s Jay Timmons, and other brave souls -- very few of them elected officials -- have stated, we desperately need reform.

What legislative changes might be considered? Some could be relatively benign, such as means testing (for example, limiting benefits to those making less than $500,000). In addition, as people work and live longer, slowly increasing the retirement age to keep up with contemporary trends in longevity would make sense. Other proposals will prove more politically difficult, such as changing the benefit formula, raising payroll taxes, and raising the cap on taxable wage income.

Taking action now can save future resources. As CBO Director Doug Elmendorf has noted, the longer we wait to make changes, “the larger the changes need to be and the more abruptly they would need to take effect.”

About the Author

Stephen Gold

President and Chief Executive Officer, Manufacturers Alliance

Stephen Gold is president and CEO of Manufacturers Alliance. Previously, Gold served as senior vice president of operations for the National Electrical Manufacturers Association (NEMA) where he provided management oversight of the trade association’s 50 business units, member recruitment and retention, international operations, business development, and meeting planning. In addition, he was the staff lead for the Board-level Section Affairs Committee and Strategic Initiatives Committee.

Gold has an extensive background in business-related organizations and has represented U.S. manufacturers for much of his career. Prior to his work at NEMA, Gold spent five years at the National Association of Manufacturers (NAM), serving as vice president of allied associations and executive director of the Council of Manufacturing Associations. During his tenure he helped launch NAM’s Campaign for the Future of U.S. Manufacturing and served as executive director of the Coalition for the Future of U.S. Manufacturing.

Before joining NAM, Gold practiced law in Washington, D.C., at the former firm of Collier Shannon Scott, where he specialized in regulatory law, working in the consumer product safety practice group and on energy and environmental issues in the government relations practice group.

Gold has also served as associate director/communications director at the Tax Foundation in Washington and as director of public policy at Citizens for a Sound Economy, a free-market advocacy group. He began his career in Washington as a lobbyist for the Grocery Manufacturers of America and in the 1980s served in the communications department of Chief Justice Warren Burger’s Commission on the Bicentennial of the U.S. Constitution.

Gold holds a Juris Doctor (cum laude) from George Mason University School of Law, a master of arts degree in history from George Washington University, and a bachelor of science degree (magna cum laude) in history from Arizona State University. He is a Certified Association Executive (CAE).