The Panama Canal Expansion is a Boon for Shippers…For All the Wrong Reasons

When the expansion of the Panama Canal was first proposed by then-Panamanian President Martin Torrijos, the rationale made business and trade sense. The China to U.S. West Coast flow of goods was booming and well established. Any expansion to handle more volume and larger ships was welcome news to both shippers and carriers.

The formal start of the project in September 2007 led to a mini-boom in projects by East Coast ports to expand capacity to handle Post-Panamax ships (ships larger than the maximum width of the “old” Panama Canal.) That was expected. But then a number of unexpected developments occurred that will change the shipping industry forever.

These developments are a boon for shippers and the ocean freight industry—for reasons I’m sure the backers of the Panama Canal expansion did not anticipate. As a result, I will argue that the announcement of the project’s completion will land with more of a thud, than the fanfare many might expect. Here are just a few of the most important developments:

Carriers Moved on….Quickly

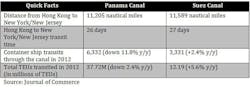

The ocean shipping market has always run on tight margins and periods of deep losses, but the Great Recession inflicted serious damage on the industry just when lots of new capacity was coming on line. To respond, carriers have moved quickly to deploy much larger vessels (larger than the expanded Panama canal can accommodate) and run them at slower speeds (less fuel burned) through the Suez Canal—in fact, container volume, measured in TEU’s was up 6% in 2012 through the Suez while Panama Canal volume was down 2.4%. The carrier strategy of “slow steaming and super-slow steaming” was born.

Investment in Port Expansions Ironically Supporting Suez Canal Traffic

The draft dredging projects in places like Norfolk, Savannah, Charleston, and bridge-raising in New Jersey will eventually support ever-larger Post-Panamax ships. But for now, they are receiving even larger vessels coming through the Suez Canal and encouraging more volume to flow through that trade route.

New, More Competitive Asian Trade Routes

As Chinese labor inflation continued over the last decade, global companies have moved more capacity to non-China hubs like Indonesia, India, Thailand and Viet Nam. Trade volume from those new Southeast Asian hubs to the Eastern U.S. is making the already competitive Suez journey even more competitive, shaving 4-6 days off of the China to Eastern U.S. Route. This provides manufacturers with more sourcing options, and potentially lower logistics costs due to the shorter journey. The more volume that flows over this new trade route, the more entrenched—and competitive—this trade route becomes, taking some potential post-Panama expansion volume with it.

Future Port Investments Could Make the Suez Route Even More Attractive

To capitalize on the increasing volume through the Suez route and to handle super-sized ships, there are two very large dedicated intermodal port facilities proposed in Northeastern Canada. These planned deep-water facilities would be purpose-built for the largest ships, and rapid unloading, vessel-to-vessel transfers, and intermodal connections, allowing the largest vessels to service the northeast U.S. markets whose ports are too small or too shallow to accommodate these ships. Oh, and these ports make the Suez journey one day shorter: good for carriers and shipping rates.

What does it all mean?

A number of factors have come together to form a near-perfect storm that has made the Suez Canal route far more competitive—and creating a dynamic that backers of the Panama expansion project likely never envisioned. However, the most recent turmoil in the Middle East remains a concern for shippers.

Therefore, shippers have a number of new options. The Suez route opens up new sources of supply; shippers have already started to diversify away from over-reliance on the Western U.S. ports that have been subject to major labor disruptions in the past several years. Keep in mind that the next ILWU agreement comes up for renewal in mid-2014, so be prepared for potential fireworks and supply chain hiccups around that event.

Meanwhile the growth of Canada and Mexico as viable ports of entry to the U.S. market, and the growth of the Suez Canal routes for very large ships to the east coast creates another point of competition for the ILWU and more options for shippers (the new 6-year labor agreements covering east coast ports makes them all the more attractive for the near to medium term).

When the expanded Panama Canal does open up for business, it will add yet another option for shippers to utilize, but as I’ve described, many carriers have moved beyond the Panama Canal and the Suez is at the top of their agenda. These industry changes that were at first borne of necessity may become permanent. Then, of course, it’s not all roses. You have to factor in the reality of a shrinking U.S. Naval Force that currently ensures safe Suez Canal passage, combined with an elevated level of hostility in neighboring countries.

All in all, we’re at the dawn of a new era for ocean freight, with expanded options for shippers, and the potential for new supply chain flows. It’s not that the new Panama Canal is a non-event, but companies need to look at a variety of new options already, and they aren’t waiting for the new Panama Canal. They are taking advantage of the fruits of the investments that have already been made to support the new normal in global ocean trade.

Ed Sands is the Global Logistics Practice Leader at Procurian, a provider of the leading procurement solutions.