The Economic Case for Recycled Plastics Is Improving

It feels safe to say that most forward-thinking brands and manufacturers agree a circular economy for plastics is a shared goal. Most brands have publicly committed to creating recyclable products and replacing virgin plastic with recycled plastic by 2025-2030.

Progress against those commitments has been slow, however. Brands continue to report that they can’t find the recycled materials they need to hit their goals. Why is that? What’s happening in the plastics industry? What does it mean for manufacturers?

Headwinds

Industry analysts cite key headwinds facing plastic circularity:

- A lack of infrastructure to collect, sort and recycle higher volumes of quality recyclates

- Unattractive economics to stimulate both demand/supply and solutions to #1

Bill Gates calls the core issue a “Green Premium” – when the environmentally preferred option costs more than the unsustainable option. Post-consumer resin (PCR) has historically been more expensive than virgin plastic resin, dampening demand, yet plastic recovery has been largely unprofitable, suppressing supply. It’s become a vicious cycle: the material we need to create circularity in plastic manufacturing is out there in our waste streams, but it’s been too expensive to reclaim, and too hard to source at scale consistently. When the fundamental economics don’t work, it’s unlikely circularity will prevail.

But that is changing.

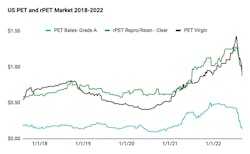

OPIS Data as of 9.8.22

This chart details the story of one of the major US PCR markets over the past 5 years, polyethylene terephthalate or PET, and recycled PET or rPET.

In 2018, China stopped importing the equivalent of 2 billion tons of plastic trash per year. Overnight, the world realized the size and impact of our global waste issue. From 2019 to 2021, brands committed to circularity goals and governments created policies to reduce virgin plastic. A good start, but those green premiums persisted, dampening both demand and supply.

In the last 12 months, demand pressure for rPET and other PCRs pushed prices up, making waste recovery profitable. Following that, we saw significant supply-side investments in collections, sortation and processing capacity. The upward price trend eventually created an unacceptable green premium for most buyers (manufacturers) however, ultimately softening demand as global macroeconomic issues impacted consumer projections. Prices now show a rare buy opportunity, stimulating demand again.

This is the same kind of economic story you will find in any emerging illiquid market. What’s news here is that the historically ever-present green premiums are trending to zero: waste recovery and recycling will be profitable, and PCR will be more cost-effective to manufacturers (and of higher quality) over time.

Tailwinds

Here’s what we see happening in the PCR markets now and in the near future:

Supply

- Packaging norms are changing toward sustainable recyclable designs, ultimately increasing higher quality “circular” supply. For example, in March 2022, Colgate introduced fully recyclable toothpaste tubes and open-sourced their designs.

- Waste collection, recovery and recycling are becoming more economically attractive. Large companies like Republic Services, WM and KW Plastics expanded and invested in new capacity, increasing supply volume and quality.

- Tech start-ups are entering the market with higher frequency—applying hardware and software to help solve sortation and contamination challenges, increasing supply volume and quality/consistency.

Demand

- PCR demand continues to increase as oil becomes more expensive, unstable and undesirable.

- Buyers see PCR at parity with virgin plastic and create long-term contracts (stimulating more supply) and demonstrating to lagging brands how to source sustainably.

- New digital marketplaces are creating opportunities for buyers and sellers to find supply and trade more easily than in the analog past.

These positive trends are likely to build momentum and continue to push those green premiums closer to zero.

Just follow the money to see what’s coming: from an investor’s standpoint, the global plastics market holds huge potential at over $600 billion and 5% compound annual growth rate. It’s an essential industry in the middle of a sustainable evolution: Consumer trends are driving demand and supply changes toward recycled and environmentally preferred alternatives.

Technology will help increase efficiencies and reduce costs throughout the value chains of all major manufacturers. We’ve seen those same trends and forces in other industries already (electric vehicles, solar power, travel, media, etc.) and the results are inevitable, even if the timeline is unpredictable. So, despite the seeming lack of progress against circularity commitments, we are seeing positive foundational trends and the beginning of a new, more liquid tech-enabled PCR era in 2023.

The key is the decline in green premiums stimulating increased investments throughout the value chain as recycling becomes economically attractive. Digital-trading platforms and real-time data can help make markets more accessible, transparent and liquid, too. With economic opportunities come investment, innovation, and positive change. This is capitalism at work--economic opportunity ultimately creating circular solutions.

Practical Advice

During any evolutionary phase, we can expect significant volatility and opportunities for manufacturers to capitalize on now. Every CEO, COO, CFO, supply-chain procurement professional and product engineer benefits from thinking two steps ahead of market trends.

Consider this story of one high-growth food brand:

Brand executives committed to transition to 100% PCR packaging to align with their healthy premium brand positioning and get ahead of market trends.

They hired packaging and sourcing leaders with experience in recycled packaging (vs. virgin) and created a company goal to align and incentivize cross-functional teams. They required their co-manufacturer to help them meet their goals, and on budget—theywouldn’t take no for an answer. The co-manufacturer helped source and set up testing and sustainable supplier approval processes to create diversity and competition.T hey engaged digital trading and supply chain platforms using their buying power to help stimulate attractive supplier partnership opportunities.

Multiple suppliers adapted to their process and product specs. At each step, they learn and become more agile, changing product design, budgets, and suppliers and shortening sales, testing and production cycles along the way.

Bottom Line? Their process will take 3+ years, and they are on track to hit their 2025 goals.

Of note, when this brand started their journey, PCR prices were >40% higher than virgin and of such variable quality they couldn’t rely on it in production. No obvious solution presented itself. They only made progress by committing to the long-term direction, then testing, learning, and iterating. Now they are in a position to differentiate themselves in the market and maintain positive margins as they grow.Ian Arthurs is founder and CEO, Circular.