Ending the federal ban on crude oil exports would offer a significant boost to the U.S. manufacturing sector and the broader American economy, according to a new study from the MAPI Foundation and the Aspen Institute.

The study examined two scenarios – a low-export version in which the U.S exports 2 million barrels per day of oil and a high export case which leads to an increase of 3.25 million barrels per day in 2025.

When Congress passed legislation in 1973 to ban crude oil exports, the U.S. was suffering from the Arab oil embargo and legislators sought to preserve domestic oil supplies. Over the ensuing decades, the U.S. continually increased its consumption of foreign oil. By 2008, the U.S. imported two-thirds of the oil it needed.

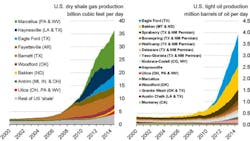

But since then, the revolution in U.S. oil production from fracking and horizontal drilling has quickly made the U.S. a leading producer of oil and natural gas.

“In July, production of oil was 3.5 million barrels a day greater than it was in January 2008,” noted Don Norman, an economist with MAPI and the study’s co-author.

According to the study, based on an econometric model conducted by Inforum at the University of Maryland, lifting the export ban would provide the following economic benefits:

- GDP increases 0.93%, or approximately $165 billion, in 2019-2021, and levels off at 0.74%, or about $141 billion, in 2025

- Some 650,000 jobs would be added at peak in 2019

- Real household income would increase by $2,000 to $3,000 per household in 2025, an increase of 2.2%.

As oil production ramped up, manufacturing would benefit from the increased need for pipeline supplies, machinery and other products. The study estimates that:

- Production of durable goods and materials would increase 1.4%, or $8 billion, by 2017. Mining and construction equipment would grow by 6%, or $6 billion, by 2017.

- Manufacturing would grow an average of 37,000 per year through 2025. Construction jobs would grow by over 217,000 in the peak year 2017, and related professional jobs would grow by an average of 148,000 per year.

- Capital investment in machinery for exploration and development would grow to $7 billion in 2020.

At a press conference announcing the study, Norman said it made sense to export the light oils produced from shale to markets such as Europe. U.S. refineries are set up principally to process heavier crudes and converting them for light oils would be prohibitively expensive.

“It makes sense to export lighter oil to markets where it is more highly valued because it can command a premium price,” he said. “This will provide additional incentive for U.S. producers to develop domestic resources.”

About the Author

Steve Minter

Steve Minter, Executive Editor

Focus: Leadership, Global Economy, Energy

Call: 216-931-9281

Follow on Twitter: @SgMinterIW

An award-winning editor, Executive Editor Steve Minter covers leadership, global economic and trade issues and energy, tackling subject matter ranging from CEO profiles and leadership theories to economic trends and energy policy. As well, he supervises content development for editorial products including the magazine, IndustryWeek.com, research and information products, and conferences.

Before joining the IW staff, Steve was publisher and editorial director of Penton Media’s EHS Today, where he was instrumental in the development of the Champions of Safety and America’s Safest Companies recognition programs.

Steve received his B.A. in English from Oberlin College. He is married and has two adult children.