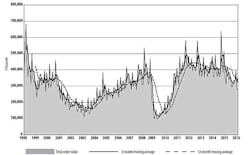

U.S. machine shops and other manufacturers ordered $270.9 million worth of new machine tools during February, a decline of 5.1% from the January total and of 12.8% from February 2015. The new result brings year-to-date new orders to $556.43 million, or 16.3% less than the comparable result for January-February 2015.

The figures are drawn from the latest edition of the U.S. Manufacturing Technology Orders report (USMTO), a monthly summary presented by AMT – the Association for Manufacturing Technology. USMTO summarizes actual totals for machine tool orders reported by participating companies that produce and distribute metal-cutting and metal-forming and –fabricating equipment, including domestically manufactured and imported machinery and equipment. USMTO is an indicator of capital investment (not manufacturing activity), reflecting manufacturers’ confidence in current and developing economic conditions.

AMT observed that the February results, the second-consecutive decline in new orders, and the fourth decline in the previous six months, reflects the U.S. manufacturing sector contending with the effects of a strong currency and weak global demand. However, the Institute for Supply Management’s Purchasing Managers’ Index (PMI) improved during February for the first time since July 2015, suggesting changing conditions on the demand side of the industrial economy. AMT also offered that rising commodity prices (among other indicators) hint at improving conditions for some U.S. industrial sectors, citing mining, construction, and agriculture.

AMT also pointed to improvements in European and Japanese industrial activity: Europe’s PMI readings also showed moderate growth, it noted, and many Japanese manufacturers frequently record improved order activity at the end of their fiscal year.

However, the group also acknowledged that the Chinese economy continues to show weakness, along with other emerging economies.

“We’ve seen some better news about manufacturing, especially for the domestic market, but the industry will continue to face a number of economic challenges through much of the year,” commented AMT president Douglas K. Woods. “Our members are reporting more quotation activity for their products and equipment and we expect an expanded market for manufacturing technology towards the fourth quarter.”

Woods continued: “Additionally, a recent surge in housing starts is anticipated to give a boost to consumer spending, and the March PMI showed expansion in the manufacturing sector for the first time in six months.”

American Machinist is an IndustryWeek companion site within Penton's Manufacturing & Supply Chain Group.

About the Author

Robert Brooks

Content Director

Robert Brooks has been a business-to-business reporter, writer, editor, and columnist for more than 20 years, specializing in the primary metal and basic manufacturing industries. His work has covered a wide range of topics, including process technology, resource development, material selection, product design, workforce development, and industrial market strategies, among others. Currently, he specializes in subjects related to metal component and product design, development, and manufacturing — including castings, forgings, machined parts, and fabrications.

Brooks is a graduate of Kenyon College (B.A. English, Political Science) and Emory University (M.A. English.)