Lear Corp.'s Competitive Advantage Drives It Forward

How did Lear Corp. a global supplier of automotive seating and electrical and electronic systems, rise to number seven on the 2018 Industry Week 50 Best U.S Manufacturers, from a rank of 19 in 2017?

First a little about the company. Lear, which was founded in Detroit in 1917, is one of the world's leading suppliers of automotive seating systems and electrical systems (E-Systems). Its content can be found on every major automaker in the world, and more than 400 vehicle nameplates. The company employs 165,000 employees located in 39 countries.

The financial performance that earned that a top place on this year's IW 50 Best US Manufacturing was strong. Perhaps the most compelling was that from 2016 to 2017 revenue grew 10.29%

And 2018 seems to be no different. Growth has led them to open the first auto supply plant in Flint in 30 years. The company,'s CEO, Ray Scott, has a special tie to the Flint location. "I was born in Flint and have a long history with this location,” explains Scott in a video last year talking about the company’s decision to build in Flint. “Both my Mom and Dad worked for Buick and during college, I worked at the unit flow through the terminal which was a sequencer to Buick City. Ironically, we are now putting up a JIT facility to service Truck and Bus (GM), where I worked as well.”

The plant, which will produce seats for General Motors Co.'s assembly plants in Flint and Orion, Mich. is also operating under a new management style which calls for members of the line, instead of salaried superiors, to manage many aspects of their teams, from hiring to providing quality assurance to supporting their peers. The plant will be a zero waste to landfill.

This plant will bolster the company's standing in the competitive auto landscape. But competition doesn't seem to be an issue for the company according to analyst, Raul Shah, of Seeking Alpha. “Lear has many competitive advantages which will enable them to win new business, produce higher profits, and enter an era of great growth. As a result, shareholders can sit back and reap the benefits of a wonderful company,” he wrote in an article on the company.

Forbes too is singing the praises of this company. Based on the company’s stock price gaining 16% since the beginning of 2018, Forbes predicts continued growth. “We expect the company to gain further momentum given its strong presence in the seating segment and the global shift towards energy efficient and connected vehicles. We expect Lear’s top line to grow at a CAGR of 8% over the next two years.”

In the seats systems assembly market, the company holds the second largest market. And with the recent acquisition of Grupo Antolin’s automotive seating, which has a strong business in Europe, this business will continue to grow.

Another area of growth for the company is based on consumer demand that has returned to SUVs. In this product line, it's estimated that Lear’s content per SUV is estimated at $1,000 as against the $700 average content per vehicle.

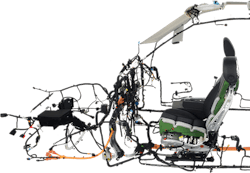

Lear's E-Systems is a particularly bright spot as the company expects the electrical content, which addressed the connectivity required in autos, will be higher than the overall industry growth rate by almost 5%.

While third-quarter sales were down slightly, 2%, from last year Scott remains optimistic. In the third quarter report issued on Oct. 25, Scott explained the company's success. “We again delivered strong sales and earnings results in the third quarter in the face of challenging macroeconomic conditions marked by significant volume declines, particularly in China and Europe, as well as foreign exchange volatility.

The company's success, according to Scott, is based on five key drivers:

- Resilient business model and strong balance sheet

- Powerful growth drivers

- Strategically positioned in electrification, connectivity and shared mobility

- Accelerating innovation, including in software and data

- Capital allocation strategy engineered to maximize long-term shareholder value

"We have continued to demonstrate our strong execution capabilities, and we remain excited about the opportunities that lie ahead. We will continue to focus on investing in profitable growth, further improving operational efficiencies and delivering superior value for our shareholders,” said Scott.