A Strategic Look at Thailand

Having toured industrial estates, a research center, a deep sea port, logistic and IT companies, I turned to three Deloitte Touché Tohmatsu partners based in Thailand, to help put into perspective both the challenges and opportunities that the country is facing.

Nuanjai Gittisriboongul, Cameron Mccullough, and Stuart Simons provided background information as well as some perspective on the country’s strategic plans.

One of the overall economic concerns Thailand faces is that they are in a “middle income trap.” A middle-income trap occurs when a country is successful in lifting its economy from the status of being a low-income country to a middle-income one but remains at that level without much prospect of becoming an advanced, rich country.

In an article 'Thailand in a Middle-income Trap', author Somchai Jitsuchon, the research director for Inclusive Development, Macroeconomic Policy Program, at Thailand Development Research Institute, explains that Thailand fell in to this trap since it “continues to depend on the same model of development that lifted it out of poverty—cheap labor, and low innovation, with technological acquisition mainly through technology importation.”

When I asked Deloitte about Thailand’s chances for moving out of this, they were optimistic. They explained that the government does have policies in place to go after high value manufacturing. The government understands the pressure they face from nearby ASEAN competitors.

In fact in June 2013, The Board of Investment (BOI), a government agency, plans to actively “promote a good balance between economic growth and social and environmental development, as well as a balance between the agricultural, industrial and service sectors.”

In addition to balance the BOI is focusing on targeted sectors that are “related to future global trends, such as alternative energy, biotechnology and high-value-added services.” The BOI will offer additional incentives for research and development, human resource training and environmental protection.

Implementing policies of targeted growth within an economy that is predicted to see substantial growth should help ensure success. In fact the 2013 Global Manufacturing Competitiveness Index Report prepared by Deloitte‘s Global Manufacturing Industry group and the Council on Competitiveness ranks Thailand 11th in 2012 in terms of competitiveness, while the IMF is predicting Thailand will grow by 7.5 % this year.

Part of this growth will come from more foreign direct investment, which is another facet of Thailand’s strategy. The country is ranked as the11th best destination for foreign direct investment in the world.

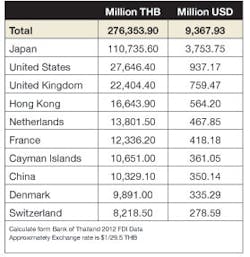

In 2012, foreign direct investment in Thailand was $9.4. billion. The top two investors were Japan at $3. 8 billion and the U.S. at 937 million.

The table below provides the rest of the top ten investors.

While U.S. investment in Thailand rose 13% in 2011, and is an important source, the government is being careful to make sure they are diverse in terms of sources of investment, not wanting to rely solely on a couple of countries.

A strong source of future investment will come from the ASEAN nations due to its tremendous growth potential. By 2020 this economy will double, according to IHS from $2 trillion in 2012 to $4.7 trillion by 2020.

Optimism seems to abound when discussing Thailand’s manufacturing sector. Companies operating there cite its business-friendly climate, coupled with a large supply chain, backed up by a geographical advantage and supported by a network of incentives, as factors that will enable Thailand to remain an important player on the manufacturing stage.

For more on Thailand's manufacturing industry growth, click here.