Thriving after the Chaos

“My barn having burned down, I can now see the moon.”

― Mizuta Masahide (17th century Japanese poet and samurai)

The year of 2020 has already presented a century’s worth of disruption in its first six months with a pandemic, market crash, depression-like unemployment, and national protests. In late 2019, at the end of the longest period of continuous economic expansion in U.S. history, most industrial manufacturers ranked problems of rising cost pressures, labor scarcity and meeting escalating customer demand as top issues. As the summer of 2020 emerges, leaders face existential decisions about moves they must make today to thrive in tomorrow’s post-crisis landscape.

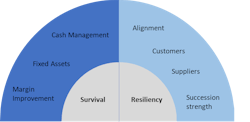

Successfully managing through the turbulent times should include both short-term cash management for survival and addressing broader resiliency issues to ensure business viability on the other side (Exhibit 1).

Exhibit 1: This playbook calls for both defense and offense.

Part I: Survival

Recessions are opportune times to be aggressive in making forward progress for your business. But you will not be able to capitalize on the market recovery if the business is unable to weather the immediate challenges of the downturn. Every business owner or manager likely feels the need to circle the wagons quickly around the mantra of “Cash is King.” Below is a summary of our key areas to leverage for short-term survival.

1. Cash Management

Inventory management – Do not tie up cash with inventory (inputs or outputs), produce only what is needed to continue servicing the real time demand of the market. Leave production for EBITDA for another day.

AR and AP – Keep a close eye on receivables and consider incentivizing customers to pay promptly. While delaying payments does not actually give businesses more cash, it effectively replaces debt to creditors with debt to vendors. For instance, Dell Computer was well known for their payment model in which the customer prepaid for the desktop, Dell built it, and then paid their suppliers 100 days later.

2. Fixed Assets

Divest the Obsolete – somewhere in your business is an unused building, a laydown yard with surplus materials, or maybe just a storage area or an ignored corner of the garage that has been piling up with old and forgotten equipment. If it can longer create value for your business, now’s the time to sell it off.

3. Margin Improvement

SG&A – Develop plans for rightsizing SG&A under various business scenarios and act as soon as possible. Avoid the common lament of “I wish I would have moved sooner” and look beyond simply reducing personnel. For example, are there service providers to your business that could be eliminated, reduced, or brought in-house to keep more good employees on payroll?

COGS – Identify key areas of leverage for margin improvement (low effort/high return) and focus intently on quick implementation - maximum of three initiatives.

Targeted pricing – Do not drop prices to meet the competition or your customers will assume you have been overcharging them all along. Instead, find areas to raise prices where supply and demand allow. A price rise of 1 percent, if volumes remained stable, would generate a 4 percent increase in operating profits.

Part II: Resiliency

More than half of current Fortune 500 companies were founded in a recession. The other 40% are still standing after having weathered at least two significant downturns. Resilient businesses like these recognize and adeptly respond to shifts in competition, customer problems and priorities, partner/collaborator relationships, and other disruptive changes in the business climate – the proverbial 5 C’s. From data, there are four key areas companies have leveraged when jump-starting resilient growth.

1. Align the team. If you gathered your management team together today and had each of them write down the Top 3 Strategic Priorities for the business – would the lists all match? If not, now is the time to reset or clarify those Strategic Priorities for the “new normal” and eliminate the areas of confusion for the business.

2. Review customers. According to analysis by Boston Consulting Group, companies undermanage pricing for small SKUs because they find it too time consuming or expensive to use sophisticated pricing tools. In our experience, the same premise holds true for customers. The 80/20 rule is often applied, and the margin review is limited to only the Top 10 or Top 25 customers based on volume or revenue. Taking the time to review the entire customer base can identify pricing opportunities and margin outliers in the “long tail” of smaller customers that can easily add up to important wins for the business (exhibit 2). For example, one company went beyond the top 20% of their customer base and found a smaller customer who was buying product at below the producer’s cost due to a legacy promotional deal that should have expired years earlier.

(Note: Aside from correcting the immediate term profitability impact, there is a larger danger that exists in not catching these type of long tail issues - in a period of rapid consolidation, a large customer could buy smaller player and discover the unfavorable pricing discrepancy.)

Exhibit 2: Revenue Contribution by Customer of $250m Business

3. Review suppliers. Supply chain flexibility has been tested in most industries. To ensure uninterrupted flow, procurement leaders are gravitating towards suppliers that are already vertically integrated and closer to home. While some temporarily idled plants are burning FG inventory, they are also building raw material stockpiles, securing critical materials with long-lead items, and identifying multiple suppliers. Qualifying new suppliers is often a lengthy and involved process – initiating those steps now can reduce the risk of disruption to your business in both downturns and boom times when supply gets tight. Moreover, involving your current suppliers in the review will encourage them to keep their best deals and service options in front of you.

4. Build multi-dimensional bench strength. Our experiences with major manufacturing businesses in building products over the past six years show that pursuing discrete, focused margin improvement opportunities - using dedicated cross-functional talent, applying rigorous analytics, and formal implementation tracking - can reduce costs and/or enhance product margin by up to 10 percent. Moreover, an important benefit to these campaigned margin improvement initiatives is building internal capabilities and providing development opportunities for key personnel. This is also an excellent stage to test succession plans during project backfills, all while creating a culture of continuous improvement.

Closing Thoughts

Setting your business up to succeed in the new normal means first surviving the challenges of today -develop and aggressively implement your survival plans to strengthen your short-term position as much as possible. As your business comes out of this challenging period, ensure it is resilient enough to take advantage of fresh opportunities. Update your business strategy to account for market shifts and make sure that strategy has been clearly communicated to your team. Build additional resiliency in your business by looking granularly for discrepancies and gaps in your customer and supplier bases. Finally, a resilient business is all about having great people – consider the targeted margin improvement technique to help develop key personnel and build a winning culture.

Ryan Brown is founder and Managing Director of Next Level Essentials, LLC. Brian Below has 20 years of experience at international industrial and manufacturing organizations, recently serving as a division president with Boral North America.