Tales From the Transcript: Demand Hopes, Inflation Fades

Richard Tobin was inspired to invoke a 1980s hard-rock mainstay to describe how Dover Corp. is preparing for the rest of 2023.

“The Sammy Hagar song about one foot on the gas and one on the brake, that’s the way we’re trying to run it here—meaning that there’s a lot of macro uncertainty in the marketplace,” the president and CEO of the $8 billion manufacturer of equipment and parts said on Dover’s first-quarter earnings conference call. “We think that we’ve got some tailwinds but we can’t just be blind [and] not [watch] our own balance sheet.”

Tobin uttered his sentiment April 26, relatively early in the first-quarter earnings season. But his take on the push-pull nature of Dover’s outlook and the delicate balancing act required of executive teams in today’s industrial economy was echoed by other leaders in the weeks that have followed. Our newest analysis of the conference call transcripts of a 50 members of the 2022 IndustryWeek U.S. 500 list of public companies showed that seven other executive teams talked both positively and negatively about broad demand expectations for the coming quarters.

That cohort of eight was up from just three early this year and speaks to the potential pivot point at which the U.S. economy finds itself. The effects of numerous exogenous shocks are fading and, while first-quarter GDP growth dipped to 1.1% (a slowdown our IW500 leaders told us early this year they were seeing), it’s far from clear whether we’ll get more expansion in coming quarters or take a clear turn downward.

And yet: Our research showed renewed optimism about growth in what remains of 2023 as well as brighter takes on inflation, supply chain and labor conditions. More on those trends below.

As we did in March and November, we’ve tallied dozens of forward-looking sentiments—150 of them, to be precise—from executives leading the five largest companies in 10 sectors of the IndustryWeek 500. We rated the commentary on a five-notch spectrum from fully positive to fully negative—there’s more on our methodology at the bottom of this story—and then computed composite scores. Here’s how those calculations turned out, starting with what remains the most negative category.

Inflation: -0.08 (versus -0.22 in Q4 and -0.42 in Q3)

Consider Deere & Co. a microcosm of that dynamic. The farm and construction equipment giant’s leaders pointed out on their conference call that production cost inflation last quarter was the lowest in more than two years.

Still, many executives noted their antennae remain up because inflationary pressures continue to have a number of root causes.

“I feel like there could be, there will be, an ongoing tail to this inflation,” Applied Industrial Technologies Inc. President and CEO Neil Schrimsher told analysts April 27. “Especially when considering labor and kind of overhead expenses-type things tied around medical and others.”

Labor: 0.03 (versus 0.00 in Q4 and -0.14 in Q3)

That confidence is being reflected in broader statistics: As analysts at Renaissance Macro Research pointed out this week, manufacturing employment is now at its highest point since September. But Leonard and a bucketful of other CEOs also discussed their investments in robotics and automation, saying they are not only needed to help manage costs but also serve as part of the solution to the long-term problem of worker supply.

“Labor availability continues to be an issue and companies are going to have to run their businesses differently going forward than how we did pre-pandemic,” said David Dauch, chairman and CEO of American Axle & Manufacturing Holdings Inc. “That's just a fact, a reality.”

Supply chains: 0.25 (versus 0.15 and -0.17)

A few irritants remain, most notably in the world of electronic components such as semiconductors and in an aerospace sector that’s running close to flat out, and there are still some companies expecting to face struggles in coming quarters. But progress has been steady on the whole, execs told analysts and investors.

“Our supply chain has done a nice job recovering and trying to support the ramp up,” TransDigm Group Inc. President and CEO Kevin Stein said on his team’s call. “I think, in general terms, we’ve seen more stable and predictable performance out of suppliers.”

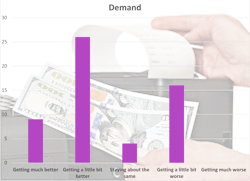

Demand: 0.25 (versus 0.04 and 0.29)

Despite repeated forecasts of a recession, growth has persisted and—helped now by a housing sector that appears to be strengthening and infrastructure funds that are starting to flow into factory orders—increasingly looks as though it will expand well into 2024.

Many a buyer of industrial goods held off on some orders late last year and early in 2023 to run down inventories or hunker down in anticipation of a downturn. But judging by the demand commentary aggregated in our database—35 of the 54 sentiments we recorded were positive—the pause was quite short and the tailwinds Tobin mentioned are regaining the upper hand.

“We’re all watching whether or not [softness in architectural billings] could create some constraints on demand,” Carrier Global Corp. Chairman and CEO David Gitlin. “We’ve seen none of it in the underlying business.”

Gitlin’s peers at Parker-Hannifin Corp., Deere and Weyerhauser Co. presented similar demand outlooks, speaking of growing order books stretching into next year and about buying activity broad enough to support continued optimism.

One potential red flag? Relatively fewer businesses appear to be doing well, said W.W. Grainger Chairman and CEO D.G. Macpherson.

“The pattern is more industrial is doing better, less industrial is slowing more,” he said. “And then bigger companies are generally doing better, I'd say, than smaller companies are.”

Which leads us back to Dover’s Tobin and his team’s risk management and scenario planning. Given the one-foot-on-the-brake-and-one-on-the-gas nature of Dover’s approach, Tobin told analysts he was preparing to lead a management meeting to make sure the company is covering all its bases.

“Part of what we’re going to do is basically go business by business and say, ‘All right, what’s your plan to meet your numbers for the year and what’s your plan if we run into trouble?’” Tobin said. “We have no choice but to run the corporation that way.”

At least until the summer and fall confirm the brighter days many CEOs and CFOs think they see today.

About the Author

Geert De Lombaerde

Senior Editor

A native of Belgium, Geert De Lombaerde has been in business journalism since the mid-1990s and writes about public companies, markets and economic trends for Endeavor Business Media publications, focusing on IndustryWeek, FleetOwner, Oil & Gas Journal, T&D World and Healthcare Innovation. He also curates the twice-monthly Market Moves Strategy newsletter that showcases Endeavor stories on strategy, leadership and investment and contributes to other Market Moves newsletters.

With a degree in journalism from the University of Missouri, he began his reporting career at the Business Courier in Cincinnati in 1997, initially covering retail and the courts before shifting to banking, insurance and investing. He later was managing editor and editor of the Nashville Business Journal before being named editor of the Nashville Post in early 2008. He led a team that helped grow the Post's online traffic more than fivefold before joining Endeavor in September 2021.