Manufacturer Replaces Tribal Knowledge with Data-driven Price Optimization, Increasing Gross Margins by 3.5%

After achieving record sales performance and gross margins in 2005, management at a major building products manufacturer was still concerned about the company's pricing system. Things were just too complex and too many decisions were based on undocumented tribal knowledge and gut instinct. On top of this, they were challenged by rising raw materials costs.

While status quo pricing worked for now, the head of marketing had the vision to recognize that the industry was changing fast and that existing pricing systems were only going to become more strained. The director of commercial pricing for the company said that " if we want to continue to grow market share we needed to innovate."

Innovation through Price Optimization

With the fixed/variable cost-ratios in a manufacturing environment, pricing has a tremendous amount of leverage. Even relatively small improvements to realized price can dramatically impact a manufacturer's profitability. And optimizing a manufacturer's prices can have significantly more bottom-line impact than cost reductions and volume increases combined.

Having the vision to recognize this, the company chose to implement price optimization technology. Price optimization technology leverages a company's transactional data and combines it with statistical science and business application software to improve all aspects of pricing setting. At its core, price optimization measures opportunities to differentiate prices for individual sales transactions on the basis of their unique circumstances. Prices are then delivered to the sales force in the form of a negotiation "band" of three to five price points enabling them to negotiate with more confidence and consistency while maximizing prices and profits. And despite the underlying mathematical sophistication, the output of price optimization software is intuitive and simple for business users to understand and act upon.

Pricing -- the Way It Was

The building product manufacturer's pricing process was based on a single price list, with the company's 400 products and 5,000 SKUs each having fifteen price points. Little to no segmentation analysis was applied in understanding how deal pricing would differ dependent on unique circumstances such as product category, customer relationship or regional variance. The prices were distributed in a paper list and through the sales force automation tool, and deal-by-deal margin was not known by the sales rep or territory manager.

Implementing Market-Driven Pricing

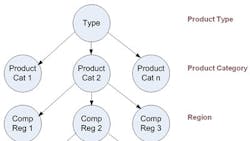

After choosing a pricing software vendor who demonstrated superior science capabilities and applications, as well as deep industry knowledge, the first step of the implementation was to analyze historical pricing data. This was to determine how pricing outcomes vary based on different deal circumstances including product category, region and job size. The vendor identified over 6,000 price segments -- clusters of transactions that demonstrate similar price response. This historical looking analysis highlighted grossly unprofitable outliers and also the more common cases where prices and margins could have been slightly higher. In addition to price increases, the analysis also highlighted price sensitive segments where there was an opportunity to increase margin dollars by reducing prices and increasing volume.

Now that the building products manufacturer had a relevant segmentation strategy, they & the pricing vendor focused on price setting. For each one of the 6,000 relevant price segments, the optimization engine produced a negotiating band that included only five price points instead of the fifteen used in the old system. The reduced number of price points eased the decision-making process for the sales people. Additionally, sale people had more information on margin at each price point.

The company decided to conduct a trial to roll out the new price points. Half of the sales force, the test group, received the new pricing guidelines in the form of Excel spreadsheets and paper printouts. Prices were color coded to show the margin percentage for each pricing level. These sales reps were trained in the use of market-driven pricing based on the characteristics of each customer and job. The other half of the sales force, the control group, worked with the existing pricing methods.

Realizing Significant Margin Increases

The results from the test group and control group were analyzed over a six month period. During this same time, the company also saw increases in raw material costs which put additional pressure on prices and margin. However, the group using the market-driven pricing tools managed to substantially increase margin contribution despite these cost increases. Across each product category, the test group consistently outperformed the control group and in one area increased margin dollar per unit by 10.2% compared to 6.1% for the control group. Further contribution analysis showed that pricing rather than costs or product mix drove these improvements.

A user survey also revealed that the sales team using market-driven pricing felt the new system was very beneficial. The overall experience with market-driven pricing was rated as very positive or positive by 71% of the sales reps, and 65% of the sales reps had a very high or high level of confidence in the market-driven pricing recommendations. Additionally, 49% of the sales team said they earned higher commissions and 44% said they spent less time in asking management for pricing assistance. Finally, 87% of the users said they preferred to keep market-driven pricing.

Based on the success of the pilot, the building products manufacturer rolled out market-driven pricing to the entire group's sales organization. Simultaneously, they also upgraded their existing sales force automation product so that prices could be delivered electronically.

Success of Trial Leads to Larger Rollout

As a result of the immediate success of the trial, the building products manufacturer is now in the process of rolling out the system to other groups in the company. "Providing prices electronically gives us the ability to update pricing instantaneously," said the director of commercial pricing. "We have eliminated the old pricing system completely. Having already generated a 3.5% increase in gross margin, we are confident that we can achieve a 5% margin improvement over the entire group once the rollout is complete."

Zilliant, Inc., is a provider of price-optimization and management software for B2B companies. For more information visit www.zilliant.com

Interested in information related to this topic? Subscribe to our Information Technology eNewsletter.