You've got a project you know is important for you and your company. Maybe it fixes a problem that's put a damper on profits or maybe it helps you grow. Either way, you're going to make it happen by pulling together a team of internal resources or bringing in a consultant or both.

Well, hold on there buckaroo, because your project may be a dud.

How many times has this happened: A consultant helpfully suggests that your royal road to success requires that you run an energy audit or "lean out" a production line or replace all your left-handed squeegees with right-handed squeegees. You turn a quizzical eye on the consultant and inquire, politely, "Why on earth would I do that?"

Because, of course, you are justifiably confident that your energy usage is just fine, your production lines are plenty lean and the left-handed squeegees are being reliably employed by right-handed personnel.

Pretty common scenario, right?

Try this one on: You suggest to a consultant that you need the energy audit, lean project or squeegee upgrade and the consultant pushes back, equally politely, with "What a terrible idea. Why on earth would you do that?" Pity. A large percentage of the projects that under-deliver versus expectations never should have been approved in the first place.

They were duds.

While I typically write about how to use consultants better, all too often the consultant is irrelevant because the client shouldn't be doing the project at all. What you need, as a potential buyer of consulting services, is a five step, dud-proofing process which establishes (or fine-tunes) the value of your project.

It so happens I have just such a process handy.

Steps 1 and 2: Ask "Why Bother?" Rinse and Repeat

The first question I always ask clients when they inquire about a project is, "Why bother?" The reply is either bafflement or an eloquent recapitulation of events that led up to the project. Either way, I quickly pose an equally sophisticated follow up: "Yeah, so what? Why bother?" Then I keep asking the question until we get to meaningful, quantifiable rationale. It looks like this:

Client: I need help building a presentation to the board about our emerging markets plan

Me: Why bother?

Client: Because if we don't have a good presentation, the plan won't be funded.

Me: Yeah, so what? Why bother obtaining funding for the emerging markets plan?

Client: Because if we don't, we won't have the resources to launch into Brazil and Mexico.

Me: Yeah, so what? Why bother launching into Brazil and Mexico?

Client: Because those markets are central to our growth efforts for the next three years

Me: Yeah, so what? How central? You didn't really answer my question. Why bother launching into Brazil and Mexico?

Client: Central to the tune of $15 million over the next three years.

Me: Now we're getting somewhere.

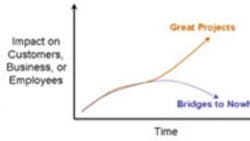

The value of virtually every project, from the leadership retreat to repainting the break-room floor, can be quantified. To be fair, sometimes I intersperse a second question into my litany: "What is the real, measurable impact on customers, your business or your employees?" If you can't identify the real, measureable impact on one of those three, there's a good chance you are working on what I call a Bridge to Nowhere.

Step 3: Fine-Tune Your Estimate With Contribution, Duration and Frequency

The first two steps were easy and looked suspiciously like Toyota's 5-Whys model, even though we're looking for value, not root causes. Those steps got you in the rough ballpark; however, before you call McKinsey, McWhimsey or MacDonalds for some help, let's refine that estimate of what the project is worth.

The first door to look behind is your project's Contribution to the overall goal. One of my clients was struggling to get hospitals (his customers) to buy on value rather than price. He figured he needed a better sales story, and that's where the consultant would come in. Steps 1 and 2 revealed the value of shifting the sales conversation should be around $15 million. Terrific. Not a dud.

Or is it?

I asked how much the story project would contribute to the $15 million overall goal? After all, in addition to getting the story right, he needs to train salespeople how to tell the new story, give continued coaching to improve delivery, develop contracts in line with the story, and numerous other tasks. Clearly, the value of the story is less than the whole megillah.

The second door in our quest is the Duration of benefit. In other words, how often, or for how long, will the benefits be in effect? A manufacturer who had us install a new purchasing process estimated the value at $3 million in incremental margin annually. Unless they suddenly halted purchasing in 12 months, the total benefit of the project was more than $3 million, but how much more? Should the annual value be counted in perpetuity? Over 25 years? Two years?

There's a long answer and a short answer to that question. Here's the short answer: the rough rule of thumb I recommend is three years. A project whose benefit doesn't last more than a year or two tends not to be worth the effort and resources. Once you start looking out past three or four years, however, promises of value become notoriously unreliable.

Your third fine-tuning adjustment is frequency; i.e., how often you will receive the benefit of the project. Most good initiatives have a noticeable halo of value which extends beyond the immediate objectives. Most duds don't. A project which helped a client lower attrition at the Cleveland plant yielded a process applicable in Columbus and Toledo too.

To accurately assess the value of your projects, therefore, consider whether the same benefits can be realized again in the future or in similar situations elsewhere in your company.

Step 4: Correct the Underestimation Error

So far, so good. We have a fine-tuned estimate and now it is time to fix two big errors which make swans look like ugly ducklings, and vice versa. The first, amazingly common blunder is looking too narrowly at a project's potential benefits. Not only does this depress the expected value of your initiative, it lowers the actual value you get at the end.

For example, let's say your project will improve visibility among prospective customers. To estimate project value, you forecast the change in awareness then model that back to increases in sales. But there's more gold in that project's hills.

The new marketing campaign could improve morale across the company and inspire line workers to take quality up a notch. If you design your project only with visibility in mind, all you'll get is a bump in awareness; however, if you keep the ancillary benefits in mind while you design and conduct the initiative, you have a good chance of reaping them too.

Would a cheat-sheet for identifying additional sources of value help? Of course it would. Virtually every project you embark upon delivers on at least two of the 37 common, quantifiable sources of value and the complete list can be downloaded here.

Step 5: Correct the Egocentricity Error

Flip the underestimation error over and you'll find the egocentricity error. Next time you spot folks emerging from a conference room, ask each individual how much they contributed to the solution reached inside. The total will add up to far more than 100%.

Why? Research shows we tend to overvalue our own contribution. The same can be said of our projects. Correcting the egocentricity bias requires you to factor down the contributions you came up with in Step 3.

The magic question in this step -- the one you should ask every time -- is, "What if we didn't do this project?" Consider the client who wanted a new story for hospitals: if they had worked on their story without our group involved, trained and coached the sales folks and revamped the contracts could they still have captured some of the $15 million bogey?

Of course. Together, we estimated the story contributed 30% of the total value of the project. We also figured they could achieve a reasonably effective story on their own; at least 60% of the total benefit they'd achieve using an outside expert. In other words, after we corrected for the egocentricity bias, the value of bringing in a consultant to write a new sales story was only 12% of the original $15 million estimate.

Deciding whether to hire a consultant to deliver $1.8 million is a heck of a lot different than giving the thumbs up or down on a $15 million initiative.

Are many of your pet projects worth only 10% to 15% of what you originally estimated? Maybe, maybe not. Alas, most hired hands will sign on either way. In fact, they will applaud your brilliance while happily bidding on the project to replace your left-handed squeegees. Therefore, the responsibility for dud-proofing is on you. Fortunately, now you have a process.

David A. Fields, managing director of the Ascendant Consortium, shows companies how to get extraordinary value from consultants. Contact him by email at [email protected] or call 203-438-7236. His monthly news quiz is available at http://ascendantconsortium.com/newsquizentry.php.

About the Author

David A. Fields

Managing Director

David A. Fields is a speaker, author and the founder and managing director of The Ascendant Consortium, a unique organization specializing in maximizing the ROI from consulting engagements. He is the author of "The Executive's Guide to Consultants" (McGraw-Hill, 2012). He writes monthly columns for IndustryWeek and Consulting Magazine, and his commentary has appeared in USA Today, CNN Money, Investor’s Business Daily, Advertising Age, BusinessWeek, SmartMoney, and other publications.