Marketing Spending Climbs CFOs’ Priority Lists

It’s still early days but a handful of recently published studies suggest we might look back at 2024 as the year marketing and automating were the blocking and tackling of business.

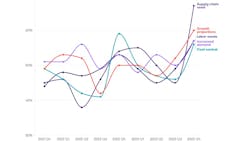

The latest data points come from Grant Thornton, which recently polled more than 240 CFOs for its quarterly report series. Among the headlines are that 71% of respondents expect revenue growth this year, an increase of five points from three months earlier. Similarly, sentiment has improved (see the chart above) when it comes to cost controls and labor and supply chain needs—i.e., the executives don’t plan on devoting as much of their budgets to those latter items.

That growing confidence and extra cash flow are translating into a greater willingness to spend on initiatives that can ensure sales and share gains aren’t only for the short term: 45% of CFOs expect to spend more on sales and marketing in the next year. That demand generation is high on the priorities list is something of an eyebrow-raiser; in the past, C-suites were almost always reining in that line item late in a business cycle.

“They’re confident in their supply chain and in their growth projections,” Paul Melville, the national managing principal of Grant Thornton’s CFO Advisory group, said in his firm’s report. “What we’re seeing is they feel that they actually can deliver on their growth projections.”

Investing in marketing also ranked high in The Conference Board’s C-Suite Outlook 2024 study. Globally, it trailed only new products and services and Conference Board researchers noted that “about two-thirds of CEOs say they are planning to increase budgets for customer service, customer experience, and new customer acquisition over the next 24 months.” Solid recent U.S. GDP data will have confirmed many of those intentions.

The more positive outlook isn’t just the purview of large multinationals, either. The recent 2024 Global CFO Report from FTI Consulting highlighted that nearly 70% of respondents with less than $100 million in sales expect to grow at least 10% this year. The message from many leadership teams is consistent: There’s opportunity but they know they need to work for it.

“Finance leaders and other executives are saying, ‘We just can’t stay stagnant. We have to do something,’” Gina Gutzeit, senior managing director at FTI and the global leader of its Office of the CFO Solutions. “That the finance people are optimistic speaks highly about where we are.”

Tech Appetite – and Frustration

The inclusion of technology investments near the top of CFOs’ priorities list is far less of a surprise, if it is a surprise at all, than that of demand generation. The pace and types of innovation have picked up in recent years and the COVID pandemic’s disruptions rudely pointed out many leadership teams’ relative lack of analytics tools. Investments have been looking to close gaps ever since.

Cases in point: An annual survey from our Food Processing sister brand has automation behind only food safety and cost-cutting as executives’ top priority. IT and digital transformation projects are the top area for projected spending increases in Grant Thornton’s report. And nearly half of manufacturing executives responding to a BDO USA poll—nine out of them plan to expand this year—said they are adding to their investments in artificial intelligence and machine learning this year.

Those cutting-edge investments don’t come without risk, though, and a sizable payoff may be years away. Alan Numsuwan, an FTI executive vice president and member of the Office of the CFO Solutions practice, said a similar dynamic is at play when it comes to investing in more commonplace software such as analytics tools. The proliferation of options, he said, and their varying use cases has created frustration and inertia about spending decisions.

“If you introduce something and say, ‘Don’t worry, this will solve all our problems,’ you’re on the hook,” Numsuwan said. “But there’s just not that level of confidence in many of these tools.”

Execs do, however, have greater confidence in the general economic outlook: The Moody’s Analytics Survey of Business Confidence has steadily trended up over the past year (a move that included a big summer spike up and subsequent retreat) and Chief Economist Mark Zandi noted this week that positive responses outnumber negative ones.

“Businesses are notably more upbeat in their response to the broad question concerning present business conditions and prospects through this summer,” Zandi wrote. “The survey results are consistent with a global economy that is growing below its potential but is decidedly avoiding recession.”

For many business leaders, that environment is good enough to open the spending spigots. After all, growth rarely comes for free.

About the Author

Geert De Lombaerde

Senior Editor

A native of Belgium, Geert De Lombaerde has been in business journalism since the mid-1990s and writes about public companies, markets and economic trends for Endeavor Business Media publications, focusing on IndustryWeek, FleetOwner, Oil & Gas Journal, T&D World and Healthcare Innovation. He also curates the twice-monthly Market Moves Strategy newsletter that showcases Endeavor stories on strategy, leadership and investment and contributes to other Market Moves newsletters.

With a degree in journalism from the University of Missouri, he began his reporting career at the Business Courier in Cincinnati in 1997, initially covering retail and the courts before shifting to banking, insurance and investing. He later was managing editor and editor of the Nashville Business Journal before being named editor of the Nashville Post in early 2008. He led a team that helped grow the Post's online traffic more than fivefold before joining Endeavor in September 2021.