The announcements are impressive.

GM is on its way to an all-electric future, with a commitment to 30 new global electric vehicles by 2025. In addition, GM aspires to eliminate tailpipe emissions from new light duty vehicles by 2035.

Of the 40 electrified vehicles Ford plans for its global lineup by 2022, 16 will be fully electric and the rest will be plug-in hybrids. On Feb 4, 2021, CEO Jim Farley said, “We’re now allocating a combined $29 billion in capital and tremendous talent to these two areas, and bringing customers high-volume, connected electric SUVs, commercial vans and pickup trucks.”

But, why are the automakers seemingly hot on the future of electric vehicles?

Let’s look at the numbers.

Although a 2019 survey of 1,000 drivers conducted by Castrol show that 60 percent are taking a wait-and-see approach to making an EV purchase, across the board industry projections reflect that consumer acceptance is growing.

And automakers are listening with plans to have 500 different EV models available for purchase by 2022. Currently, there are 300 EV and 150 hybrid models available.

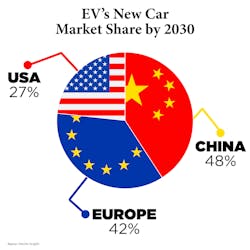

According to Deloitte Insights, the share of new car sales taken up by EVs will vary considerably across markets with China forecasted to realize domestic market share of around 48% by 2030 – almost double that of the United States (27%), and Europe should achieve 42%. In its Electric Vehicle Outlook, Bloomberg-NEF anticipates EV market share of new car sales will hit 58% by 2040.The McKinsey Electric Vehicle Index shows EV sales rose 65 percent from 2017 to 2018. But in 2019, the number of units sold increased only to 2.3 million, from 2.1 million, for year-on-year growth of just 9 percent. Globally in 2019 and the first quarter of 2020, Europe expanded its market share to 26%, representing 44% growth.

According to IEA, the sales of electric cars topped 2.1 million globally in 2019, surpassing 2018 – already a record year – to boost the stock to 7.2 million electric cars. Electric cars, which accounted for 2.6% of global car sales and about 1% of global car stock in 2019, registered a 40% year-on-year increase.

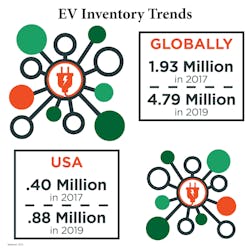

In response, manufacturers are starting to make strides with EV inventory, according to IEA. Globally, electric car stock increased from 1.93 million in 2017 to 4.79 million in 2019. In the US although the numbers were more conservative .40 million in 2017 to .88 million in 2019, it accounts for more than a double in stock numbers over a two-year period.Charging conundrum?

The long held concern of range anxiety ultimately points to the need for stronger charging infrastructure often surfaces as a concern. However, numbers paint a different story.

After all, according to US Department of Energy, most (80-90%) EV owners are either charging their vehicles at home overnight or during the day at work. A trend few experts anticipate changing even as market penetration climbs. This process only requires slow level 1-2 chargers.

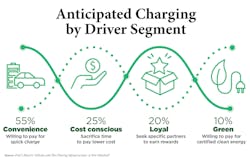

At the same time, with battery innovations now offering similar milage to the internal combustion engine, the range anxiety for long distance travelers or road-trippers is fading fast. Specifically, depending on battery configurations, the latest EVs can travel between 300-500 miles on a full charge.Of course, there will be a need to build out a charging infrastructure that exceeds the 7.3 million chargers deployed worldwide in 2019 (source IEA). PwC anticipates as the EV market penetration increases, the coinciding infrastructure will include a mix of level 1-4 charges to accommodate different driving styles and desires. Specifically, PwC anticipates 55 percent of market share will go to time starved travelers willing to pay for time saved, 25% will sacrifice time for lower cost and 20 percent will follow loyalty to earn and redeem points with preferred partners.

According to the recent report by Frost & Sullivan, Transitory Trends in the Electric Vehicle Ecosystem in the U.S. 2025, California has the most densely populated charging station infrastructure, which has allowed it to be the biggest market for EVs in the country. Report authors anticipate that charging stations will be installed in strategic locations with multiple points of interest for consumers to engage with hotel/lodging as the most favored location followed by shopping centers. Ideal locations for level 1-2 slow charging units.

Environmental Impact

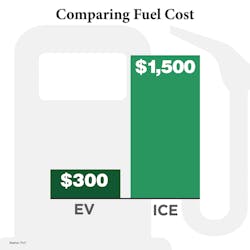

Understandably, the reduction of emissions through the consumption of carbon fuels is goal of ultimately transitioning market penetration away from ICE and towards EVs. However, simply moving from consuming one form of carbon fuel (gasoline) to another (i.e. coal). Fortunately, for EV proponents, it appears the tides are turning.

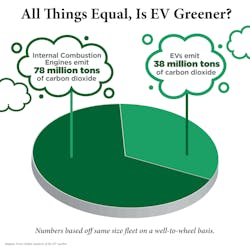

According to Virta Global analysis of the EV market, EVs emitted 38 million tons of carbon-dioxide equivalent on a well-to-wheel basis. Compare that to the 78 million tons an equivalent ICE fleet would have emitted. In practice, all emissions from EVs are born as a result of the manufacturing process, whereas a similar logic can’t be applied to ICE cars.

About the Author

Peter Fretty

Technology Editor

As a highly experienced journalist, Peter Fretty regularly covers advances in manufacturing, information technology, and software. He has written thousands of feature articles, cover stories, and white papers for an assortment of trade journals, business publications, and consumer magazines.