Hiring in manufacturing is troubled, but paying top dollar for talent works. In the 2023 IndustryWeek Salary Survey, companies that pay better salaries also had less trouble hiring. Despite the clear correlation between pay and effective hiring, manufacturers remain concerned about a number of other key issues in addition to labor availability, especially interest rates and the risk of a recession in North America.

The 2023 IndustryWeek Salary Survey surveyed about 200 manufacturing administrators, engineering managers, health and safety professionals, and more who currently live and work at manufacturing companies in the United States. In terms of their responsibilities:

- · 38.0% of respondents worked in company or plant operations;

- · 22.5%, worked on the corporate or administrative level;

- · 18% worked in engineering and technology;

- · 11.5% worked in marketing;

- · and 10% work in supply chain or logistics operations.

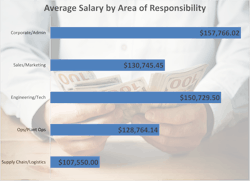

Respondents working in corporate and administrative roles made the most money, with an average wage of $158,000. Engineering and technology employees followed close behind with $150,000. (For more on salary figures for engineers, see our sister publication MachineDesign’s story, Engineers Bring Pride, Experience to Their Craft—and it Pays.) The average wages for those in marketing and in operations roles were similar at $130,000 and $129,000, respectively, with supply chain and logistics employees the least well-paid of responsibility groups: The average wage for those mainly concerned with supply chain operations was $108,000.

Manufacturers’ Top Fears for ‘24: Labor Availability

In a question on what their biggest economic concerns for 2024 are, a majority of respondents found four issues concerning:

- Labor availability

- Interest rates

- A North American recession

- General political instability.

Only about one-third of respondents rated two more issues—a global recession or more supply chain issues—as top concerns.

The most-commonly listed item for respondents’ greatest economic concerns for 2024 was “labor availability,” with 56.9% of respondents including it as a top fear. Most comments on labor availability were pessimistic.

One respondent noted that jobs in tech are “less stressful and higher paying.” Another found himself caught between concern for their employees and the health of the company: “One of the biggest challenges is staying competitive in a marketplace that continually demands higher hourly and salaried pay,” he wrote. “We do not want to move to a [low-cost country] or a lower-cost state, but the cost of living for our staff keeps rising. … While I do not want to burn out my staff, I also do not want to add layers of fixed costs to our business.”

One-third noted that manufacturers have unique challenges other industries, including the tech industry, don’t have: “Rural counties cannot compete with large urban areas in wage scale, so talent is leaving to go to higher-paying jobs. Also, remote work offers flexibility and benefits not found in on-site jobs.”

The second-most concerning issue for respondents are interest rates, which have steadily increased throughout the year, affecting the affordability of capital improvements investments. 54.5% of respondents named it as a top concern.

Just over half of respondents, 50.5%, said they were seriously concerned about “political instability.” In a comment attached to their response, one IW reader cast the blame on intraparty disfunction in Washington: “Political parties not working together.”

The lack of available labor most cited as a top issue by IW readers is not a new issue: Manufacturing companies have been sounding the alarm about available labor for close to 30 years now. In the past few years of the IndustryWeek salary survey, the proportion of respondents reporting indicating their companies are having difficulty hiring has increased from roughly 50%, to 75%, and now to around 83%.

Difficulty Hiring Correlates with Lower Average Salary

There’s no shortage, then, of manufacturing companies with trouble getting talent. So what are the companies of 17% of respondents—which, they say, aren’t having any trouble hiring—doing right? Wages aren’t the only factor, but responses suggest it’s a significant one.

Next to the question about difficulty hiring talent, the 2023 survey included a field for respondents to elaborate on what their company is or is not doing to attract top talent. Roughly 25% of readers who said their companies could locate talent without too much hassle indicated that many of these companies were focusing on higher wages—possibly too high, from some respondents’ point of view. Answers to this question that reflected higher wages from companies successful at attracted employees included “salary,” “salary and benefits,” “bonuses!” and a slightly terse one-word response: “Overpaying.”

Wages were the top-cited factor for successful talent attraction, though about one-fifth of the group cited nonmonetary benefits and intangibles like work/life balance, regular employee surveys, and/or company culture.

Troublingly for the economy, the second-largest group of responses came from employees of companies that are currently reducing their openings without hiring, either by downsizing, laying off workers, or offshoring.

Though the IW survey is limited, and many respondents from companies with difficulty hiring said their companies were trying to pay more, the data supports that higher salaries improve hiring outcomes. Respondents at companies that are struggling to hire made on average about $20,000 a year less than those at companies that did not have an issue attracting employees:

- $138,470: Average salary for a company struggling to find workers

- $157,028: Average salary for a comapny reporting no trouble finding workers

Despite an awareness that higher pay makes workers more attracted to a job, several comments noted that maintaining competitive wages is increasingly difficult.

One executive of an electrical power product company with trouble hiring noted that his company, like others, is caught between profitability and higher costs of living for employees. “One of the biggest challenges is staying competitive in a marketplace that continually demands higher hourly and salaried pay,” he said, adding he’s reluctant to move the company to a lower-cost state. “We must continue to innovate and find ways to do more with the existing staff we have,” he added.

For now, he says, the company is aiming at hiring for culture and training for skill, while giving existing employees more paid time off.

More Salary Surveys

Several of Endeavor Business Media (IndustryWeek's owner) publications also ran salary surveys in 2023.

- Electronic Design: Employment Prospects for Engineers are Looking Up

- Chemical Processing: Survey: 2023 Chemical Industry Salaries Get Stronger

- Supply Chain Connect: Key Demographic Trends Impacting Purchasing Professionals

- EHS Today: Secrets of the Safety Leaders

Higher Pay Doesn’t Correlate with Job Satisfaction—but it Does Match Career Satisfaction

Despite the apparent effectiveness of higher pay for recruiting, our results indicate that high pay is more likely to predict how satisfied a respondent was with their career than their current job.

Charting respondents’ satisfaction with their current position versus their salary showed a curious but clear inverse-bell pattern: The people making the most money were either very satisfied with their jobs, or very unsatisfied: Those groups made on average $176,000 per year and $153,000 per year, respectively. The noncommittal group, who said they were neither satisfied nor unsatisfied with their jobs, made the lowest average wages.

One theory that could explain this is to note that employees with less workforce experience may not feel as confident as more seasoned workers in rating their jobs as especially good or bad. Workers with more experience in various jobs may feel more comfortable rating their current job as satisfactory or not by comparing it to previous jobs younger or less experienced employees just haven’t had yet.

Survey Participants

Primary responsibility

- Plant operations (38.0%)

- Corporate/administration (22.5%)

- Engineering/technology (18.0%)

- Marketing (11.0%)

- Supply chain/logistics (10.0%)

Average salaries

- Corporate/administration: $158,000

- Engineering/Technology: $150,000

- Marketing: $130,000

- Plant operations: $129,000

- Supply chain/logistics: $108,000

One respondent, a director of digital transformation, indicated that she was “very satisfied” with her manufacturing career and “satisfied” with her current job. “Manufacturing as a career has been transformative for my life,” she wrote, citing two commonly-named positive features of manufacturing jobs: Pay, and challenge.

“In less than 10 years, I have been able to nearly quadruple my income by furthering my experience in manufacturing,” she said. “I have found it to be a challenging yet extremely rewarding and fulfilling career path.”

About the Author

Ryan Secard

Associate Editor

Ryan Secard joined Endeavor B2B in 2020 as a news editor for IndustryWeek. He currently contributes to IW, American Machinist, Foundry Management & Technology, and Plant Services on breaking manufacturing news, new products, plant openings and closures, and labor issues in manufacturing.