The 2017 IndustryWeek Salary Survey: Smooth Sailing on Pay as Skilled Jobs Go Unfilled

It’s that time of year again: we unmask the results of the annual IndustryWeek Manufacturing Salary Survey. This year, we analyzed data from 780 leaders in jobs from CEO to engineering management; vp of operations to EHS supervisor.

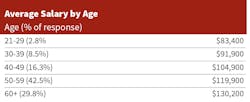

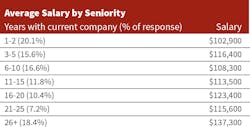

Manufacturing may no longer be dirty, dark and dangerous, but according to the survey demographics this year, its leadership still heavily skews white, male and over 50. Our prototypical respondent is a white, male corporate executive in his 50s working in the industrial machinery or automotive industry. He has a bachelor’s degree, lives in the Midwest and has spent more than a quarter century working in manufacturing. Being in the C-Suite, he makes, on average, 180K per year.

According to our results, 2016 was a good year to be making heart monitors and joint replacements; motor oil and emulsifiers, not so much. Salaries in the medical device category topped our survey this year, while salaries in last year’s leader, chemicals, decreased 8% to $124,500 as demand slowed with the strong dollar and lower oil prices cut into revenues.

Salaries in the automotive, consulting/education and food and beverage sectors showed healthy growth (13%, 11% and 13% respectively), while petroleum and coal salaries lost considerable ground (17%).

Check out our Salary Survey page for more manufacturing pay and workforce analysis.

The most lucrative job titles were vice president of manufacturing/production, CEO/CFO/COO and vice president of operations. Directors of manufacturing/production, lean and engineering managers, human resource and R&D managers and consultants also cracked the 100K threshold.

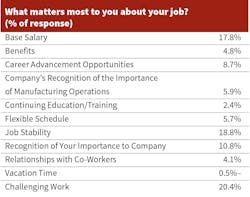

Strengths of U.S. manufacturing, according to our respondents, are certainly substantial: career stability, a family atmosphere and solidly middle- and upper-middle-class salaries.

Weaknesses include a reluctance to adopt new thinking and a slowness to address the skills gap with well-thought-out (and –funded) plans to recruit and train new workers.

Career satisfaction improved from last year, with 47% respondents saying they were “very satisfied with manufacturing as a career path,” compared to 41% last year. Thirty percent were “very satisfied” with their current job, up from 29% last year.

In addition to dollar signs and charts, we asked a series of open-ended questions about workplace culture, workforce issues and the state of manufacturing. Here’s a closer look at how our readers responded.

Q: What Are Your Biggest HR Concerns and Why?

Against the rising tide of low unemployment, manufacturing’s skilled worker shortage isn’t showing any measurable signs of slowing over last year. Sixty-five percent of respondents said their company had trouble filling a position last year, compared to 67% last year.

The No. 1 concern in the HR portion of our survey was the lack of skilled workers to fill open positions. A less-than-adequate technical training pipeline and the industry’s inability to connect with young people as they decide on a career are leaving a worrisome void.

“In West Michigan, we have a tight labor pool,” said a C-suite executive at a mid-size medical device manufacturer. “Skilled workers come at a premium. … It’s an expensive and difficult challenge for a company our size when revenues have been flat for the past couple of years.”

An engineering manager at a small wood products/furniture firm lamented that “our county has an average unemployment rate below 3%. There are virtually no workers available who actually want to work.”

Soft skills are hard to come by, said a good number of respondents. A lean/continuous improvement manager at a small building equipment company said his biggest HR challenge is “hiring people with life skills, who come to work every day, on time, and participate in discussions to improve the process.”

A human resources manager at a paper/printing company described her biggest hurdle as “finding people with a good attitude and a willingness to learn.” Right now, she’s struggling to fill operator, inspector and maintenance technician jobs.

On the flip side, employers could do a better job of making soft skills more of a priority in the hiring process. “We tend to hire on qualifications, while our internal data tells us cultural fit is the mostly likely determinant of long-term success and retention,” said a lean/continuous improvement manager who works at a medium-sized building equipment company.

An aging workforce was also on the minds of many; nearly three quarters of respondents said the issue was either a mild or big concern.

“There seems to be no effort to train people to adequately fill positions that will be left empty by individuals retiring in the next few years,” wrote a quality manager whose workplace has machine maintenance and operator jobs to fill.

Although the oldest members of the Millennial generation are now entering their late 30s, integrating this group into the workforce continues to be a struggle at many workplaces. An engineering manager at a large plastics company said engaging younger employees was his company’s biggest quandry.

A few respondents mentioned the government overreaching on its regulations, with policies like the overtime rule changing the description of salaried workers, OSHA public reporting of workplace accidents and the requirement of healthcare plans to cover contraceptives. Drug use of new employees and the inability of new recruits to pass a drug screening popped up more than a few times.

Performance review practices also met with some criticism for being too limited in scope. One respondent, an R&D manager for a plastics company, said her company’s yearly review system “pretty much guarantees people will be rated as ‘successful’ rather than ‘exceptional’ and then we’re quite locked into a raise that is about cost-of-living adjustment. People don’t feel rewarded—they feel trapped.”

Another frequent HR concern (17 respondents mentioned it specifically) was rising healthcare costs.

“We have seen nearly a 50% increase in cost over the past two years,” said a 20-something financial manager/controller in the consumer goods/durables industry.

“Healthcare costs are outpacing inflation,” said a vice president of purchasing/procurement at a manufacturing company with revenues of $100 to $500 million. “This hits lower-paid employees the hardest.”

Q: What is the Biggest Challenge Facing the Manufacturing Industry?

Manufacturing is less impermanent, requires more capital to start and takes up more physical space than other areas of the economy, so it makes sense that nimble response time and flexibility would not be among its strongest suits. But some respondents worried that leaders are actively resisting change, that inflexibility is pathology rather than an obstacle to creatively strive to overcome.

A sales/marketing manager in his 20s, in the metals sector, was struck by the unwillingness of management to consider fresh approaches. “Because I have only been in this role for a couple of years, my ideas are not relevant [to my bosses],” he said. “We need to change and adapt to new innovations so we can stay open and competitive, or else other countries will take all our business.”

“Manufacturers don’t seem interested in changing their product, approach, etc., to keep up with changes in the world,” said a female EHS leader in the apparel industry. “I understand that people do not like change, but if we don’t change approaches and even products, we will never adapt to the world as it is now. In my industry, more time is spent blaming government, laws and people than figuring out a way for the company to remain innovative and relevant in the current economy.”

Changing the perception of manufacturing among Millennials was a notable concern, as were trade imbalances, keeping pace with changing technologies, insufficient incentives to reshore and manufacturing’s comparatively low return on capital that makes it less attractive to Wall Street than other investments.

Q: What Jobs Are You Having the Most Difficulty Filling? (Hint: Engineers, and more engineers)

Last year, the most unfilled jobs were, in ranking order, engineer with a bachelor’s degree or above, industrial maintenance, quality specialists and sales. This year, engineer still held the top spot, with 25% of respondents having difficulty filling those jobs, but it was followed by machinist (13.7%), production laborer (12%) and management (11.5%)

Q: With the Shift in U.S. Presidential Administrations, What, If Any, Adjustments Do You Anticipate Having to Make in Your Workforce Policies and Approaches to Hiring?

The survey took place in November and December, after the U.S. presidential election but a good month before the inauguration. At the time, most respondents felt the change in administration would have a negligible effect on their businesses. Of those who did anticipate adjustments, a number expected an easing of governmental regulations.

“I hope for improvements in the regulatory process and in pro-growth policies,” said a vice president of manufacturing/production at a small automotive company. “Improvements in our education system will take longer to have a positive impact.”

“If excessive regulations are reduced and taxes adjusted to give a level playing field versus imports, we can probably increase production and add jobs,” said a consultant with more than 25 years in manufacturing.

A few respondents mentioned they had no idea what to expect. “Be prepared for totally unforeseen policy changes from the new ‘loose-cannon-in-chief,’” predicted a 60+ sales/marketing manager at a large electronics company. An executive at a West Coast plastics company that has difficulty filling machine operator and packing positions said that potential deportations of undocumented workers “may cause a worsening labor shortage.”

A manufacturing vp of a small metals company was hopeful that “more work will be brought to the United States and the corresponding demand for our services will allow more margin in our industry.”

The IndustryWeek 2017 Salary Survey was conducted online via e-mailed invitations to subscribers. The survey took place November 2016 to January 2017. A total of 910 people responded to the survey, and of that number, 780 U.S. respondents completed the entire survey. Respondents were not compensated but were offered the chance to provide candid comments regarding their salaries, occupations and employers. All responses were anonymous.

About the Author

Laura Putre

Senior Editor, IndustryWeek

As senior editor, Laura Putre works with IndustryWeek's editorial contributors and reports on leadership and the automotive industry as they relate to manufacturing. She joined IndustryWeek in 2015 as a staff writer covering workforce issues.

Prior to IndustryWeek, Laura reported on the healthcare industry and covered local news. She was the editor of the Chicago Journal and a staff writer for Cleveland Scene. Her national bylines include The Guardian, Slate, Pacific-Standard and The Root.

Laura was a National Press Foundation fellow in 2022.

Got a story idea? Reach out to Laura at [email protected]